The AI drug discovery race: Who’s leading the charge?

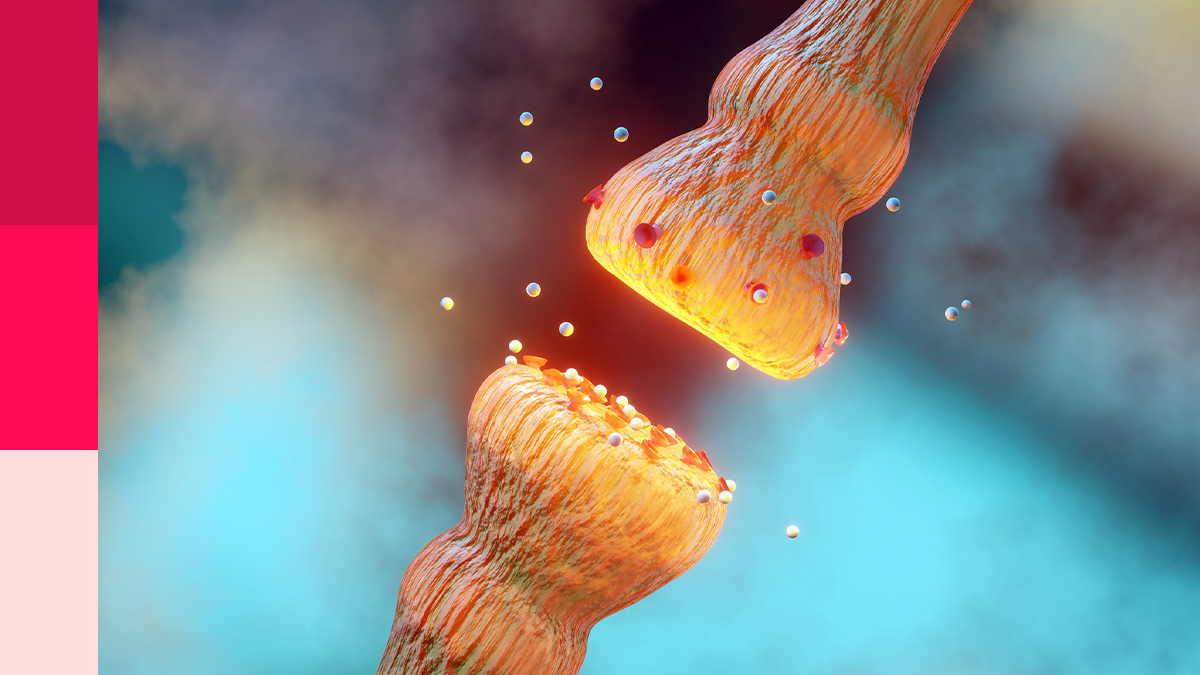

In 2015, AI in drug discovery was still a theoretical pursuit – exciting, but unproven. A few early start-ups were applying deep learning to virtual screening and molecular modelling, but the industry as a whole remained sceptical. Could algorithms really find and optimise drugs faster than human scientists?

Ten years later, AI has gone beyond assisting discovery. It’s producing named clinical candidates, informing regulatory decisions, and driving global partnerships worth billions.

In this timeline, we chart the evolution of AI drug discovery from proof-of-concept to defining the future of pharma innovation. But first, let’s meet the key players in the AI drug discovery race:

AI-native biotechs

Recursion

Atomwise

Insilico

BenevolentAI

Big pharma adopters

Sanofi

Novartis

Bayer

GSK

Tech disrupters

DeepMind

Alphabet

Microsoft

AWS

2015

Atomwise puts deep learning on pharma’s radar

A decade ago, the idea that algorithms could outperform scientists in drug discovery was still a fringe belief. That was until the San Francisco-based start-up Atomwise unveiled AtomNet: the first deep learning neural network built to predict how molecules interact with protein targets.

At a time when most drug discovery still hinged on laborious trial-and-error screening, Atomwise’s idea was radical: feed the system structural data and let the algorithm simulate binding outcomes.

The start-up quickly garnered attention, not just for its technology, but also for the vision that AI can generate high-confidence drug leads early in the process, eliminating the bottlenecks of traditional screening. Backed by Y Combinator and early-stage investors, Atomwise began forging research partnerships across academia and pharma, testing the waters with Ebola and cancer. But beneath the caution and scepticism, a seed had been planted. What if discovery doesn't have to take a decade?

AI was still in its infancy, but a serious player had stepped into the ring.

2017

GSK and Exscientia launch one of the first public AI-pharma partnerships

Just two years later, several AI-first companies had begun to gain traction, but pharma remained largely cautious. GSK became one of the first large players to make a bold move. The company’s £33 million partnership with Oxford-based Exscientia marked a turning point. It wasn’t a pilot or proof-of-concept; rather, Exscientia was positioned as a discovery partner, tasked with identifying novel compounds using its Centaur Chemist platform, which blends machine learning with human design oversight.

GSK’s commitment gave AI-native discovery a credibility boost and offered the first glimpse of what AI-native partnerships could look like: outcome-focused, multi-programme, and baked into the pipeline.

2018

Insilico’s generative chemistry steps out of the lab

In the early years of AI in pharma, debate largely revolved around efficiency. Then, in 2018, Insilico Medicine challenged that assumption with a study showing that AI could do more than speed up existing processes – it could create entirely new ones. Using generative adversarial networks (GANs), the team created novel molecular structures that were optimised for desired biological characteristics.

The compounds that emerge aren't just theoretical curiosities. They're synthesised and tested, and one targeting fibrosis even advances toward the clinic. Suddenly, AI isn't just finding needles in haystacks; it's creating needles that perfectly fit the locks of human biology. Venture capitalists start writing bigger checks.

2019

Novartis and Microsoft bring AI into core operations

Through a multi-year strategic alliance with Microsoft, Novartis shifted from isolated AI pilots to embedding the technology across the core of its operations. The collaboration extended across the entire value chain, from early discovery and clinical development to manufacturing and patient access. It also marked a broader shift in mindset: AI was no longer a siloed experiment at the edge of R&D, but a catalyst for enterprise-wide transformation.

Early results included AI-powered tools capable of forecasting treatment outcomes, mining insights from trial documentation, and streamlining digital pathology workflows. Microsoft provided the cloud infrastructure and machine learning muscle; Novartis unlocked its deep, complex data landscape for integration. Together, they built a blueprint for how pharmaceutical companies could scale AI internally – not by starting from scratch, but by leveraging strategic partnerships.

2020

Recursion goes big with Bayer and deep data

Recursion Pharmaceuticals had spent years quietly building the infrastructure to pair computer vision with automated biology. In 2020, it stepped firmly into the spotlight.

A $239 million Series D round, led by Bayer, gave Recursion the fuel it needed to scale up its high-throughput drug discovery platform dramatically. Using high-content cell imaging and AI-powered analysis, Recursion created one of the largest datasets of cellular phenotypes in the world, using that data to predict drug responses, uncover new biology, and identify repurposing opportunities.

That year, Recursion shifted from being a fast-moving biotech to a platform company with infrastructure at the centre of its value. It also began positioning itself as both a drug developer and a builder of foundational tools for understanding human biology at scale.

2021

AlphaFold rewrites the rules of structure-based design

BenevolentAI’s knowledge graph platform identified baricitinib as a possible treatment for COVID-19. The drug went on to receive Emergency Use Authorisation from the FDA, offering a rare real-world validation of AI’s clinical potential. It was not a newly discovered drug – but it was an AI-driven decision that led to regulatory action, under pandemic pressure and scientific scrutiny.

Meanwhile, DeepMind’s AlphaFold stunned the scientific world by publishing the most accurate protein structure prediction model ever developed. Its open-access release of predictions for nearly all human proteins provided researchers with tools previously limited to specialists, dramatically shifting expectations around AI’s utility in molecular biology.

2022

AI-native platforms attract bigger deals… and bigger expectations

In January 2022, Exscientia and Sanofi announced a sweeping $5.2 billion collaboration – one of the largest AI-driven deals in drug discovery history. The agreement covered up to 15 targets in oncology and immunology, with $100 million upfront and significant backloaded milestones. More importantly, it reflected Sanofi’s shift from exploration to integration. AI was now part of how the company wanted to build its pipeline, not just something it was watching from a distance.

That summer, DeepMind and EMBL-EBI released AlphaFold Protein structure predictions for nearly all catalogued proteins, offering public access to over 200 million protein structure predictions.

For academic labs, biotech start-ups, and global pharma alike, AlphaFold’s release removed a long-standing bottleneck in target validation and structure-based design. Within months, it became a standard tool in discovery workflows. AI was no longer just building molecules – it was laying the foundation to model biology itself.

2023

Platforms mature, and AI began to resemble infrastructure

Recursion deepened its ambitions by partnering with NVIDIA to build large-scale biological foundation models. Using 23+ petabytes of proprietary data – including three trillion annotated cellular images – the goal was to train AI systems capable of predicting how cells would respond to genetic or chemical changes across hundreds of disease contexts. The work was still early, but it captured a growing shift: AI was moving from specific applications toward general-purpose simulation engines for biology.

Exscientia, meanwhile, initiated clinical trials for EXS-21546 – its first fully AI-designed oncology compound. The molecule had been discovered, optimised, and prepared for IND submission entirely within Exscientia’s AI-led pipeline. It reached the clinic in under a year from candidate nomination. This was no longer a case study – it was a product.

2024

The clinical reckoning

Insilico advanced ISM001-055, its fibrosis candidate, into Phase II trials. The molecule’s development – from target identification to structure generation to preclinical testing – had been entirely AI-led. Phase I had shown a clean safety profile. Phase II would test whether AI could deliver clinical efficacy, not just compelling chemistry.

At the same time, Exscientia announced milestone payments from Sanofi, confirming that two of its discovery programmes had met key goals. These updates did not dominate headlines, but they offered concrete signals that AI-generated candidates were progressing steadily inside pharma pipelines.

Later in the year, Recursion and Exscientia confirmed plans to merge, combining Recursion’s image-based phenomics engine and vast cellular datasets with Exscientia’s generative chemistry and model-based design tools. The move signalled a new phase of platform consolidation – one that sought to integrate, rather than compete. With their capabilities joined, the new entity aimed to offer the industry’s most comprehensive AI drug discovery stack, from phenotype-driven target discovery to clinical-stage compound optimisation.

2025

AI’s most visible year yet

In March, ISM001-055 was officially named Rentosertib by the USAN Council. It was the first time an AI-discovered drug had reached this symbolic milestone – an ordinary step for any advancing molecule, but a historic one for the field. Rentosertib was now officially a candidate, with a name and a clinical profile.

Shortly after, Phase IIa data confirmed safety and showed early signs of efficacy in idiopathic pulmonary fibrosis. The study positioned Rentosertib as the most clinically advanced AI-designed compound to date. For Insilico, it was a scientific breakthrough. For the industry, it was proof that AI-driven pipelines could deliver viable human therapies.

Meanwhile, DSP-0038 – developed by Sumitomo Pharma using AI to target serotonin receptors – entered Phase I trials for psychosis related to Alzheimer’s disease. It reached first-in-human studies just one year after initial compound generation, setting a speed benchmark in central nervous system drug development.

And in a final marker of momentum, the FDA announced it would roll out generative AI tools, including its internal model, “Elsa”, across all centres by the end of June. Once a cautious observer, the regulator is now a participant. The system that oversees drug approvals is beginning to embrace the same technologies driving their discovery.

About the Author

Eloise McLennan is the editor for pharmaphorum’s Deep Dive magazine. She has been a journalist and editor in the healthcare field for more than five years and has worked at several leading publications in the UK.

Supercharge your pharma insights: Sign up to pharmaphorum's newsletter for daily updates, weekly roundups, and in-depth analysis across all industry sectors.

Want to go deeper?

Continue your journey with these related reads from across pharmaphorum

Click on either of the images below for more articles from this edition of Deep Dive: AI 2025