Tariffs, pharma, and patients: A Q&A with Orr Inbar

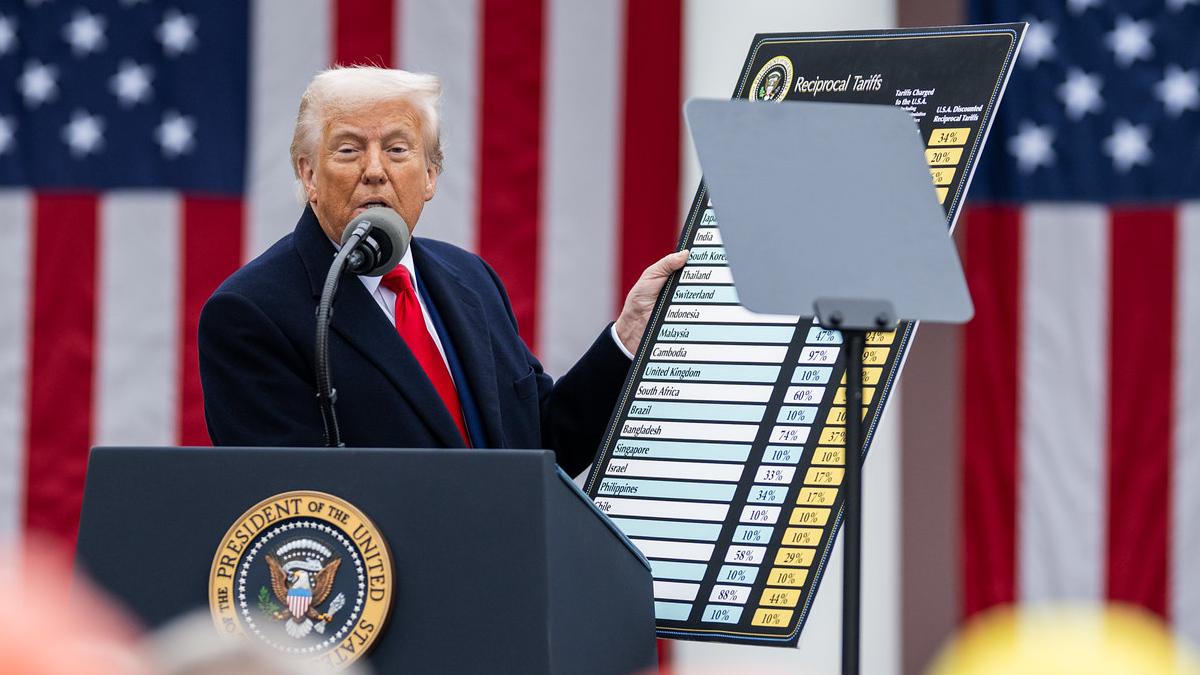

The threat of tariffs has loomed over countries and industries alike during Trump’s second administration. But with a potential 200% tariff on pharmaceutical imports into the US – which could affect ~$200 billion in imports – the life sciences sector has been rightly unsettled, forcing many drug developers to reconsider and adjust their business strategies.

In August, as reported by Business Today, Trump told CNBC that planned tariffs on imported pharmaceuticals could even eventually reach as high as 250% — the most severe rate he had proposed. Yet, on 21st August, the trade agreement between the US and EU confirmed the tariff on pharmaceuticals will not exceed 15%. The joint statement did away with the fears that tariffs of 250% could be applied to pharmaceuticals, which were not specifically included in a blanket 15% rate on imported goods from the EU into the US, and the EU-US tariffs apply as of today, 1st September.

Nonetheless, a lengthening list of big pharma companies has pledged billions of dollars in new builds and upgrades to manufacturing and R&D facilities in the US in the coming years in response to pressure from President Donald Trump to onshore and reshore manufacturing and avoid such tariffs on imported medicines.

In order to discuss this current and as yet unsettled landscape further, and just how these tariffs might affect patients themselves, pharmaphorum spoke with Orr Inbar, CEO and co-founder of QuantHealth.

Q: How would a potential 200% increase in pharmaceutical imports to the US affect the economics of drug development?

Inbar: There is no question that it will become more expensive to import pharmaceutical drugs to the US, which is the largest market for these drugs globally. Therefore, to offset supply-chain challenges, pharmaceutical companies will need to find cost savings at every turn, to maximise profit margins, and continue vital R&D efforts for innovative treatments for patients in need.

Therefore, to offset supply-chain challenges, pharmaceutical companies will need to find cost savings at every turn. Unlike before, there is now an increased need and opportunity for big pharma to optimise its drug development process, and to do so on a large scale. The companies that will succeed despite these tariff pressures will be those that adopt well-established and validated AI solutions to increase clinical trial success rates and accelerate drug development timelines.

Q: Do you anticipate that tariffs will ultimately impact patients?

Yes, 100%. The Pharmaceutical Research and Manufacturers of America (PhRMA) predicted that even a 25% tariff on pharmaceutical imports would increase domestic drug prices by just under 13%. Now, we’re talking 8+ times that, which means that these companies will have to pass on significant costs to consumers just to operate.

My hope is that, if these tariffs do take effect, insurance plans will work with patients to ensure they continue to receive necessary medications through Patient Assistance Programs (PAPs) or by covering generic alternatives. Ideally, Medicare recipients who take insulin, for instance, will be less impacted due to price caps implemented over the past few years. However, even price caps don’t account for global drug shortages that are likely to occur if these tariffs are implemented.

R&D for high-unmet-need patients is a top priority for pharmaceutical companies. Patients will be impacted by these tariffs regardless of how quickly pharma adapts its operations; however, if companies use the appropriate AI tools at their disposal to introduce efficiencies at each stage of the drug development process, patients will gain access to essential treatments faster, minimising the impact on pricing.

Q: Are early-stage biotechs more vulnerable to tariffs than large pharma? How do you expect smaller companies to react to potential tariffs?

Actually, the opposite. Larger pharmaceutical companies have more contracts with PBMs and pharmacies, so they have to meet higher production volumes, which will be taxed more with these tariffs. Smaller biotechs, which have historically lacked funding and federal support, are more focused on R&D and optimising their tech infrastructure than on distributing drugs.

That said, smaller biotechs saw an uptick in FDA approvals last year for conditions like fatty liver disease and pulmonary disease. If that trend continues, these biotech companies may become more susceptible to increased tariffs.

Regardless, I expect biotech to double down on their tech-enabledness and AI applications to increase efficiencies from the trial stage all the way through to development.

Q: How will these tariffs impact how drug developers invest in technology to prioritise cost savings?

As I mentioned, these tariffs will create downward pricing pressures and, as a result, the pharmaceutical industry will have to become more savvy about how it operates and shifting its focus to higher efficiency at all levels.

In R&D, for instance, which accounts for 30%-50% of pharmaceutical drug costs, developers can test only one hypothesis at a time for each clinical trial, making development slower and higher risk. Recent AI development, however, has proven its potential to help pharma assess multiple hypotheses at once, improve the confidence and clarity in clinical trial design, shorten timelines, and increase the probability of success, so I expect to see more timely AI investments around R&D alone.

Q: Which areas of drug development do you think AI can provide the most cost savings, as it faces financial pressures due to tariffs?

Without a doubt, at the clinical development [stage]. Clinical trials are the most costly part of the drug development cycle, from participant recruitment to design and execution. If pharma can significantly reduce its spend on trials, it will be much better prepared to weather economic uncertainties.

With the advent of tariffs, investing in efficient tech-enabled trials has become more critical than ever.

Q: Would these tariffs give an advantage to any drug developers who’ve been quick to adopt AI?

The reality is that these tariffs will affect the entire pharmaceutical industry from the big players down to the smaller biotechs. However, those companies that have already invested significantly in their tech infrastructure may see better equipped to handle these tariffs when implemented.

AI is advanced enough to optimise drug development significantly, but it’s up to pharmaceutical executives to invest in innovation so that they are best prepared for all the economic uncertainties that come their way.

About the interviewee

Orr Inbar is a data scientist and expert in AI-powered drug development, with over 10 years of leadership experience helping small to mid-sized start-ups in Israel and the US to grow, innovate, scale, and deliver. Inbar is CEO and co-founder of QuantHealth.

Orr Inbar is a data scientist and expert in AI-powered drug development, with over 10 years of leadership experience helping small to mid-sized start-ups in Israel and the US to grow, innovate, scale, and deliver. Inbar is CEO and co-founder of QuantHealth.