AbbVie turbocharges its US investment promise to $100bn

AbbVie's chief executive Robert Michael.

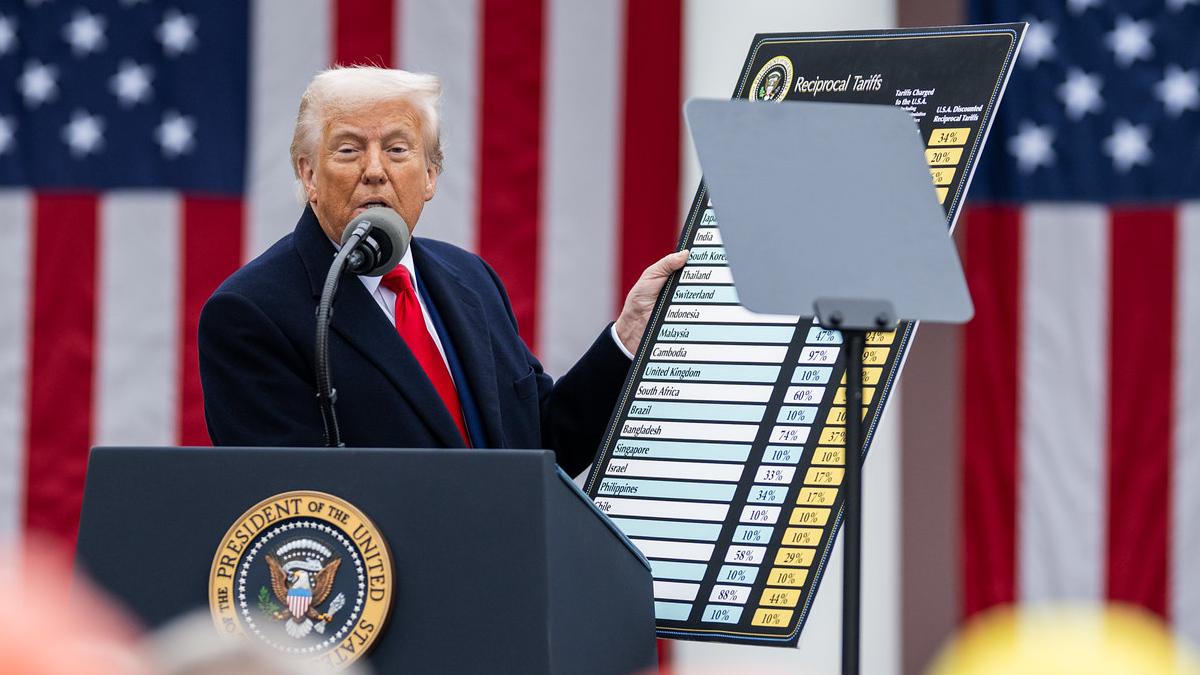

AbbVie has joined many of its big pharma peers by signing a Most-Favoured Nation (MFN) drug pricing deal with the Trump administration to avoid tariffs – sweetened with a promise to invest $100 billion in R&D and manufacturing projects in the US over the next 10 years.

The company was one of the last remaining holdouts among a group of 17 pharma groups that were singled out by President Trump in letters ordering them to adopt MFN pricing or face tariffs on drugs imported into the US of up to 100%. Its announcement leaves Regeneron as the last of that group yet to reach an agreement.

The broad sweep of the AbbVie agreement is much the same as the others announced to date, including Johnson & Johnson's last week, and is built around the provision of MFN prices to Medicaid and cut-price medicines through Direct-To-Consumer (DTC) sales channels, including the TrumpRx platform that is scheduled to launch this month.

In a statement, AbbVie's chief executive Robert Michael said the voluntary, three-year agreement means the company is "following President Trump's call to action by reaching this agreement, allowing us to collectively move beyond policies that harm American innovation."

He added that the deal will give the company an exemption from "tariffs and future pricing mandates" and "addresses all […] of the President's drug pricing priorities."

The medicines covered by the DTC agreement include anti-TNF antibody Humira (adalimumab), used for a wide range of inflammatory diseases, which is now subject to biosimilar competition, but is still making multibillion-dollar sales per year.

The others are mature brands that make relatively modest sales, but are nevertheless still widely used in the US market. They are glaucoma treatments Alphagan (brimonidine) and Combigan (brimonidine and timolol), and Synthroid (levothyroxine) for hypothyroidism.

Investment details scant

AbbVie's investment pledge of $100 billion is ten times the figure it first proposed in April of last year, but, while the value has risen, there remains little information about how and where those dollars will be spent.

The announcement refers to "US-based research and development and capital investments, including manufacturing, over the next decade," but provides no further details. In its initial announcement, AbbVie said it already has a significant US manufacturing presence that spans 11 sites, with plans to add four new manufacturing plants to the network and support growth areas like obesity.