AbbVie makes its tariffs-driven investment play

AbbVie has become the latest pharma group to make a big capital investment announcement in the US and court favour with the Trump administration.

On a conference call to discuss AbbVie's first-quarter results, chief executive Rob Michael alluded to speculation that pharma-specific tariffs could be forthcoming and said that over the next decade they "anticipate investing more than $10 billion of capital in the US to support [...] volume growth and [...] expansion into new areas such as obesity."

The comments come after a lengthening list of big pharma companies – including Roche, Novartis, Eli Lilly, and Johnson & Johnson – have pledged billions of dollars in new builds and upgrades to manufacturing and R&D facilities in the US in the coming years.

So far, AbbVie has not provided any details on the specifics of its investment programme, with Michael alluding to the company's already "extensive manufacturing presence" in the US, spanning active pharma ingredients, biologics, toxins, and small molecules.

"I would […] highlight that AbbVie has a significant US manufacturing presence that spans 11 sites with plans to add four new manufacturing plants to our network, expanding our production for API, drug product, peptides and devices in the US," added chief financial officer Scott Reents later on the call.

Michael also said that the impact of the current tariff environment in the US – ahead of any decision on a sectoral levy – has not been factored into AbbVie's financial guidance yet, but added: "We believe it would be in line with our peers."

Last week, MSD – which has also said it will look at relocating manufacturing – said it expects tariffs will add around $200 million to its cost base this year, while J&J has indicated it expects to take a $400 million hit, mainly in its medtech division.

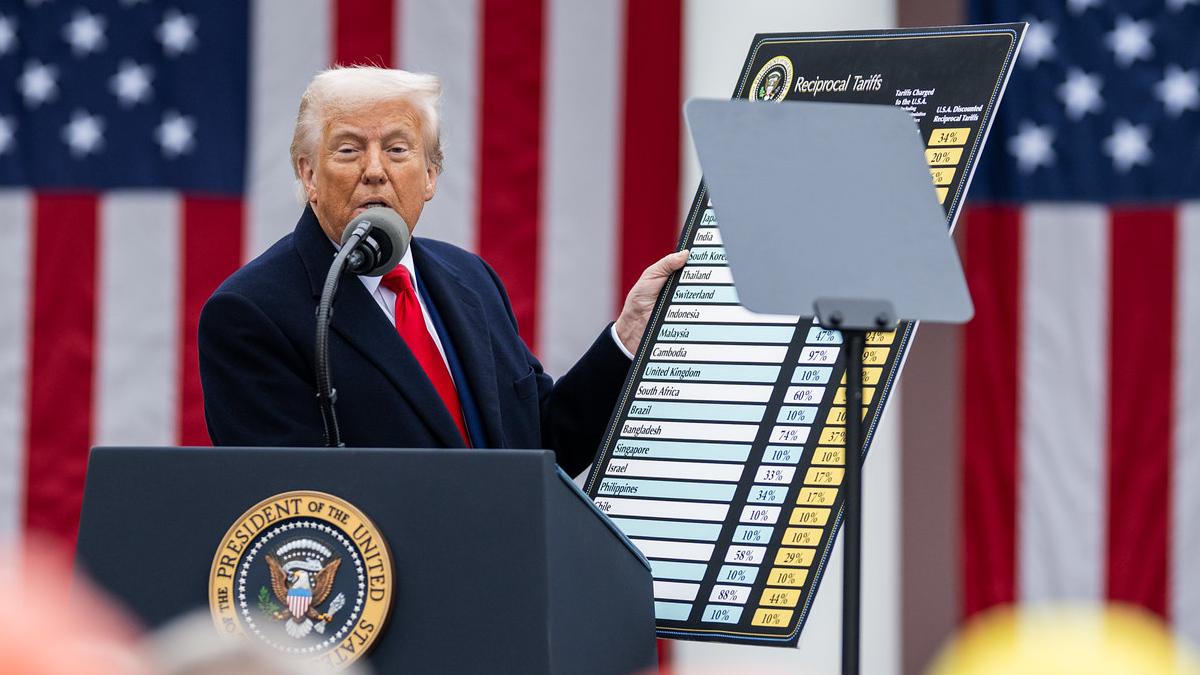

Pharmaceuticals were excluded from the initial round of tariffs introduced by the US administration earlier this month, but the White House has launched an investigation into pharma imports into the US, which is seen by some as the first stage in coming up with a plan.

AbbVie added that it has had to absorb cost rises in its aesthetics business – which sells products like wrinkle treatment Botox and dermal filler Juvederm, that are in scope of the tariffs – but said the impact was modest, at "approximately $30 million."

On the risk of interrupted supply of APIs from China, a major world supplier, Michael said: "We could take inventory management actions or secure alternate sources of API," and would also look at cost efficiencies and productivity initiatives to limit the impact of a pharma levy.

On the pricing impact, he remarked: "I think what’s more challenging is trying to pass the tariff impacts to our customers, especially with penalties in the government channel and with existing contracts in the commercial setting. So, I don’t see that as a viable source for mitigation."

AbbVie reported first-quarter revenues up 8.4% to $13.34 billion, with immunology blockbuster Skyrizi (risankizumab) leading the charge with 70.5% growth to $3.43 billion.