Is the launch environment really more competitive now?

It’s often stated - mostly without reference to data - that the environment for innovative launches is more competitive now than it ever has been. Is this true? IQVIA has the long term market data, from World Reviews back to 1978, to investigate, and analysed nearly 30 years of launches into leading therapy classes, from multiple eras in the development of the pharmaceutical industry.

Starting with the primary care era of 1997-2005, when key launches were primary care blockbusters, such as Losec, Diovan, and Lipitor, IQVIA took five key therapy classes from that era that consistently appeared in the top 10 therapy area by sales for the time period of the era.

In the case of the first era, 1997-2005, the classes covered were: Statins, Proton Pump inhibitors, SSRI antidepressants, Erythropoietins, and Angiotensin II antagonists - in other words, four primary care therapies and one specialty care (albeit widely used) therapy. The launches into these five therapy areas happened from 1988 (the launch of the first statin, Mevacor) onwards.

A second, “transitional era” from 2000-2015 was one of older specialty products, including those in multiple sclerosis, early immunological biologics, and oncologics. The third era saw five specialty therapy areas consistently in the top 10 most valuable areas in the time period 2015-2021 - HER2 MAbs, HIV Anti-virals, Hepatitis C antivirals, Interleukin inhibitors, and PD-1/L1 MAbs. The launches into these therapy areas happened from 1995 onwards.

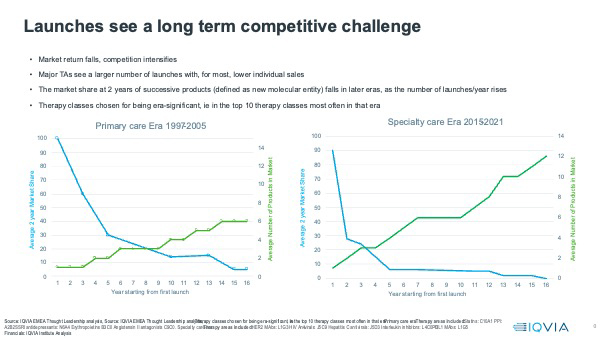

For each class, IQVIA recorded the New Active Substances entering the class by year for up to 16 years, and also calculated the global value market share at two years into the market for each. From this, there are two measures of competitive intensity and its consequences - competitive intensity being the number of follower launches entering the class, how fast they did so, and the impact of that competition being the share of the global market (defined as the class) achieved at two years by each launch.

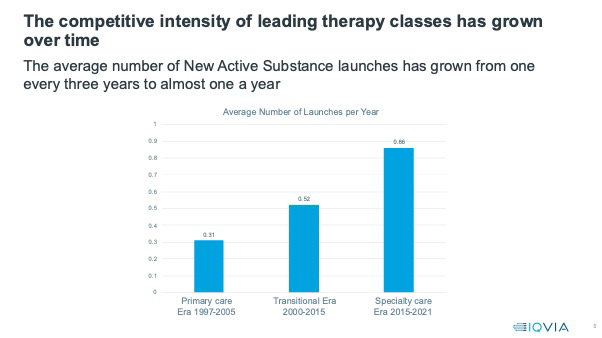

In the first, primary care era, New Active Substances entered therapy classes at a rate of on average one every three years. The first to market product had ample time to establish and a class market share, at two years, of 100%.

Continued competitive intensity

Competitive intensity has increased significantly - from a launch, on average, once every two years in the therapy classes which dominated the transitional era, to almost one New Active Substance launch a year in the classes dominating the specialty care era. The first in class launches barely have time to establish before they face competition, and then the competition keeps on coming. The number of products in a class at 16 years has risen from an average of six in the primary care era to 12 in the specialty care era.

This has clear consequences for the market share achievement of follower products. In the primary care era, follower products often did well, better than the first in class product - Lipitor was 5th into the Statins market, with a market share of 41% at two years post launch. Diovan, the second to the market Angiontensin II antagonist, had a market share of 77% of the ARB class at two years.

As the graphic below shows, follower products on average now get diminishing shares of the market, unless the followers in the class focus on completely new indications and therefore access new markets, as Stelara did in Interleukin inhibitors. On average, only the first three entrants into classes get more than 10% class market share at two years for the latest specialty era. For the primary care era, the first five entrants, on average, achieved more than 10% market share in their first two years.

The forces shaping the launch environment are likely to increase competitive pressure, with more targeted medicines in narrower indications and more tightly defined markets. Multi-indicationality can provide escape, but only until very similar products also acquire those indications, which they will do swiftly. Payers are motivated to take the view that they only need one or two products in each indication and may refuse access or demand steep discounts for followers they regard as superfluous. In therapy areas, such as oncology, where the outcomes data drives standard of care product choice, first to market is first to generate the outcomes and other real world data, which then builds a formidable barrier to the establishment and use of follower launches that do not have that wealth of data. What should companies do to give their launches the best chance in this environment?

1. The first, critical investment is in speed of clinical development, giving the best possible chance of submitting first and being first to approval. Companies can speed their product’s clinical development through intelligent automation of all aspects of clinical development, for example, the use of AI/ML powered approaches to patient finding for clinical trials . For Orphan medicines, use of RWE as well as clinical data in submission has been proven to lead to faster approvals in almost all pathways for the FDA and EMA .

2. Early and effective pre-Launch preparation has always been critical to launch success, but never more than now. Launch planning must include competitive scenario planning even for the first to market, right from the earliest stages, because competition will almost always follow fast. A strategic, integrated evidence strategy should be at the heart of launch planning and preparation - building the library of evidence early and fast is critical to establishing and maintaining competitive advantage.

3. Thirdly, speed of commercial execution and launch roll out is vital. Even if smaller indications come first, they must be consolidated and roll out across indications executed with ruthless speed. Customer-facing teams must pursue every interactive engagement opportunity, non-promotional and promotional, across all the channels available to them, with a speed and focus like never before. Once again, the right data and AI/ML powered processes to use it are key.

All of this pressure is, of course, on top of the triple post-pandemic challenge of reduced patient opportunity, reduced engagement opportunity with healthcare professionals, and tightened medicines budgets with raised barriers to access - which is driving down the sales performance of most post-pandemic launches. Launching innovative new medicines was never easy; getting it right in the future is going to be the toughest challenge yet.

About the author

Sarah Rickwood has 30 years of experience in the global pharmaceutical industry, and has led IQVIA’s EMEA Thought Leadership team for a decade. She provides insights into Launch, Innovation, and Global pharmaceutical trends and competitive challenges.

Sarah Rickwood has 30 years of experience in the global pharmaceutical industry, and has led IQVIA’s EMEA Thought Leadership team for a decade. She provides insights into Launch, Innovation, and Global pharmaceutical trends and competitive challenges.