Ultragenyx, Mereo's brittle bone drug flames out in trials

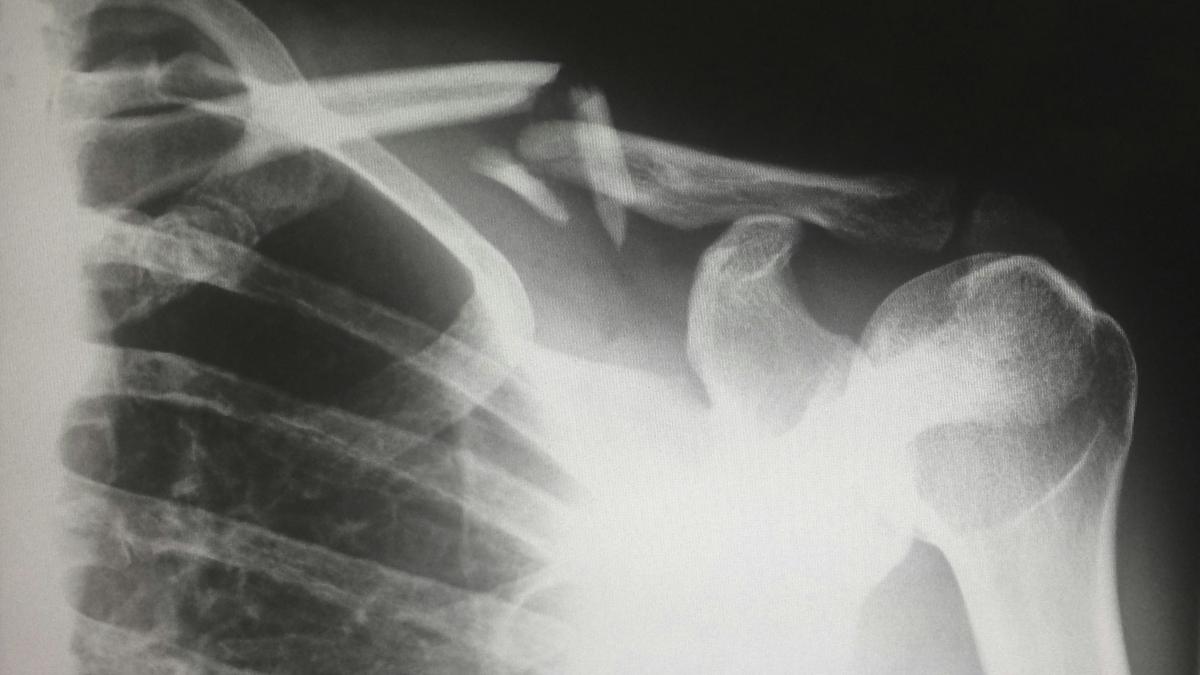

Shares in Ultragenyx and Mereo BioPharma have plunged after their drug for osteogenesis imperfecta (OI) or brittle bone disease, setrusumab, failed a pair of phase 3 trials.

The two partners said neither the ORBIT nor COSMIC studies of setrusumab (UX143) achieved their main objective of a reduction in the annualised clinical fracture rate compared to placebo or bisphosphonates, respectively. The ORBIT result was affected by a lower-than-expected fracture rate in the placebo group.

The drug was able to achieve statistically significant improvements in bone mineral density compared to bisphosphonates, however, and Ultragenyx and Mereo said they will evaluate the data to see if there is a route forward for the antibody.

US biotech Ultragenyx lost more than 42% of its value after the announcement, while London, UK-based Mereo – which originated setrusumab – slumped almost 88% to enter penny share territory. Both companies, which are listed on the Nasdaq, said they would embark on cost-cutting initiatives to conserve cash.

The news is a deep blow to patients with OI, an enormously debilitating and painful condition. Children afflicted by the disease sometimes suffer five to 10 fractures a year, with even something as trivial as a cough potentially leading to a cracked rib, for example.

There are no approved therapies for the disease, but some bone-building therapies like bisphosphonates, approved for osteoporosis, are used off-label to treat OI patients. Setrusumab acts by a different mechanism to bisphosphonates, which inhibit bone breakdown, as it encourages bone formation by inhibiting a protein called sclerostin that regulates bone remodelling.

"Whilst we are disappointed by these results, we will be conducting additional analyses on the data, to assess next steps and the best path forward for the programme, especially in paediatrics, given the totality of the data and lack of other treatment options for individuals with OI," commented Mereo's chief executive, Dr Denise Scots-Knight.

Ultragenyx – which already has four commercial products and posted third-quarter revenues of $160 million – said it would implement "significant expense reductions" as a result of the failed programme. The company added that it is now looking ahead to two potential gene therapy launches for rare diseases Sanfilippo syndrome type A and glycogen storage disease type Ia, as well as a phase 3 readout in Angelman syndrome.

For Mereo, which still has no approved therapies and ended the third quarter with just under $49 million in cash reserves, the focus will be to "tightly control costs" as it seeks a partner for alvestat, its candidate for alpha-1 antitrypsin deficiency-associated lung disease (AATD-LD), and continues work on already-partnered candidates vantictumab for osteopetrosis (with ashibio) and male infertility drug leflutrozole (with ReproNovo).

Photo by Harlie Raethel on Unsplash