FDA starts review of Lantheus’ generic Lutathera

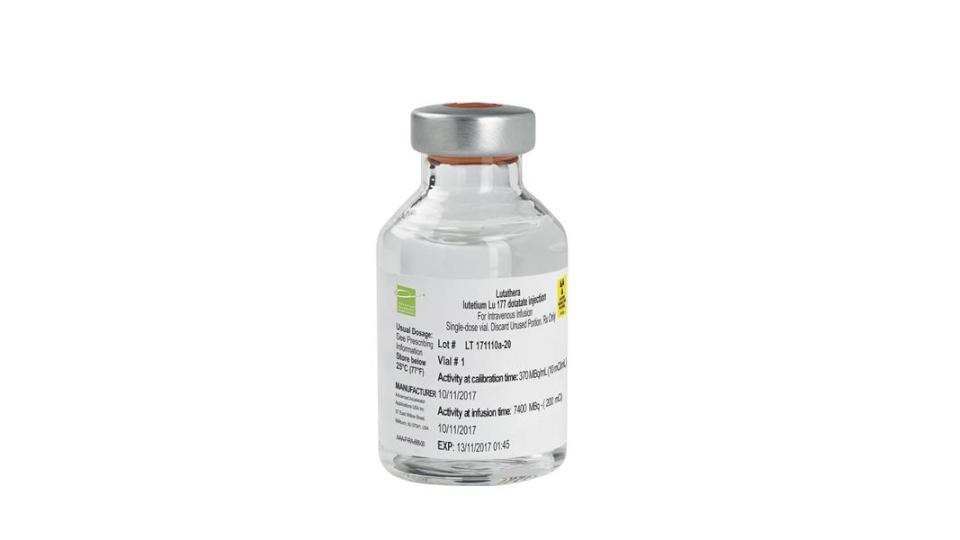

Lantheus has filed what it says is the first generic version of Novartis’ big-selling cancer radionuclide therapy Lutathera in the US, used to treat rare neuroendocrine tumours (NETs).

The FDA has started a review of the generic and – if approved – Lantheus could be in line for 180 days of market exclusivity as the first company to bring a copycat version of Lutathera (lutetium Lu 177 dotatate) to the US market.

Novartis has already said it may consider legal action to try to block Lantheus’ generic on the grounds of patent infringement, which could lead to a 30-month stay on launch under the US legal framework. That seems almost inevitable, given that there are US patents on the drug out to 2038.

Lutathera was acquired by Novartis when it bought Advanced Accelerator Applications for $3.9 billion in 2017 and has been at the forefront of the Swiss pharma’s push into the radionuclide category, one of its strategic priorities.

Sales rose 34% to $458 million in the first nine months of 2023 from its use as a second-line or later treatment for patients with gastroenteropancreatic neuroendocrine tumours (GEP-NETs), a diffuse range of cancers that are often diagnosed late, as they cause a wide range of symptoms.

It has been FDA-approved since 2018 in combination with octreotide for GEP-NETS that are progressing despite standard treatment, and Novartis recently reported results from a phase 3 trial of the drug as a first-line therapy that could expand its market.

The radionuclide therapy is also in mid-stage clinical trials for other solid tumours, including brain cancer glioblastoma and small cell lung cancer (SCLC), which if successful could add additional upside to peak sales forecasts of $650 million or more.

Lantheus’ generic, called 177Lu-PNT2003, was licensed in December 2022 from Point Biopharma, which was acquired by Eli Lilly last month. Lantheus has worldwide rights to the drug, with the exception of some Asian territories.

While Lutathera was the first of its radionuclides to reach the market, Novartis’ flagship therapy is Pluvicto (lutetium lu177 vipivotide tetraxetan), which was approved by the FDA for PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) in 2022.

It has already become its biggest-selling drug in the category, with nine-month sales of $707 million despite manufacturing capacity constraints. Novartis acquired Pluvicto through its $2.1 billion acquisition of Endocyte in 2018.

Lantheus, meanwhile, has also been looking externally to grow its pipeline, announcing at the JP Morgan Healthcare conference this week that it had paid $28 million for a near-20% stake in Perspective Therapeutics and secured an option to license its Pb212-VMT-α-NET radiotherapy for NETs, currently in phase 1/2.