AMPLIFY results dial up Calquence's potential in CLL

AstraZeneca's Calquence has hit the mark in the phase 3 AMPLIFY trial in chronic lymphocytic leukaemia (CLL), a study that chief executive Pascal Soriot recently said could be a "blockbuster indication" for the drug.

AMPLIFY is testing BTK inhibitor Calquence (acalabrutinib) in combination with AbbVie/Roche's BCL-2 inhibitor Venclexta (venetoclax) – with or without Roche's anti-CD20 drug Gazyva (obinutuzumab) – compared to standard therapy in previously untreated adult patients with CLL without del(17p) or TP53 mutations.

Patients in the comparator arm received a chemoimmunotherapy (CIT) regimen of fludarabine, cyclophosphamide, and rituximab (FCR) or bendamustine plus rituximab, depending on their age.

AZ said this morning that the trial was positive with a statistically significant improvement in progression-free survival (PFS), as well as a trend towards improved overall survival (OS) with the Calquence regimens.

BTK inhibitors were the first class of targeted agents introduced in CLL and are dosed indefinitely until disease progression, which can take years and can raise the risk of cumulative toxicity and the development of resistance. In contrast, CIT is given in a fixed series of cycles lasting a few months.

AMPLIFY is hoping to change that for the BTK class, with the Calquence-based treatment given over a fixed duration of 12 months. Venclexta, meanwhile, is already approved in two time-limited treatment regimens for CLL, and AMPLIFY is one of the first large-scale trials to combine BTK and BCL2 agents with a fixed duration.

"This is an important advance in this setting as fixed-duration regimens allow those living with this chronic disease to take breaks from their treatment, thereby decreasing the possibility of long-term adverse events and drug resistance and improving quality of life," said the study's principal investigator Jennifer Brown of Dana-Farber Cancer Institute and Harvard Medical School.

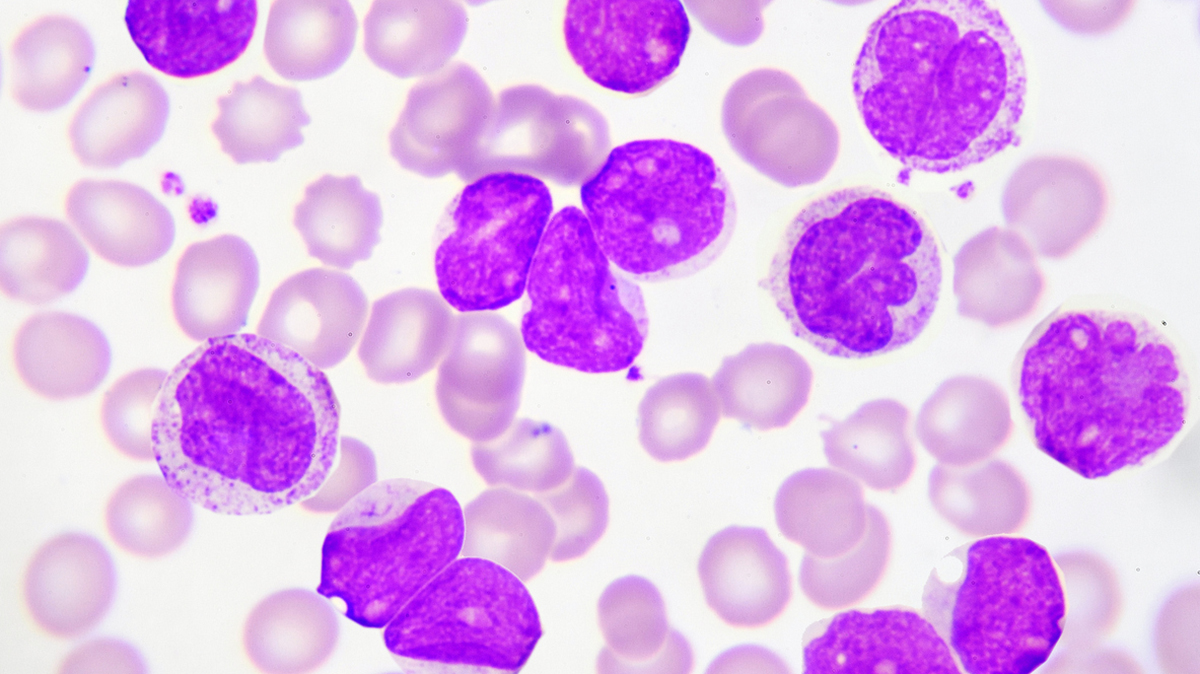

CLL is the most prevalent type of leukaemia in adults worldwide and, while it is considered incurable, patients often live with the disease for many years and may remain on continuous treatment.

Only the top-line readout of the trial is available for now, but AZ said it will share the data with regulatory authorities in the hope of extending the label for Calquence, and will present the data in full at a future medical meeting.

Calquence is a second-generation BTK inhibitor, with greater selectivity than the first-generation drug Johnson & Johnson's Imbruvica (ibrutinib) and fewer off-target effects. It has been approved for CLL since 2019 as a monotherapy or in combination with Gazyva, as well as for mantle cell lymphoma.

It has become AZ's third biggest-selling cancer medicines, with sales rising 28% in the first half of this year to top $1.5 billion.

"If approved, Calquence would become the only second-generation BTK inhibitor available as both a treat-to-progression and fixed-duration treatment, providing more options for patients and their healthcare providers," commented AZ's head of oncology R&D, Susan Galbraith.

Calquence's main rival in the second-generation BYK category is BeiGene's Brukinsa (zanubrutinib), which was given the go-ahead for CLL last year, one of four FDA-approved indications. It made sales of $1.3 billion in 2023, behind the $2.5 billion achieved by Calquence.

BeiGene is also testing its drug in combination with a BCL-2 drug, but is focusing on its in-house candidate, sonrotoclax, comparing it with Venclexta plus Gazyva in a phase 3 trial.