Nine for 2023, part three: thriving or surviving?

In this final instalment of IQVIA EMEA Thought Leadership’s Nine for 2023 three-part series, focusing on issues that will change the direction of healthcare and the pharmaceutical industry this year, three key competitive issues for pharmaceutical companies in 2023 are assessed.

1. Competing for attention: Bandwidth stress

Healthcare systems will continue to be hugely stretched in 2023, and that limits the engagement that pharmaceutical companies have with healthcare professionals to promote their medicines, get healthcare professional input and feedback, and understand wider issues related to the introduction and use of pharmaceutical innovation.

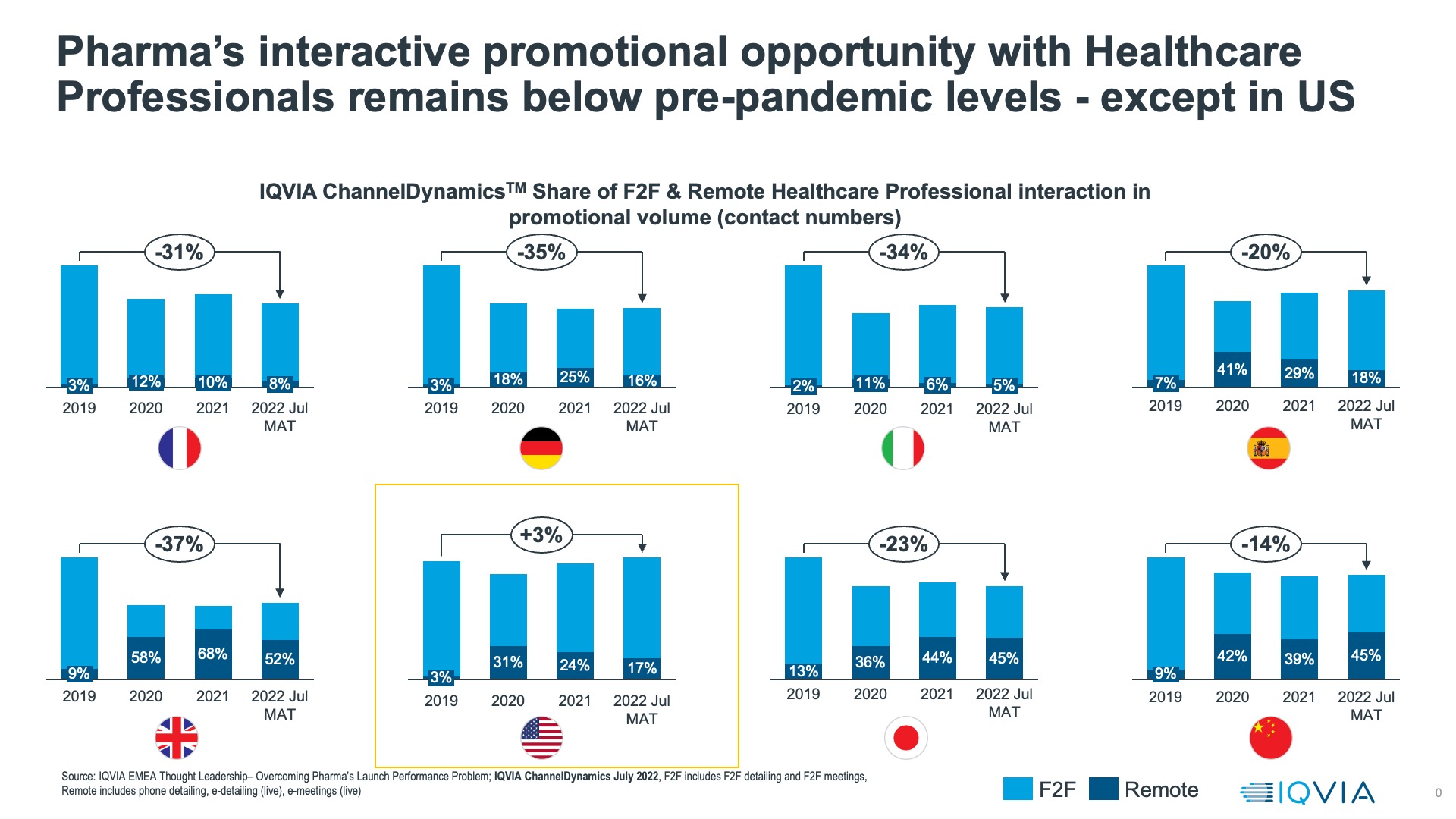

IQVIA ChannelDynamicsTM data, which tracks the promotional engagement between pharmaceutical companies and healthcare professionals across multiple channels, shows that since 2020 the interactive channels that were used for engagement swung wildly from face-to-face to virtual and then back to face-to-face, but for all major countries (US, top five Europe, Japan, China) there’s more virtual engagement than pre-Pandemic. This in itself is not problematic: studies of impact and perception of virtual versus face-to-face engagement show doctors use them for different purposes (for example, information-focused versus relationship-focused interactions), but both have value and impact.

The challenge is that the overall volume of interactive engagement, whether virtual or face to face, remains down in Europe, Japan, and China on 2019 levels by between 14% and 37%. As the analysis in our graphic shows, the only exception where engagement volumes have recovered is the US.  The competition for healthcare professionals’ attention is going to become still harder in 2023 – the calls on healthcare workers’ time as they deal with fragile healthcare systems, waves of respiratory infections, and the backlogs and sequelae caused by COVID are just too numerous and pervasive. In 2023, pharmaceutical companies must unlearn the old lessons of commercial engagement, where frequency and face-to-face were key, and focus on the quality of meaningful interaction, where a healthcare professional’s attention is fully engaged and the experience is meaningful to their work. In this context, the channel for engagement, although still relevant, is less important than the healthcare professional’s need and the way in which that is met. Pharma will be focusing more on relevant research, support, and a better mix of non-promotional and promotional interaction.

The competition for healthcare professionals’ attention is going to become still harder in 2023 – the calls on healthcare workers’ time as they deal with fragile healthcare systems, waves of respiratory infections, and the backlogs and sequelae caused by COVID are just too numerous and pervasive. In 2023, pharmaceutical companies must unlearn the old lessons of commercial engagement, where frequency and face-to-face were key, and focus on the quality of meaningful interaction, where a healthcare professional’s attention is fully engaged and the experience is meaningful to their work. In this context, the channel for engagement, although still relevant, is less important than the healthcare professional’s need and the way in which that is met. Pharma will be focusing more on relevant research, support, and a better mix of non-promotional and promotional interaction.

2. Survival of the fittest: Biotech reset

“Horrible” and “carnage” were how some described the early 2022 environment for biotech financing, as funding fell significantly below the highs of 2020 and 2021, and IPOs all but dried up. Only a December 2022 announcement by Amgen of intent to purchase Horizon Therapeutics for a possible $28.3bn brought a bright spot. A longer historic view of biotech funding, however, reverses the picture: 2020 and 2021 were not normal years. Venture capital poured into the pandemic biotech markets and not every investment was good quality. Therefore, a better way to view the last three years is that after a period of exuberance, discipline in quality investments has returned to biotech financing.

The second half of 2023 is likely to see a rebound from the trough of 2022, but it will be slow. Market volatility, inflation, and raised interest rates will all make investors cautious. If, as is possible, IPOs remain subdued and low M&A activity persists, the exit routes for venture capital will still be tough, further subduing interest and slowing the rebound.

The prolonged cash squeeze will, therefore, be the true reset button for the biotech industry. Biotechs with low quality, undifferentiated assets and inexperienced management teams unable to extend cash runway are likely to fail in increasing numbers in 2023. The deals that do materialise will focus on either ends of the risk spectrum: at the low-risk end to pharma-biotech acquisitions for de-risked, late-stage assets (phase 3 onwards, accounting for 80% of acquisitions in 2022), or the high-risk pharma-biotech partnerships focused on preclinical assets, to seed optionality with a stake in future innovation platforms (65% of such partnerships in 2022).

Given the funding environment for innovative medicines that is faced by all pharma, large or small, once assets are approved, however, this 2023 reset seems a necessary response. It won’t, of course, at product level, be limited to EBP – large pharma will also see restructuring of portfolios as weaker projects fall by the wayside. However, for large pharma, this restructuring, while painful, is not an existential challenge.

3. Pharma’s energy challenge: near-term pain, long-term green

Near-term pain for Europe

The energy and inflation crisis of 2022 will continue throughout 2023. Energy crisis effects will be felt across healthcare, but for medicines manufacturing and delivery the issue is especially complex because the networks of medicine supply extend across the globe and across countries which see differing impacts of energy costs and supply.

Medicines manufacturing is energy intensive. Heating, ventilation, and air conditioning (HVAC) systems for validated cleanroom areas of a plant, for example, are essential and subject to stringent regulation, and consume many times more energy than non-validated areas. Regulatory requirements for Good Manufacturing Practice mandate standards that must be maintained. In the past, the external pressure to improve energy efficiency in manufacturing of medicines has often been low, outweighed by the imperatives of meeting regulatory and quality standards.

Medicines distribution and supply is also an energy intensive and regulated business. For the most commonly used, high volume medicines, countrywide networks of distribution to get them to where patients live, reliably, securely, and regularly, are required. Wholesalers and pharmacies operate under regulations which define storage, supply, and service standards, and these come with energy requirements. Where medicines are biologics, such as vaccines, insulin, blood products, and numerous specialty medicines, failsafe cold chains will be necessary from manufacturer to patient. According to Medicines for Europe, medicine transportation costs increased up to 500%, in 2022.

Europe still has a long-term energy crisis, even if near-term acute impacts have been avoided. European manufacturers of generics and other lower margin products will suffer most, as will European medicines distributors. Ex- European suppliers of finished generics can step into the gaps, expanding in Europe. This still leaves the challenge, however, of securing European medicines supply and the long-term challenge of boosting European medicines manufacture.

Long-term gain: carbon footprint reduction

Longer term, the pharmaceutical industry’s energy use must be addressed in the context of its carbon footprint. Healthcare has a substantial carbon footprint, approximately 4% of global emissions and, of that, medicines generate up to one third. Human health is directly impacted by rising temperatures – from heatwaves to drought and food insecurity to changes in pathogen range. It follows that healthcare providers should be motivated to reduce their carbon footprint, and they are: 20 country health systems have pledged to achieve net zero, with target dates between 2030 and 2050, including the UK, Spain, Norway, and Belgium. To accomplish this, they will look to their medicines suppliers among others to respond with similar net zero commitments.

So far, only eight of the top 100 pharmaceutical companies by global prescription medicines sales have made a net zero commitment in the same date range. This disparity between goals of healthcare purchasers and suppliers isn’t sustainable – 2023 might be the year in which the pressure on large pharma to get serious about carbon footprint becomes unavoidable.

The global pharmaceutical industry, operating in healthcare systems still reeling from the long term effects of the COVID pandemic, is at a hinge point in 2023. Innovation remains strong, capable of delivering transformation for multiple health conditions, as well as for healthcare delivery. However, economic climate and fragility of healthcare systems combine to create formidable obstacles to the success of even the best new medicines. 2023 will therefore be a year of challenge and shakeout: what emerges to enter 2024 will be only the most innovative, agile, and above all, resilient.

About the author

Sarah Rickwood has 30 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has an extremely wide experience of international pharmaceutical industry issues, having worked most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan, and leading emerging markets, and is now vice president, European Marketing and Thought Leadership, at IQVIA, a team she has run for 12 years. She holds a degree in biochemistry from Oxford University.

Sarah Rickwood has 30 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has an extremely wide experience of international pharmaceutical industry issues, having worked most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan, and leading emerging markets, and is now vice president, European Marketing and Thought Leadership, at IQVIA, a team she has run for 12 years. She holds a degree in biochemistry from Oxford University.