Mind the gap: Are you delivering what HCPs value or what you want them to have?

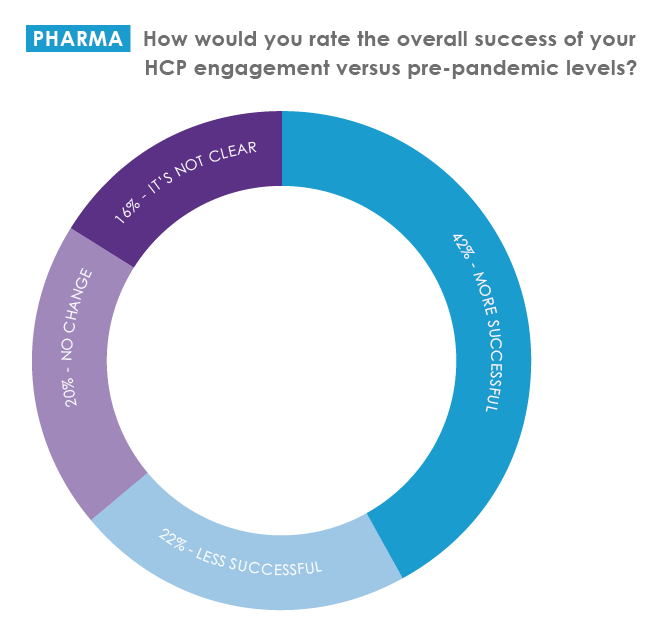

Since the onset of the Covid-19 pandemic, life science companies have acted quickly to address the evolving digital needs of healthcare professionals, with mixed success (see graph 1).

In the age of information overload, we all know that it is essential to add ‘value’ if we are to cut through the noise. And therein lies an issue.

In a recent study by EPG Health, pharma respondents voted ‘providing real value’ the top challenge (of 23) related to digital Health Care Provider (HCP) engagement.

Why is delivering value to HCPs such a challenge?

For 55% of pharma respondents and 47% of service providers, a contributing factor is their lack of insight into what HCPs actually value in terms of the content, channels, formats, etc.

For those, EPG Health’s report, The Gaps Between HCP demand and Pharma Supply of Medical Information, will provide some answers. However, the research also uncovers a more perplexing reason for not fulfilling demand – industry’s focus on delivering what it values rather than what HCPs value.

Knowledge is power, but wisdom allows us to apply it correctly.

For the most part, life science companies have a relatively good knowledge of what their audiences want and need from them.

Unfortunately, this isn’t always convenient or aligned to the information and tactics they would choose to adopt in their communications. Therefore, valuable market knowledge is ignored, and desired outcomes are not achieved.

There is clear evidence of a customer-centric paradox.

While pharma claims customer-centricity as a goal, the research highlights a number of important areas where their priorities are not aligned with those of HCPs.

The value that pharma attributes to field force activities is far removed from the value attributed by HCPs. For example, only 4% of HCPs consider pharmaceutical field reps as critical for discovering scientific information, while 68% of pharma consider their reps critical for this purpose.

HCPs value websites far greater (than field forces) as a source of medical information. 82% consider independent medical websites ‘critical or very important’ sources of medical information, compared to 52% for pharma educational websites and 40% for brand websites.

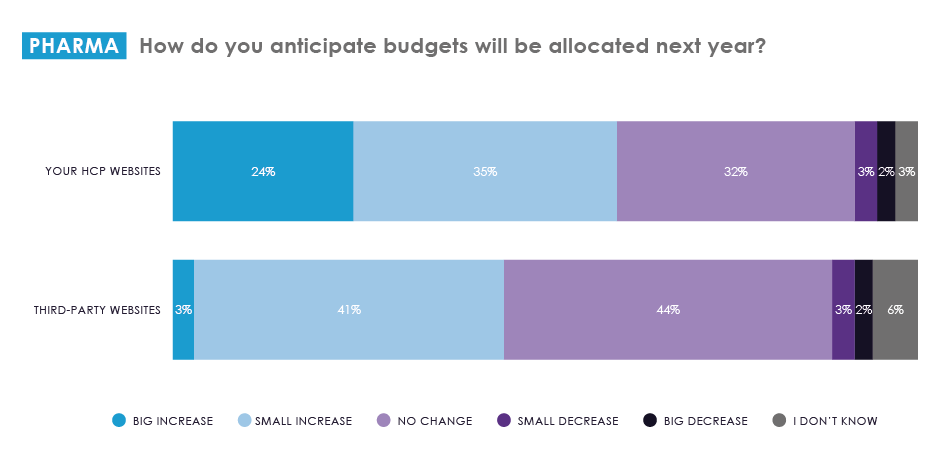

Though pharma is focused on keeping pace with digital demands, 59% expect to increase investment in their own HCP websites in 2022, versus only 44% in independent websites. Many have organisational policies in place to prioritise their websites, which HCPs value far less.

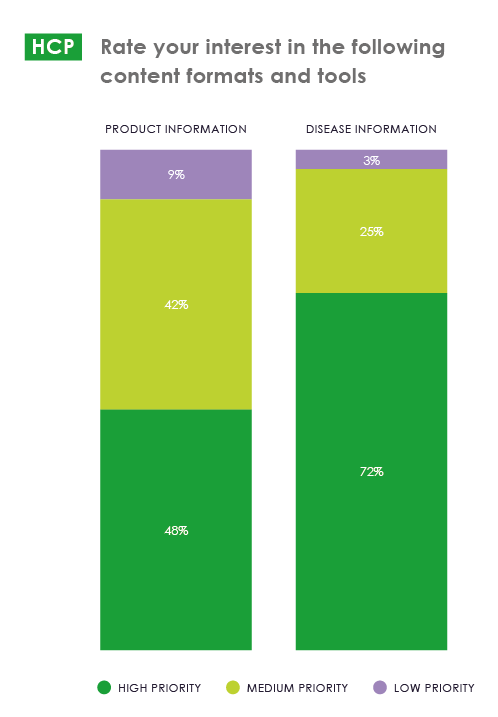

It isn’t just HCPs’ channel preferences that are being ignored. The content types and formats that pharma prioritise do not always align with demand. For example, 72% of HCPs attribute high priority to disease information versus 48% for product information. They prefer independent, non-promotional education and particularly value CME-accredited learning.

Pharma, however, has prioritised brand-led information, even on independent platforms. In 2021, more pharma companies provided eDetails (62%) and banner advertising (62%) on third-party websites than supported continuing medical education (CME) (58%) or eLearning (47%).

Despite rating independent medical education (IME) higher at meeting their own objectives, 71% of pharma companies expect to primarily create their own disease awareness in 2022.

The research delves into supply and demand of specific content and channel types in detail, however, a key takeaway is that while 54% of doctors agreed that the quality of digital medical information improved during the pandemic, only 29% agreed that pharmaceutical companies provided more valuable support and most agreed there has been too much branded content and advertising.

It isn’t all doom and gloom, though. Two-thirds of pharma companies feel well-resourced for digital HCP engagement, with all functions (digital, marketing, commercial and medical) having received increased budget and responsibility specifically for this purpose.

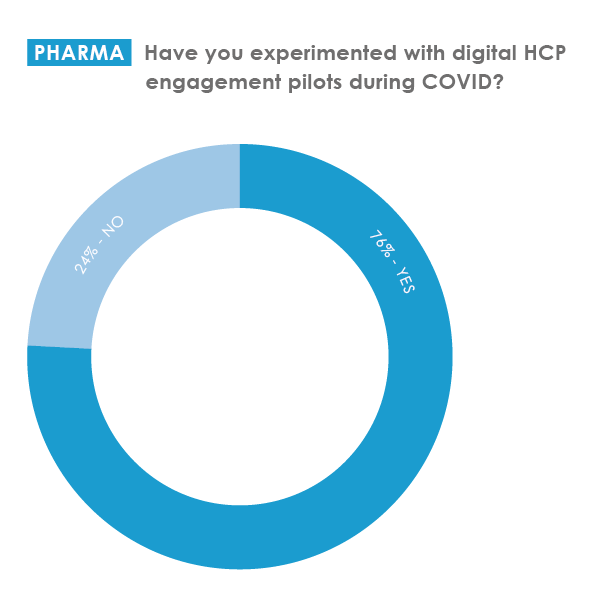

Moreover, although 95% believe further improvements in digital expertise are needed within every function, three-quarters have experimented with digital HCP engagement pilots during Covid-19.

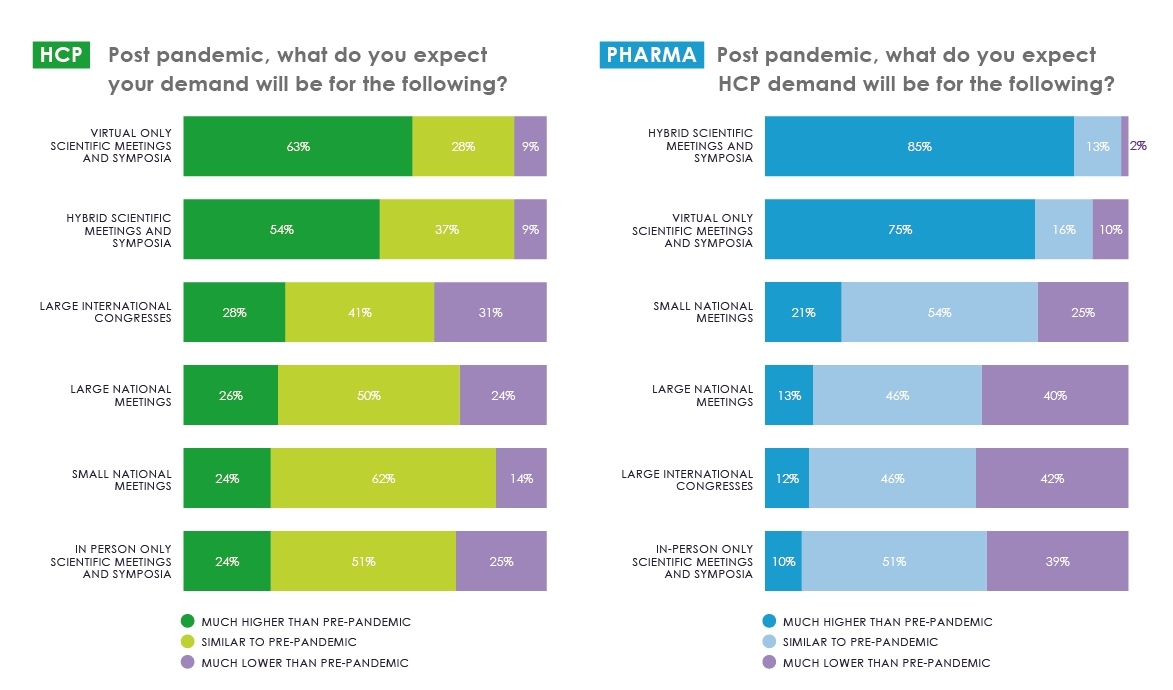

Adapting to a hybrid world, many pilots have revolved around delivery of virtual scientific meetings, with no option but to adapt to remote engagement during Covid-19.

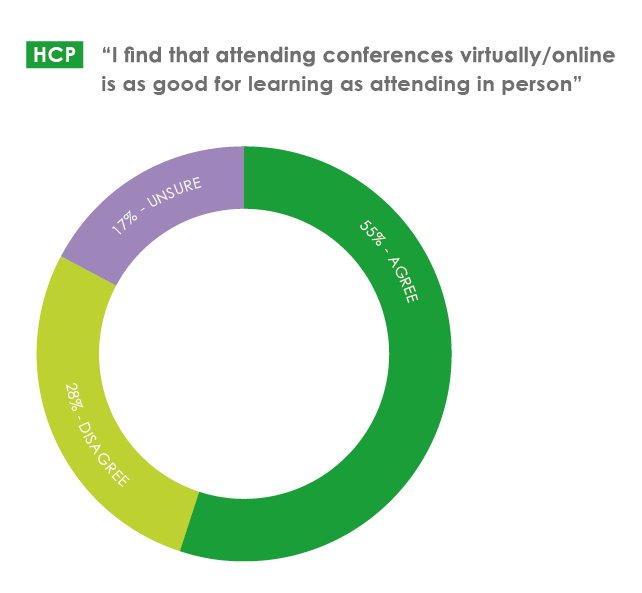

Seemingly these have delivered value for HCPs – more than 70% of HCPs consider every form of meeting (congress, symposia, workshops and webinars) ‘very important’ to their practice, whether attending in-person or remotely.

As international travel restrictions lift, HCP demand for virtual and hybrid events will remain much higher than pre-pandemic levels. The industry is preparing for that to be the case. Two-thirds of pharma respondents expect budget increases for hybrid meetings in 2022 and have developed new KPIs aligned to those.

For both HCPs and pharma, the issue is that virtual events don’t provide the valuable face-to-face networking opportunities of on-site meetings. Therefore, work must be done to develop better engagement models for all types of virtual and hybrid events.

Besides networking, 88% of HCPs attribute value to CME accredited events, conference highlights and on-demand recordings, so pharma would do well to focus more on those.

Delivering value in the virtual era requires new ways of working, including collaboration, experimentation and innovation. Organisations recognise this – more than three-quarters want to see improvements in collaboration between departments. With capacity being an issue, there has been an uplift in cross-functional activity and focus on breaking down long-held siloes.

Medical and commercial teams rely more on each other to better understand HCP preferences and behaviours and centralise content to ease access.

Despite the focus on delivering own content and channels, the industry is also seeking out external strategic partners to support digital HCP engagement – viewing third-party technology providers (80%) and network orchestrators (70%) as critical or very important. This collaborative approach, in testing and sharing wisdom within the wider healthcare ecosystem, is essential to advancing HCP education and patient outcomes.

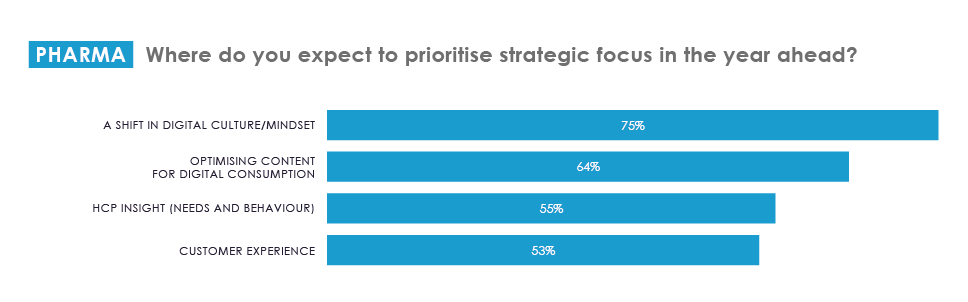

While EPG Health’s research shows that life science companies still have some way to go in achieving valuable HCP engagement, there are many positive indicators of intent. In 2022, 75% of pharma expect an internal ‘shift in their digital mindset', with a focus on ‘understanding HCP needs’ and driving ‘customer experience’. In the process, life-science companies must acknowledge and learn from mistakes. The biggest mistake is paying lip service to HCP demand.

(Note: Graph shows top four of 13 strategic priorities)

Free to access, EPG Health’s research was conducted globally with 246 HCPs, 82 pharma and 84 service providers. The report contains 65-pages of insight into HCP demand, industry supply, progress made, lessons learnt, the gaps that now exist and the challenges yet to overcome.

DOWNLOAD ‘The Gaps Between HCP Demand and Pharma Supply of Medical Information

About the author

Michelle Kelly is division head of Marketing and Market Research at EPG Health. With a focus on supporting meaningful engagement with HCPs, she has more than 20 years’ experience in medical publishing, having previously worked at Nature Publishing Group and Current Science Group. Contact her at contact@epghealth.com or on LinkedIn.

Michelle Kelly is division head of Marketing and Market Research at EPG Health. With a focus on supporting meaningful engagement with HCPs, she has more than 20 years’ experience in medical publishing, having previously worked at Nature Publishing Group and Current Science Group. Contact her at contact@epghealth.com or on LinkedIn.

About EPG Health

EPG Health is the publisher of Medthority (www.medthority.com), an independent patient management and treatment decision support tool for healthcare professionals.

Easing the discovery and consumption of valuable medical education, EPG Health supports a personalised experience and better outcomes for all stakeholders. A bespoke and integrated toolset helps pharmaceutical companies to reach and engage target audiences with key educational messages while measuring the outcomes.

For more information visit www.epghealth.com