UK and US agree zero tariffs on pharma – with price rises

An agreement between the UK and the US will maintain tariffs on imports into the US at 0% but, as a quid pro quo, prices of medicines used by the NHS will go up.

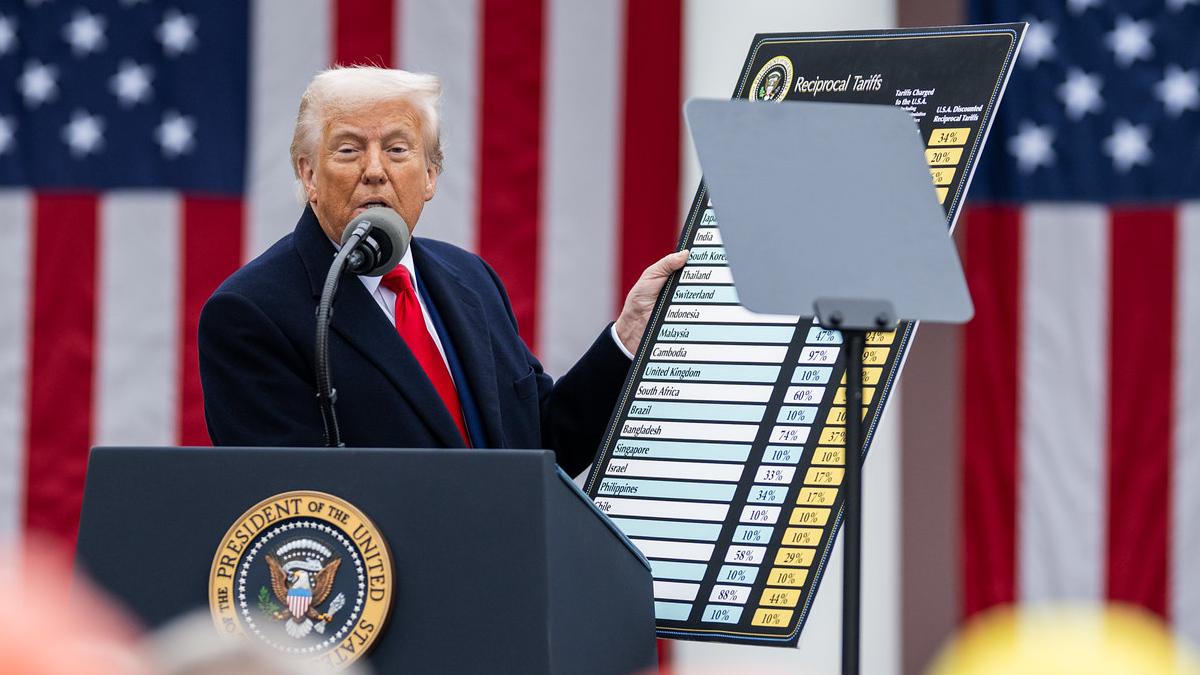

The deal has been in the works since the two countries reached a bilateral trade agreement in the spring that focused on other industrial sectors and limited tariffs on most goods to 10%.

According to the US government, it will lead to continued investment by UK pharma companies in the US, creating jobs for American workers, and will mean that the federal government will "refrain from targeting UK pharmaceutical pricing practices" for the duration of President Trump's term.

The UK, meanwhile, said it would secure and expand access to medicines for "tens of thousands" of NHS patients and protect UK-based manufacturing and jobs.

UK-based drugmakers, including AstraZeneca and GSK, have already announced major investment programmes in the US to sidestep the risk of Trump's tariffs, while various UK-based projects have been abandoned, with the companies involved alluding to an uncompetitive trading environment in the UK.

New medicine prices to rise by 25%

The agreement also calls for the NHS to increase the net prices it pays for new medicines by 25%, by tweaking the current commissioning framework overseen by health technology assessment (HTA) agency NICE in England and its counterpart, the SMC, in Scotland.

It seems the heart of the proposal is for NICE to increase its baseline cost-effectiveness threshold from £20,000-£30,000 – the level used for more than 20 years – to £25,000-£35,000, from April 2026.

The agency said this would "improve the operating environment for pharmaceutical companies in the UK" and should allow it to recommend NHS use of between three and five additional medicines per year.

The price increase means NICE "will be able to approve medicines that deliver significant health improvements, but might have previously been declined purely on cost-effectiveness grounds," said the UK government.

The Association of the British Pharmaceutical Industry (ABPI) welcomed the agreement, saying it "hopes [it] will allow more innovative medicines to reach a greater number of NHS patients and will be a positive step in supporting the UK life sciences industry."

The new cost-effectiveness thresholds mean that the UK moves close to the average in the league table of similar countries that use these measures, but will still be in the lower half.

NHS rebate battle settled

In another move celebrated by pharma, the UK has also confirmed that it will reduce the level of repayments on NHS sales required from drugmakers under the much-loathed 'voluntary scheme' (VPAG) from 23.5% to 15% between 2026 and 2028, appearing to bring what has been an acrimonious standoff with the industry to an end.

Other European countries demand much lower rebates, such as 5.7% in France and 7% in Germany.

According to the ABPI, the government has also agreed to start talks with industry on a new "more sustainable" scheme that will come into effect in 2029.

"These commitments begin to address industry concerns on NHS access to medicines, and the UK's record-high and unpredictable payment rate," commented ABPI chief executive Richard Torbett.

"There remain a great many details to work out and further technical improvements to make, but with this strong and positive progress, I look forward to working with the government to ensure this plan delivers for the NHS and UK industry."

Science and Technology Secretary, Liz Kendall, said the agreement would "ensure UK patients get the cutting-edge medicines they need sooner, and our world-leading UK firms keep developing the treatments that can change lives. It will also enable and incentivise life sciences companies to continue to invest and innovate right here in the UK."