Tecentriq beats rivals to EU breast cancer market

Roche has claimed approval in Europe for Tecentriq as a therapy for hard-to-treat triple-negative breast cancer (TNBC), ahead of its checkpoint inhibitor competitors.

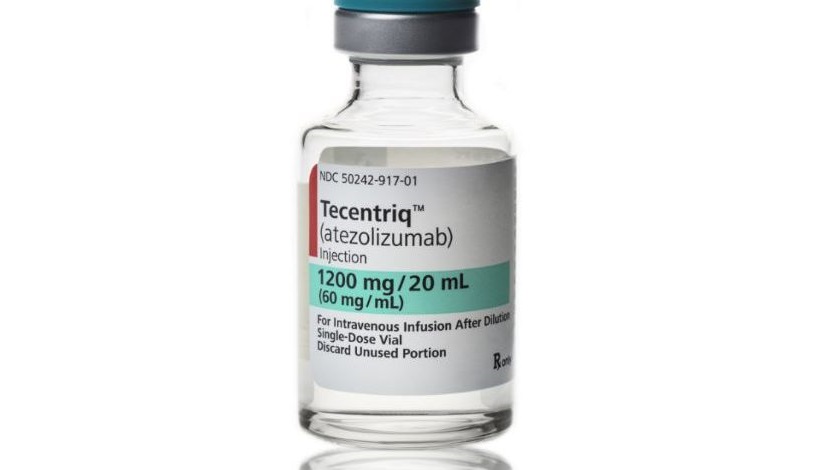

The European Commission has cleared the use of PD-L1 inhibitor Tecentriq (atezolizumab) alongside Celgene’s Abraxane (nab-paclitaxel) as a first-line treatment option for patients with advanced, PD-L1-positive TNBC who are ineligible for surgery – an indication that was approved by the FDA earlier this year.

The EC green light is based on data from the phase 3 IMpassion130 study, which showed that Tecentriq plus Abraxane significantly reduced the risk of disease worsening or death by 40% compared with Abraxane alone.

TNBC is viewed as a big opportunity for Roche as it Tecentriq is the first checkpoint inhibitor to get approved in breast cancer, which already a major focus for Roche with its trio of HER2-targeted antibody drugs Herceptin, Perjeta and Kadcyla.

TNBC is the form of breast cancer diagnosed in around 15% of the 2 million women who develop the disease each year, so represents a sizable patient population characterised by tumours that don’t express oestrogen or progesterone receptors as well as HER2.

It’s an aggressive cancer with few treatment options other than chemotherapy, as it doesn’t respond well to hormonal therapies or HER2 drugs.

Tecentriq is already showing encouraging sales growth in its first indications – urothelial carcinoma and non-small cell lung cancer – with first-half sales rising 141% to CHF 782 million ($796 million) and the drug expected to top $1.6 billion this year.

It’s lagging well behind the leaders in the PD-1/PD-L1 inhibitor category like Merck & Co’s Keytruda and Bristol-Myers Squibb’s Opdivo however, which are predicted to generate revenues of $9 billion and $7 billion respectively this year.

TNBC is Roche’s first major opportunity to build a niche for its checkpoint inhibitor without direct competition. A fail for Keytruda in this indication earlier this year suggested Roche could have a sizeable lead, although Merck resurrected its hopes in TNBC last month when a second phase 3 trial came good.

Keytruda is considered to be in second place in TNBC now, with an opportunity to sneak ahead of Tecentriq in the surgery-eligible patient population.

Roche will need to improve diagnosis rates if Tecentriq is to make headway in this market however, and to that end has also expanded the EU indications for its PD-L1 diagnostic to include TNBC as well as bladder cancer and NSCLC.

"The European approval of this Tecentriq combination represents a significant step forward in the treatment of this aggressive breast cancer, where the unmet medical need is great," said Roche’s soon-to-retire chief medical officer Sandra Horning.