Pear Tx files for bankruptcy, will seek to sell assets

The burgeoning field of digital therapeutics was struck a blow today when Boston-based Pear Therapeutics, one of the pioneers of the space, declared Chapter 11 bankruptcy.

"Today is a difficult day for Pear Therapeutics," CEO Corey McCann wrote on LinkedIn. "We announced that Pear voluntarily filed for Chapter 11 and will seek to sell assets through a sales process. We also announced a reduction in force, including me. This is certainly not the outcome I envisioned when I founded Pear in 2013."

The company will continue looking for purchasers of specific assets to hopefully create some restitution for stakeholders, the company said in a statement. According to Pear's website, this includes trying to find someone who will take over and administer the company's in-market digital therapeutics.

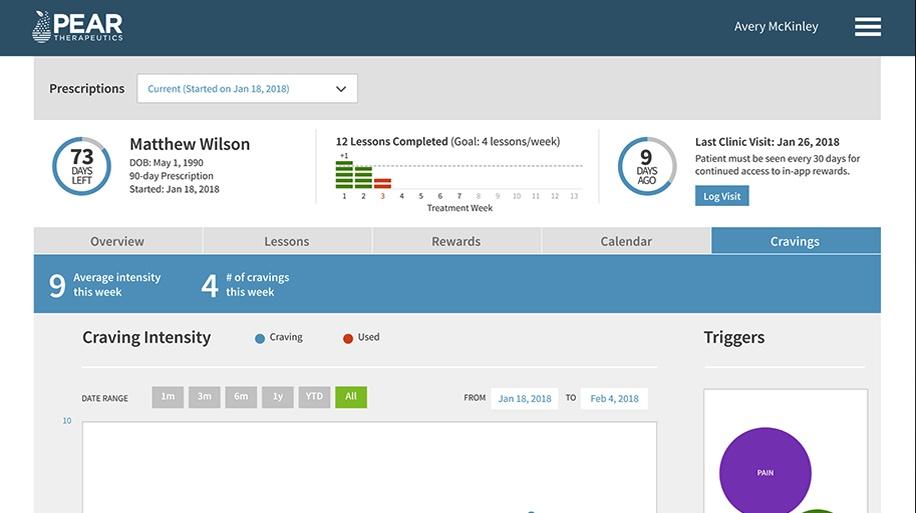

"Our hope is that our business and/or products will be purchased so that another company can provide them to patients," the company wrote. "Pear Therapeutics is not accepting new prescriptions for its products, reSET, reSET-O, and Somryst, nor will refills be dispensed at this time. We will attempt to keep our products available for patients who are already using the products for the duration of the current fill of their prescription, but there can be no assurance that we will be able to do so."

The news should not come as a total shock to anyone who has been paying attention to the space. Signs of trouble were evident in the company's third-quarter results, when the firm announced it was cutting 22% of its workforce – around 59 employees – in order to trim almost $11 million off its expenses.

And just a few weeks ago the company announced that it was seeking “strategic alternatives” for the business that could include a sale, merger or licensing out of its DTx assets.

However its fortunes have faired lately, digital therapeutics companies owe a lot to Pear's trailblazing forays into the space. Not only did Pear have the first software-only digital therapeutic cleared by the FDA with claims to improve clinical outcomes in a disease, its historical deal with Novartis's Sandoz division was among the first partnerships between a pharma company and a prescription digital therapeutics company. That deal was not destined for greatness, however, as the two would break up in October 2019.

In his LinkedIn post, McCann blamed reimbursement woes as well as the overall economic climate for his company's downfall.

"The Pear team has accomplished a lot together in bringing the first Prescription Digital Therapeutics (PDTs) to market. We’ve shown that clinicians will readily prescribe PDTs. We’ve shown that patients will engage with the products. We’ve shown that our products can improve clinical outcomes. We’ve shown that our products can save payors money. Most importantly, we’ve shown that our products can truly help patients and their clinicians," he wrote. "But that isn’t enough. Payors have the ability to deny payment for therapies that are clinically necessary, effective, and cost-saving. In addition, market conditions over the last two years have challenged many growth-stage companies, including us."