Sandoz says ‘no’ to Pear Therapeutics’ digital apps, handing back rights

Novartis has made no secret of its desire to become a leader in digital therapeutics (DTx), but that hasn’t stopped it ducking out of one of its flagship projects in the area.

The Swiss group’s Sandoz generics unit has just handed back rights to a pair of smartphone-based apps that aim to improve the treatment of people with opioid use disorder, licensed with some fanfare from developer Pear Therapeutics last year.

Sandoz says that the decision to exit the co-promotion agreement stems from its “transformation and subsequent leadership change, which has resulted in a reinforced focus on and capital allocation for Sandoz’ core business.”

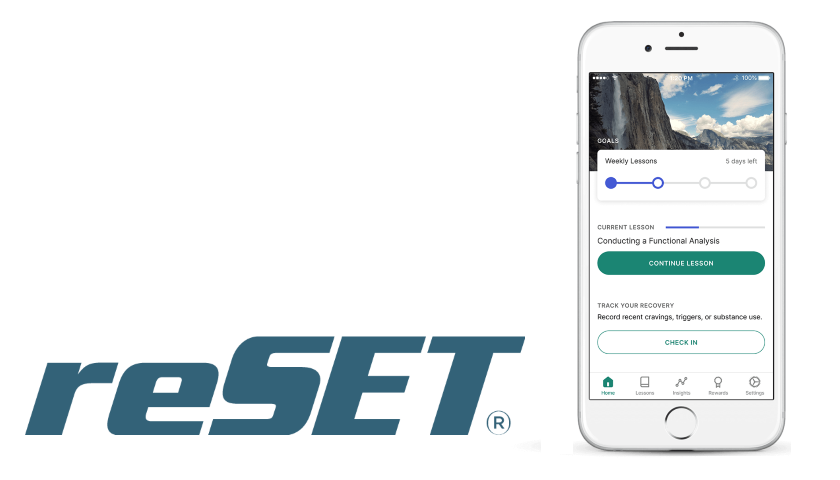

In 2017, Pear’s reSET became the first FDA-approved mobile medical application with both a safety and efficacy label, after the FDA licensed it for substance use disorders involving alcohol, cocaine, marijuana and stimulants.

It was joined at the end of last year by reSET-O, approved by the US regulator to assist people trying to come off recurrent use of opioid drugs who are receiving buprenorphine therapy. Sandoz also sells buprenorphine in patch and sublingual tablet formulations for the treatment of opioid dependence.

The timing of the divorce took some observers by surprise, as there is so much attention in the US on the opioid crisis right now, as well as increased levels of funding going into programmes to help people recover from their addiction – funded in no small part by drugmaker settlements to sidestep liability lawsuits.

A joint statement by the two companies insists that Pear has already developed the “standalone commercial infrastructure” needed to take over the two products, but says Novartis will continue its involvement for a transitional period.

“Sandoz believes that Pear is now well-suited to continue to bring these important digital therapeutics to patients, [healthcare professionals] and payers,” it continues.

A separate collaboration with Pear – focused on developing DTx for schizophrenia and to reduce the mental health burden for patients with multiple sclerosis – remains in place, according to the two companies.

The deal between the two companies was widely hailed as a sign that DTx is coming of age, but the dissolution of the partnership doesn’t change the underlying promise of the emerging sector, according to GlobalData analyst Alessio Brunello.

“The common trend is that over the years DTx should become more popular and should see continued partnership activity in…R&D and therapeutics,” says Brunello, who maintains that despite the split there is still “huge opportunity” for pharma companies who get involved.

DTx could potentially address problems associated with the growing aging population and increasing healthcare costs, and the industry’s “interest in value-based care and patient centricity is helping drive adoption…as insurers and payers can use data and analytics to manage healthcare costs and help patients to receive appropriate treatment.”

Brunello adds: “DTx are a huge opportunity for pharmaceutical companies and healthcare organizations, as they will allow improved adherence and outcomes, and treat patients more effectively.

“Drugs that are already available in the market can be efficient but are not being used optimally; DTx and digital medicine can fill this unmet need.”