GBT claims EU approval for sickle cell drug Oxbryta

Global Blood Therapeutics' run of positive regulatory news for its oral sickle cell disease treatment Oxbryta has continued with an approval for the drug in Europe for patients aged over 12.

The green light from the European Commission comes a couple of years after Oxbryta (voxelotor) was cleared by the FDA for the treatment of haemolytic anaemia caused by SCD in the over-12s, and a few weeks after an expansion of its US label to include patients aged four and above.

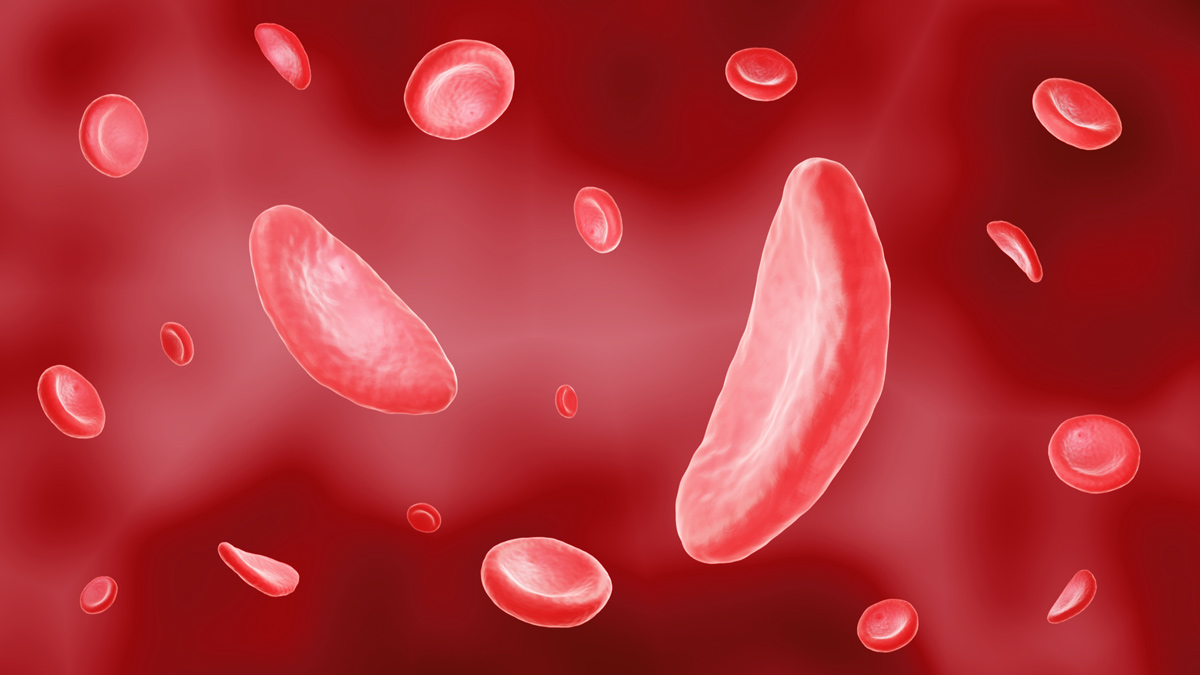

Oxbryta is the first medicine approved in Europe that directly prevents sickle haemoglobin (HbS) polymerisation, the molecular basis of sickling and destruction of red blood cells in SCD, and has been tipped to become a $1 billion-plus blockbuster at peak.

The drug – which costs $125,000 at US list prices – can be used either alone or in combination with hydroxyurea, a well-established therapy for the disease.

SCD is one of the most prevalent genetic diseases in Europe, affecting approximately 52,000 people, and is more common in those whose ancestors are from sub-Saharan Africa, although it is also seen in people of Hispanic, South Asian, Southern European and Middle Eastern ancestry.

In SCD, red blood cells lose their flexibility and become rigid, sticky and crescent or sickle shaped, impairing their ability to transport oxygen effectively. The resulting damage to tissues and organs can lead to life-threatening complications including stroke and irreversible organ damage.

Sales of Oxbryta was a little slow to gather momentum, mainly because of payer resistance in the US, but are starting to ramp up, rising 41% to $52 million in the third quarter of 2021.

The pushback has also affected another new drug for SCD, Novartis' antibody Adakveo (crizanlizumab), used to treat the painful vaso-occlusive crises (VOCs) that periodically afflict people with the disease, which has also been highlighted as a potential blockbuster.

Adakveo brought in $42 million in the same period, and $43 million in the final three months of 2021.

The confounder for both GBT and Novartis' hopes for their drug could be genetic therapies for SCD, which offer a one-shot treatment for the disease.

Any near-term impact in Europe will be limited after Bluebird Bio pulled its Zynteglo (betibeglogene autotemcel) gene therapy for another rare blood disorder, beta thalassaemia, off the market in Germany after failing to secure agreement on pricing.

The biotech also said it would pull out of Europe altogether, saying the market there was hostile to pricing and reimbursement of gene therapies, including its clinical-stage SCD candidate elivaldogene autotemcel.

CRISPR Therapeutics and Vertex are also in the running with their gene-editing candidate CTX001, in phase 1/2 trials which are due to generate final results later this year. If those results are positive the partners have said they could file for approval in the US before year-end.