AbbVie lines up Thakkar to replace outgoing CSO Hudson

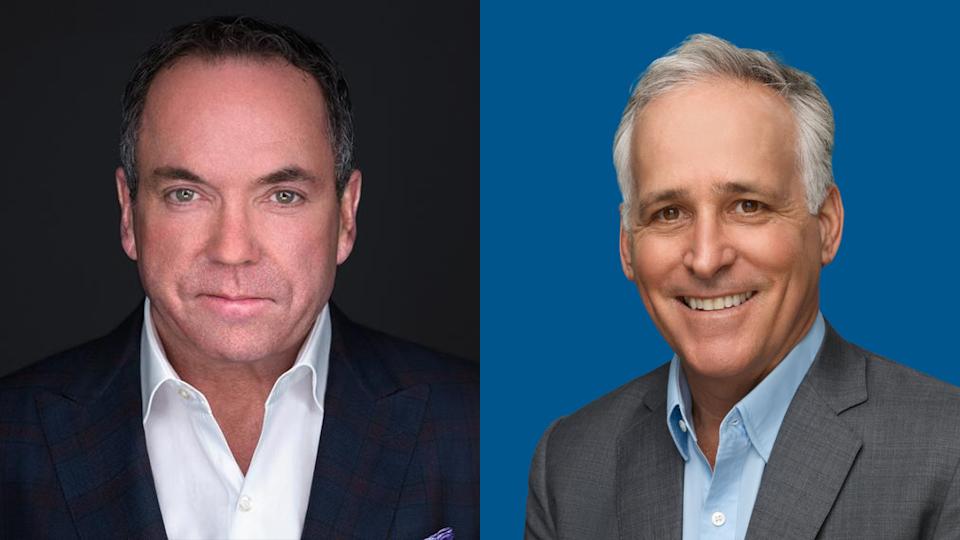

AbbVie's new chief scientific officer Roopal Thakkar (l), who is replacing Thomas Hudson (r)

There is change at the top of AbbVie’s R&D organisation, as chief scientific officer Thomas Hudson announces his retirement after four years in the role.

He will be replaced as head of AbbVie’s global R&D organisation by Roopal Thakkar, who is currently serving as chief medical officer and has been at the pharma group for more than two decades.

It’s the second major change at the top of a big pharma group to be announced this week, after Pfizer’s chief scientific officer and president of R&D, Mikael Dolsten, also announced his intention to step down, once a successor has been found.

“Dr Thakkar is a physician by training with a deep commitment to innovation and patient care. He has an excellent track record in building new capabilities, forging strategic partnerships, and advancing our clinical programmes to bring medicines and solutions to patients as quickly as possible,” said Rob Michael, AbbVie’s chief executive.

“As AbbVie's chief scientific officer, Dr Thakkar will continue to build momentum across discovery and all stages of development to fully realise the potential of our diverse pipeline. He has the right vision, skills, and experience to lead our R&D organisation.”

The promotion means Thakkar – who joined the company in 2003 as part of its physician development programme – now has responsibility for all 14,000 AbbVie researchers across the group’s therapeutics and aesthetics businesses, overseeing a pipeline of more than 90 drug and device programmes.

Hudson, meanwhile, joined AbbVie in 2016 from his former role as president and scientific director of the Ontario Institute for Cancer Research, overseeing oncology discovery and early development, before assuming responsibilities for the entire discovery organisation as CSO in 2019.

Thakkar takes over the top R&D job as AbbVie is still weathering the loss of patent protection for immunology blockbuster Humira (adalimumab), a cash-cow product for the company for many years, which saw sales peak at $21 billion in 2022, but has now started to slide due to competition from biosimilars and newer drugs in its long list of indications.

The company is looking to a roster of growth products, including Humira’s heirs Rinvoq (upadacitinib) and Skyrizi (risankizumab), to help absorb what it has described as the “largest loss of exclusivity event” ever in the pharma sector.

Analysts at Morningstar recently predicted that those two drugs could see sales peak at around $30 billion, with patent protection out to 2033, giving AbbVie time to build up a slightly thin late-stage pipeline. That has been bolstered in recent months by the $10.1 billion takeover of ImmunoGen and a planned $8 billion acquisition of Cerevel, which hasn’t yet been completed.