Are we entering a new era of blockbuster weight-loss drugs?

As revenues fall in diabetes treatments, has the industry found a new revenue driver in weight-loss treatments? Ben Hargreaves finds that demand has outstripped supply on a newly approved obesity treatment, and learns how the industry is quickly ramping up manufacturing capacity.

The diabetes treatment area has traditionally been a strong area for revenue in the pharmaceutical industry. However, as patent expirations have kicked in, and as the debate over the pricing of insulin has become a common topic in US politics, the therapeutic area is not as stable as it once was. As a result, those companies that have relied on the area for revenue are now looking to drive growth in other areas, such as through the development of new kinds of diabetes treatment and to innovate on existing therapies.

Part of the new wave of diabetes treatment saw the development of glucagon-like peptide-1 (GLP-1) agonists. The treatments function by stimulating the body to produce more insulin, with the extra insulin helping to lower blood sugar levels – making them suitable for helping to control type 2 diabetes. In clinical trials, one of the leading types of such treatments, semaglutide (also known by the brand names Ozempic, Wegovy, and Rybelsus), was found to be effective at lowering glucose levels and well-tolerated by patients in clinical trials. An additional benefit was that Rybelsus could deliver the treatment through an oral formulation, which provides an advantage over other forms of GLP-1 agonists that rely on injection for delivery. However, there was another benefit of the treatment that caught the eye of researchers.

In for a penny

With time and additional data, researchers discovered semaglutide was also able to reduce the rate of cardiovascular events in patients with type 2 diabetes, and to lead to greater reduction in fat mass. As a result, Novo Nordisk, the owner of the treatment, gained approval from the US Food and Drug Administration (FDA) for semaglutide to be used as a treatment for patients with obesity that have at least one weight-related ailment, such as high blood pressure, high cholesterol, or diabetes. In the process, the treatment became the first new treatment for weight-loss in seven years, at the time of approval.

Clinical trials for Wegovy showed that those receiving the treatment saw a mean change in body weight of 14.9% after 68 weeks, when combined with a reduced-calorie diet and increased physical activity. This compared against a 2.5% loss in weight when patients were administered a placebo. Overall, 83.5% of patients taking Wegovy showed weight loss of over 5%, and 30.2% of patients managed weight loss of over 20%.

Novo Nordisk is not the only company exploring GLP-1 treatments to treat obesity. Eli Lilly, another company that has an established diabetes portfolio, is also exploring the potential for its treatment, Mounjaro (tirzepatide), to treat obesity. The treatment already received an approval from the FDA for type 2 diabetes in May 2022, and, ahead of any additional approval, Lilly moved to bolster its manufacturing capacity for the treatment. Amgen is another company looking to move into the area, as it progresses its drug candidate for obesity into mid-stage trials.

In the public eye

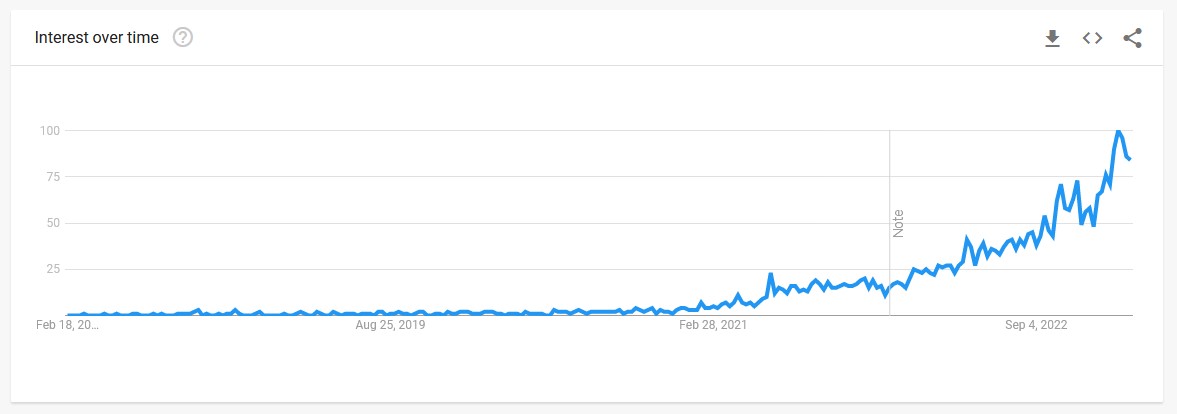

As more research emerged around the potential for semaglutide to aid in weight loss, public interest in the medication also grew. A Google Trends analysis of the frequency for searches of ‘Ozempic for weight loss’ shows that people were beginning to inquire about this potential use of the treatment, even before Wegovy received approval in the area. As can be seen in the below image, the interest has since skyrocketed in recent months.

The interest in the product is being partially driven by the amount of publicity being received around its apparent widespread use in Hollywood circles to achieve weight loss, even when those involved are not suffering from obesity. Elon Musk openly stated on Twitter that he had lost weight through a combination of Wegovy and fasting, while other celebrities have also noted their use of the treatment. As the therapy begins to be commercialised more widely beyond the US, this phenomenon of increased interest will likely only grow.

Supply takes a hit

If this increased interest does emerge, it is set to place even greater strain on the supply of GLP-1 products. According to the FDA’s database, Novo Nordisk’s Ozempic and Wegovy are currently in shortage and that has been the case for the former product since August 2022, and the latter since December 2022. The company has reacted by investing heavily into expanding its manufacturing network, as it announced a $776 million plan to increase capacity at its facilities in Bagsværd, Denmark. This move was one in a series of such investments, which includes the decision in December 2021 to construct three new manufacturing facilities in Kalundborg, Denmark, that would cost the company $2.4 billion.

Reaching out directly to Novo Nordisk, a spokesperson for the company explained the reasons for the shortages: “When we introduced this medicine in the US in 2021, we saw significant interest from the healthcare community and patients, resulting in unprecedented product demand. Shortly thereafter, we experienced issues at the contract manufacturing site for Wegovy, which resulted in supply shortages.”

In fourth quarter results, Camilla Sylvest, commercial strategy and corporate affairs at Novo Nordisk, stated that GLP-1 sales had increased by 36% in North America and outside the US by 57%, in year-on-year sales. However, Sylvest stated, “The strong sales growth has unfortunately resulted in periodic supply constraints and related drug shortage notifications across a number of products and geographies.”

Due to the supply issues and the high demand for the product, Novo Nordisk has been slow to roll out the treatment to other geographies. Wegovy received approval in the European Union in January 2022, but has so far only launched the product in Denmark and Norway in the region. When pharmaphorum asked the company whether it plans to expand access in Europe, the spokesperson stated, “We expect to launch the product in a number of countries in 2023,” but declined to state which specifically.

In terms of how the company is currently working to expand its supply, the spokesperson outlined that it expects production capacity to be increased in the first half of 2023, when a second contract manufacturing organisation (CMO) will begin commercial production of the product. In addition, the company will work with another CMO to open a second site for production. The spokesperson also noted that the company plans to invest further in its capacity across all relevant sites in 2023. As the company eyes obesity sales of $3.69 billion by 2025, more than twice that of an earlier forecast, it is clear that the company expects rapid expansion of its capacity one that is worth the investment.