Orphan drugs will fuel pharma's future - and a pricing pushback too

The boom in new orphan drug treatments is good news for patients with rare, debilitating and life-shortening diseases. But their high cost and growing numbers are leading to a payer backlash.

New analysis suggests that the industry's rare disease pipeline is poised to take an even greater role in sustaining the sector in the coming years - but there are also clear signs of a backlash against the flood of very high cost treatments.

Evaluate's Orphan Drug Report 2017 forecasts that worldwide orphan drug sales will reach $209 billion in 2022, and will account for 21.4% of total prescription drug sales.

Companies expected to do particularly well from rare diseases are led by Celgene, who will become number one in orphan drug sales by 2022, (driven on by blood cancer treatment Revlimid), while Shire will be the leader in non-oncology orphan drug therapies.

Worldwide orphan drug sales in 2022: Top 10 Companies

- Celgene - $16.9 bn

- Bristol-Myers Squibb - $13.5bn

- Novartis - $12.0 bn

- Roche - $10.9 bn

- Johnson & Johnson - $10.6 bn

- Shire - $9.8 bn

- AbbVie $9.6 bn

- Merck & Co. - $8.9 bn

- Alexion - $6.9 bn

- Pfizer $5.6 bn

Source: Evaluate Pharma

[caption id="attachment_25380" align="alignnone" width="320"] Revlimid will be the No.1 orphan drug in 2022[/caption]

Revlimid will be the No.1 orphan drug in 2022[/caption]

Meanwhile Kite's CAR-T therapy Axiabtagene ciloleucel topped the forecasts for most valuable pipeline assets, even before Kite yesterday revealed convincing results against aggressive forms of non-Hodgkin’s lymphoma. Evaluate forecasts that Kite's drug could reach almost $7.9 billion.

Beyond cancer, Shire’s lanadelumab for angioedema could generate sales of around $7.4 billion in 2022, making it the second most valuable drug on the list.

Shire has reached its current dominant status via a string of major acquisitions, including the $5.9 billion buyout of Dyax, which originally developed lanadelumab.

The third most valuable orphan drug is Tesaro’s cancer drug, niraparib – which could amass sales of nearly $5.8 billion in 2022.

The attractiveness of companies with rare disease assets means more M&A in the area is a certainty over the next few years.

Orphan drugs at centre of pricing controversy

R&D and marketing exclusivity inducements in US and European orphan drug legislation has greatly accelerated and expanded the number of new orphan drug treatments in recent years.

Drugs approved to treat rare diseases made up 40% of new drugs approved by the FDA in 2016 and nearly 50% of new drugs approved in 2015.

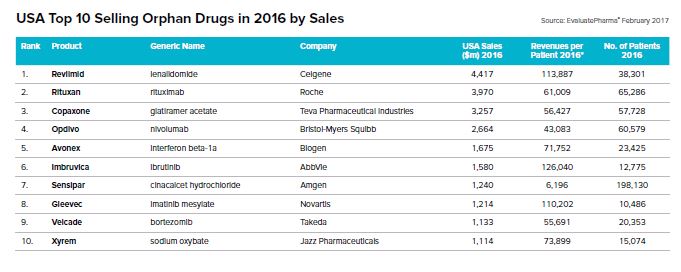

According to this year's Evaluate report, the average cost per patient per year for an orphan drug was $140,443 in 2016, compared to $27,756 for a non-orphan product.

But healthcare payers are beginning to cry foul, claiming companies are now exploiting the system to generate higher profits.

Recent high profile examples of products facing pushback from payers in the US were Sarepta's Duchenne treatment Exondys 51 and Biogen's spinal muscular atrophy drug Spinraza. Payers are especially questioning the efficacy of Exondys 51, as the FDA essentially approved the drug without it having demonstrated any significant efficacy in patients.

Add to this the uproar around Marathon's trick of turning an existing generic drug into an $89,000-a-year orphan drug Emflaza, and the field has a bona fide backlash on its hands.

Republican senator Chuck Grassley announced in February that he was launching an investigation into how companies may be exploiting the US Orphan Drug Act to foist very high cost drugs on the system.

The US rare disease patients umbrella group the National Organization for Rare Disorders (NORD) says the US legislation should remain unchanged. However its equivalent in Europe, EURORDIS, has spoken out recently on high pharma prices.

While calling for more rare disease medicines to be approved in Europe, EURORDIS also said prices should be slashed.

The non-profit alliance, of more than 700 European rare disease patient organisations, wants to see a three-to-five-fold increase in the number of rare disease medicines approved in Europe by 2025.

But it also called for these drugs to be made available at one third to one fifth of the price. Such calls will find a sympathetic audience in the UK, where NICE and NHS England are proposing a new £100,000 per QALY threshold, which would see many current treatments rejected.

Download the Evaluate Pharma Orphan Drug Report 2017 here