Shire looks to eye drug as sales beat forecasts

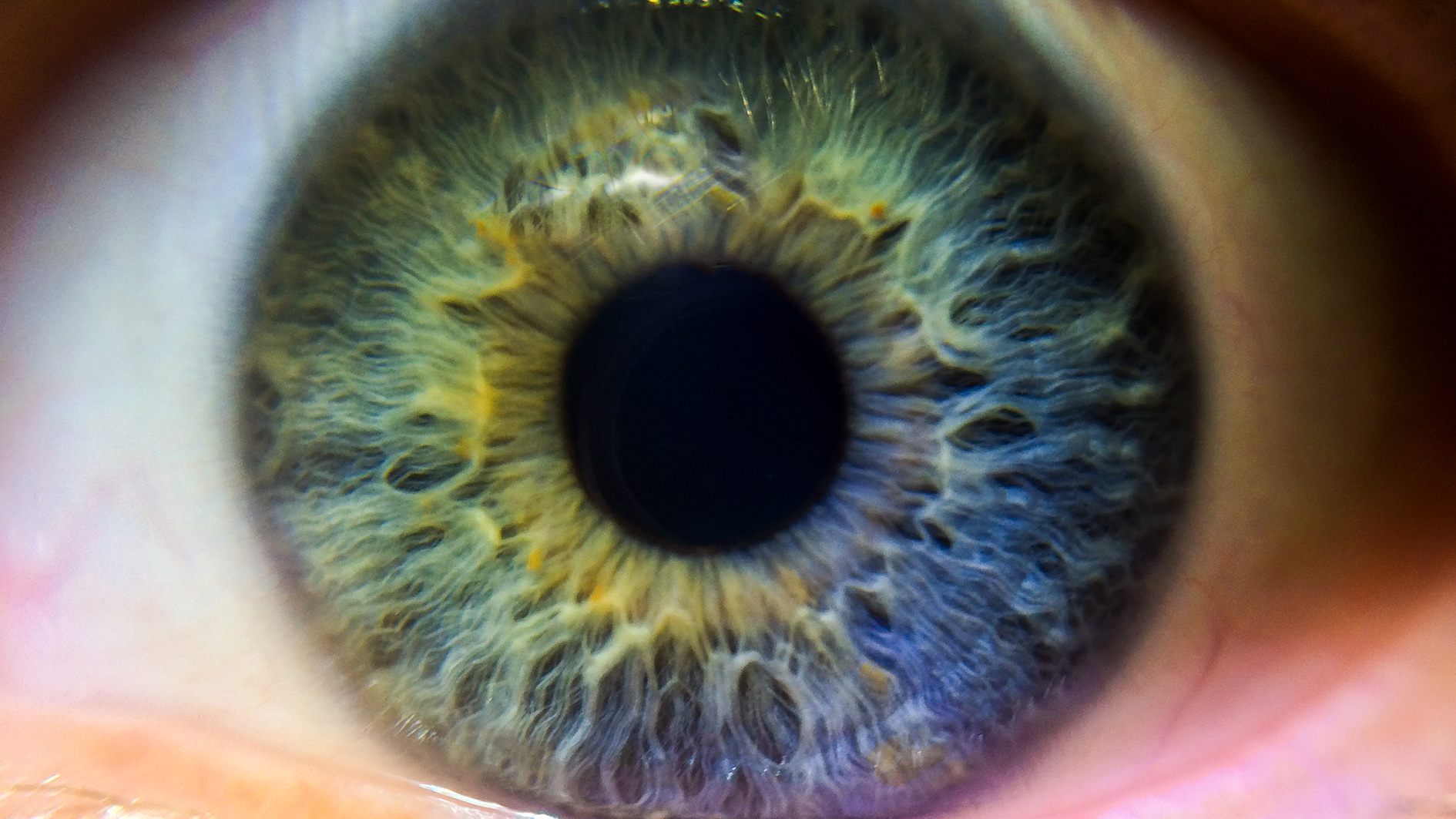

Shire’s CEO Flemming Ornskov has hailed the launch of ophthalmology drug Xiidra (lifitegrast), as the company posted better-than-expected full-year figures.

The figures included sales from rare disease biotech Baxalta, which Shire bought in June last year for $32 billion, and showed revenues were up 78% to $11.4 billion, although net income fell 75% to $327 million because of costs incurred due to the merger.

The figures were at the top end of analysts' estimates and seem to vindicate CEO Flemming Ornskov's decision to snap up Baxalta, almost as soon as it was spun off from Baxter in 2015.

Results were at the top end of analysts’ expectations, driven by sales of established products from Shire and Baxalta, and shares were up 2% today on the London Stock Exchange.

Shire’s biggest seller is still its hyperactivity drug, Vyvanse, now with sales of more than $2 billion a year, but haemophilia and immunoglobulin therapies from Baxalta have both brought in billion-dollar plus revenue streams.

But Ornskov faced probing questions from analysts in a conference call about Xiidra, a blockbuster hopeful that Shire stuck with despite a rejection in dry eye disease by the FDA in 2015.

The regulator finally approved Xiidra last summer and since it was launched in the US in August, the drug has produced sales of $54 million.

Shire got hold of Xiidra through its acquisition of SARcode Bioscience in 2013, paying $160 million upfront plus milestone payments.

Ornskov hit back when Morgan Stanley analyst Nicolas Guyon-Gellin suggested Xiidra’s sales figures were “heavily distorted” by a free sampling programme.

Orsnkov said: “I think we should just take a step back and again say this is one of the, I think, more successful launches in recent pharmaceutical history.

“You cannot just look at every day and every week. You have to take a little longer perspective, and I think this is a very strong launch, and I'm actually confident that we will continue this brand.”

Analysts predict peak annual sales of between $1-$1.8 billion for Xiidra – so although this target is a long way off, the company is clearly encouraged by the strong start.