Orexo partners with Gaia on digital opioid abuse therapeutic

Sweden’s Orexo has teamed up with Gaia Healthcare to develop a digital therapeutic to improve the effectiveness of opioid use disorder (OUD).

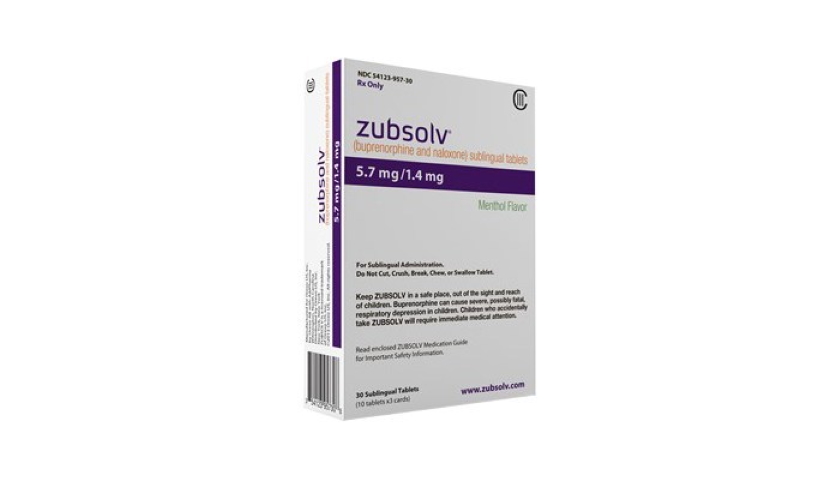

Orexo is already an established player in the OUD market as it has several years of experience marketing its Zubsolv (buprenorphine and naloxone) sublingual therapy for this indication and also has follow-ups including an intranasal formulation of naloxone for opioid overdose reversal in clinical development.

At the same time, Gaia has a long track record in developing artificial intelligence-based systems for applications such as depression, other neurological disorders, multiple sclerosis and epilepsy.

The partnership will use Gaia’s broca technology platform to develop a treatment management system – codenamed OXD-01 – that will be tailored to individual OUD patients and bring together “medication…counselling and psychosocial support.”

Orexo will have global rights to the digital therapeutic and says it hopes to have it available for marketing in the US in 2022 if clinical trials go to plan.

It won’t be the first digital therapeutic for OUD to reach the US market, however, as Novartis’ Sandoz unit and Pear Therapeutics claimed an FDA approval for their reSET-O mobile app last December, which is designed to complement Sandoz’ transmucosal buprenorphine products.

In a research note, analysts at Edison said the partnership “aligns Orexo with some of the bigger global pharmaceutical companies that have already moved ‘beyond the pill’ to the management of patients with difficult-to-treat indications, where patient compliance is challenging.”

Gaia launched its first digital therapeutic in 2001 and its online depression programme Deprexis is already deployed in Germany by Servier and has been piloted in the UK.

Its broca system has already been used to develop more than 70 products and according to the company “engages users in highly individualised, simulated 1:1 interactions, guiding patients step-by-step towards specific goals and therapeutic targets.”

Edison estimates that the digital therapeutic programme market will be worth around $890 million in 2026. It says OUD is a prime candidate for this sort of approach as “relapse is common and the diagnosis brings social acceptance and exclusion issues.”

Zubsolv accounts for the lion’s share of Orexo’s revenues, bringing in SEK 622 million ($64 million) in sales last year, up 28% on the prior year and driven by the ongoing opioid abuse epidemic in the US.

The company has been defending its Zubsolv franchise from a patent challenge from generic drugmaker Actavis in the US, but won a judgment in an appeals court earlier this year that it reckons should protect its franchise from low-cost competition until 2032.

Its chief executive Nikolaj Sørensen says the digital therapeutic could be a big asset as this approach “will become an integral and natural part of addiction treatment in the future.”

The move comes as the OUD treatment market in the US faces a big shake-up following a patent litigation defeat for Indivior, which has opened the door to the launch of generic rivals to its sublingual buprenorphine/naloxone product Suboxone Film.