Novartis backs brolucizumab with new head-to-head Eylea trial

Novartis is launching a head-to-head trial of its experimental brolucizumab therapy for age-related macular degeneration (AMD) against Bayer/Regeneron’s Eylea, the market leader.

The TALON trial in the wet form of AMD will compare brolucizumab against Eylea (aflibercept) on a range of measures, including visual acuity and treatment interval duration, to see if it can outperform Bayer and Regeneron’s drug.

An FDA verdict on brolucizumab is due shortly based on two earlier trials – HAWK and HARRIER – and the company is hoping to launch its new therapy before the end of the year in the US.

Brolucizumab is a follow-up to Novartis’ blockbuster AMD therapy Lucentis (ranibizumab), which has been competing toe-to-toe in the AMD market with Eylea for several years.

Novartis reported sales of $2 billion for Lucentis last year, with its marketing partner Roche adding another $1.7 billion in US sales. In comparison, Regeneron posted $4 billion revenues from the US while Bayer made $2.1 billion in ex-US Eylea sales.

Brolucizumab is seen as Novartis’ big chance to claim back dominance of the wet AMD market, which has seen first-to-market Lucentis progressively caught up and overtaken by Eylea over the last few years, and the company spent a priority review voucher in order to get the FDA review done as quickly as possible.

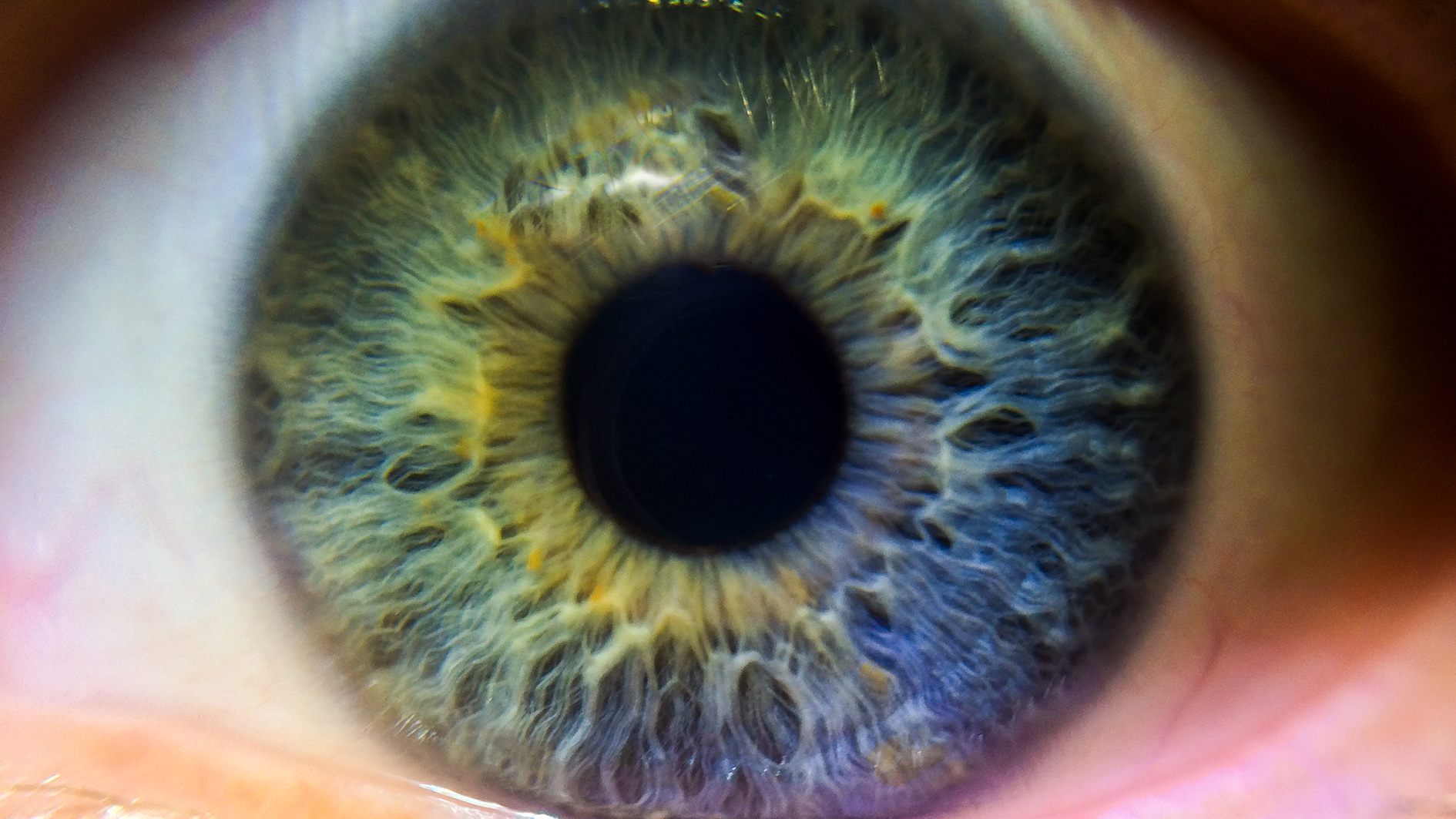

Like its predecessors the new drug is a VEGF inhibitor, blocking the growth of abnormal blood vessels in the back of the eye that are responsible for the progressive loss of vision in wet AMD.

They all need to be injected directly into the eyeball to be effective, so reducing the frequency of dosing is important. Brolucizumab need only be delivered every 12 weeks, versus four to eight weeks with Eylea and every four weeks with Lucentis.

HAWK and HARRIER also compared brolucizumab and Eylea directly, and TALON will put the dosing differences to a further test, attempting to show that brolucizumab is at least as effective as Eylea at a 12-week injection frequency and also exploring use of the drug every 16 weeks in some patients.

The 64-week trial is comparing Novartis’ drug with the current formulation of Eylea, while last year the FDA approved a 12-weekly injection formulation of the drug.

GlobalData has previously forecasted that brolucizumab’s sales will top $1 billion in 2021 and reach around $4.1 billion by 2026.

The wild card in the wet AMD market is off-label use of Roche’s VEGF inhibitor Avastin (bevacizumab), which continues to be used as a low-cost alternative to the two approved treatments.

Avastin needs to be diluted and repackaged before it can be used in the eye, with dosing every four to six weeks, and is much less expensive. That hasn’t stopped the branded wet AMD drugs from making blockbuster sales of course, and shouldn’t be a drag on brolucizumab if approved.

Meanwhile, patents on both Lucentis and Eylea are due to expire in the US in 2020, raising the prospect of additional low-cost biosimilar competitors. Regeneron has previously suggested it can claim an extension until 2023, at around the same time as Eylea loses protection in Europe.