With Alzheimer's market opening up, Lilly forms neuroscience unit

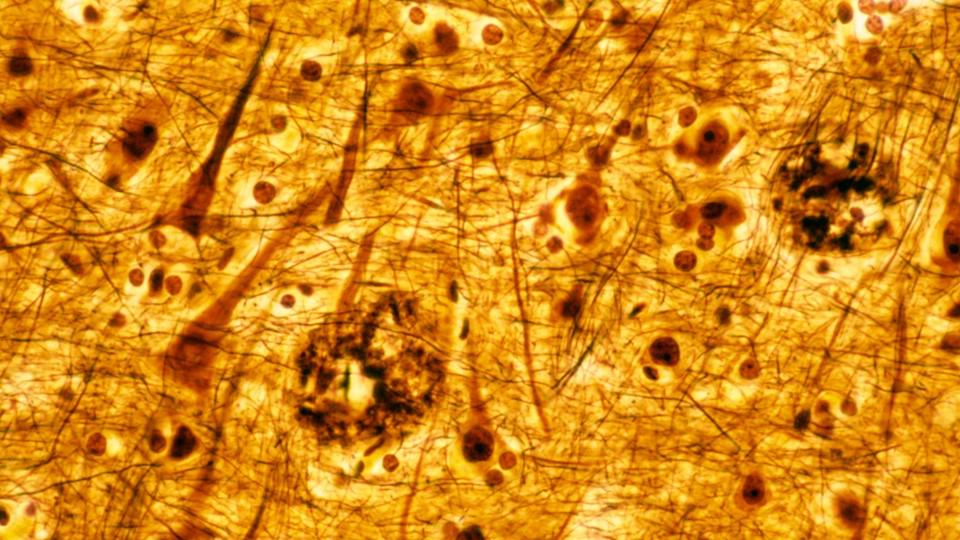

Eli Lilly is one of the front runners in the bid to follow Biogen and Eisai onto the market with an anti-amyloid drug for Alzheimer's disease, and its preparing the ground with a restructuring of its business units.

As of 5 September, Lilly's BioMedicines division will be split in two to form Lilly Neuroscience and Lilly Immunology, which the company said would help prepare for "an exciting period of growth and the potential launch of new breakthrough medicines over the next few years."

The new units also get new leadership of course, with Anne White, currently president of Lilly Oncology taking the lead on neuroscience, to be replaced at the cancer division by Loxo Oncology head Jake Van Naarden.

Immunology meanwhile will be led by Patrik Jonsson, who will add the role to his existing job as head of Lilly USA and chief customer officer.

While Lilly didn't say so explicitly, it seems likely that the change in structure has arisen from what the company sees as a shorter timeline to potential approval of donanemab, which is due to be filed under the FDA's accelerated approval pathway later this year.

The FDA has already awarded the drug with a breakthrough designation, meaning it will get a shorter review time after filing as Lilly tries to chase down Biogen and Eisai's recently-approved Aduhelm (aducanumab).

The new immunology unit meanwhile will centre around psoriasis therapy Taltz (ixekizumab), which grew 44% to almost $570 million in the second quarter, and a couple of new late-stage clinical candidates for which Lilly has high expectations.

Those include lebrikizumab – which has just generated positive results in atopic dermatitis – and psoriasis and ulcerative colitis therapy mirikizumab.

The changes also mean that Lilly's oncology assets will now be brought together under Van Naarden, who took over from former Loxo chief executive Josh Bilenker in January.

"Van Naarden has played an essential role in forging the Loxo Oncology at Lilly research and development program and has been critical to the success of its oncology pipeline," said the company in a statement on the revamp.

Lilly bought Loxo for $8 billion in 2019, bolting on a pipeline of oncology drugs that was headed by RET inhibitor Retevmo (selpercatinib) for certain lung and thyroid cancers, which was approved by the FDA last year, and BTK inhibitor pirtobrutinib (LOXO-305) for lymphoma.

"These leadership and organisational changes will allow us to realise the many opportunities we have to improve the lives of people around the world," said Lilly CEO David Ricks.

"Anne, Jake and Patrik's extensive experience will bring the focus and agility necessary to lead the growth of our existing medicines and the global introduction of Lilly's late-stage pipeline," he added.