Henlius Biotech shrugs off Hong Kong disruption with $477M IPO bid

China’s Henlius Biotech has pressed go on a $477 million initial public offering (IPO) on the Hong Kong stock exchange that will support its drive into in-house drug development.

The biotech is pressing ahead despite months of pro-democracy protests in Hong Kong that have caused turmoil in the territory, as well as recent decisions by other companies – including online retail giant Alibaba and brewer Anheuser-Busch InBev – to postpone HKEX listings.

There were 84 IPOs on the HKEX in the first six months of the year, but activity died down during the summer as the protests gathered pace and speculation that China may take direct control of Hong Kong grew.

There were still a handful of smaller listings, including IPOs for SinoMab BioScience, Alphamab Oncology, Pharmaron Beijing and Immunotech Biopharm over the summer months.

Meanwhile, two larger ones are also said to be in the offing – namely a $1 billion float by Tasly Biopharma and a $500 million offering by Chi-Med.

Henlius is best known for its biosimilar products, including its version of Roche’s Rituxan (rituximab) which was approved in China earlier this year.

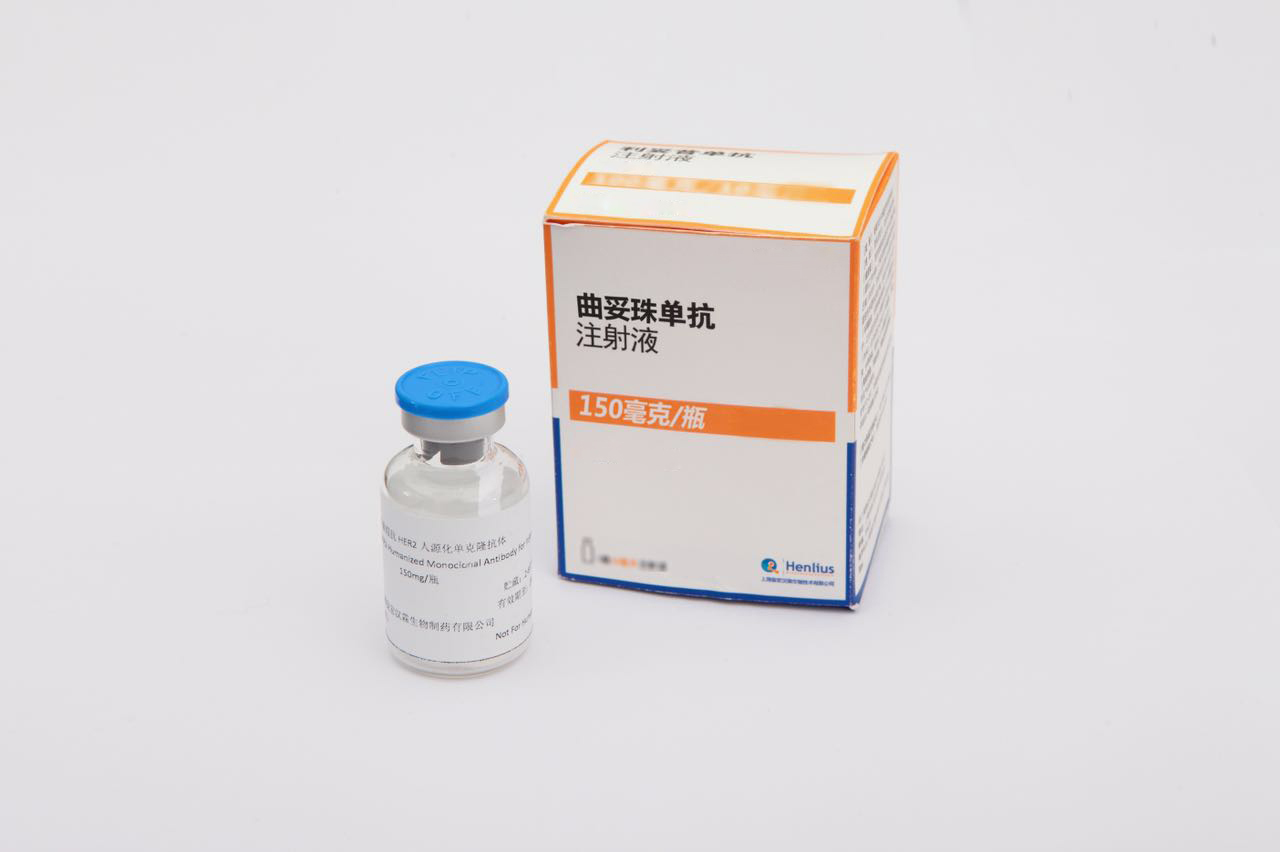

The proceeds of the IPO would help it bring forward a pipeline of other biosimilars – including copies of Roche’s Herceptin (trastuzumab) and AbbVie’s Humira (adalimumab) that have been filed for approval in China – but also a clutch of home-grown antibody therapies.

Those new molecular entities (NMEs) include anti-VEGF and EGFR for solid tumours, as well as two checkpoint inhibitors targeting PD-1 and PD-L1 for cancer and – in the case of the PD-1 drug – hepatitis B virus infections.

Henlius – founded by ex-Amgen executive Scott Liu in 2010 – is part-owned by Chinese conglomerate Fosun International, which according to Reuters is selling 12% of its stake in the IPO, with $140 million in investment already committed from key backers included Qatar Investment Authority.

The biotech is due to price its IPO next week (18 September) and trading of its shares is scheduled to start on 25 September.