GSK on top in RSV jab rollout, but is Pfizer closing the gap?

GSK and Pfizer’s full-year financial results show that the former is currently winning the battle for take-up of their rival respiratory syncytial virus (RSV) vaccines, although, there are signs that Pfizer is catching up and the distance between them is not as large as some were predicting.

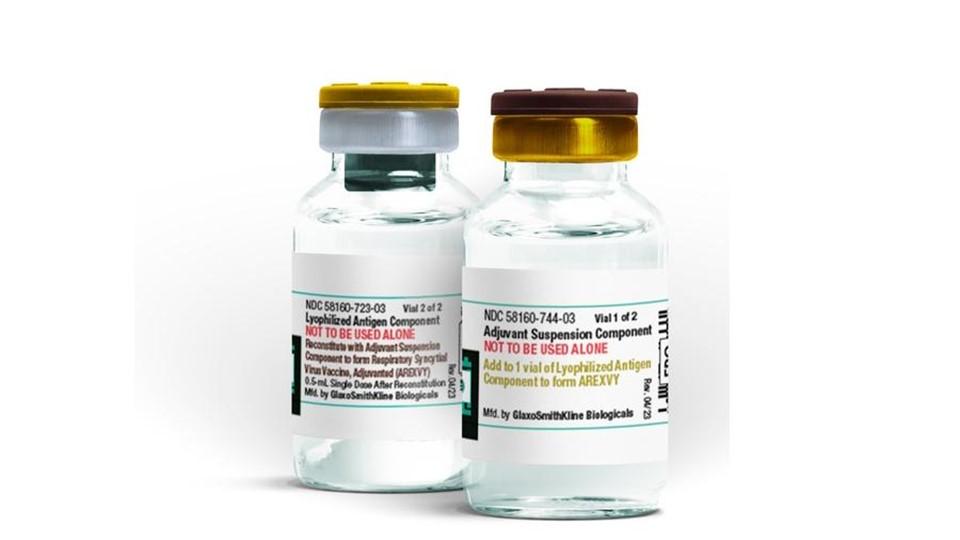

In its update posted this morning, GSK revealed that sales of its Arexvy vaccine came in at £1.24 billion ($1.57 billion) in 2023, including £529 million ($671 million) from the fourth quarter.

For comparison, Pfizer reported yesterday that Abrysvo made full-year sales of $890 million, which - while respectable - were well below its competitor. However, it brought in $515 million in the fourth quarter, suggesting it may be narrowing the gap. Both vaccines made the bulk of their sales from the US market, where vaccination peaked in the third and fourth quarters.

It’s worth noting that GSK was the first to get regulatory approval for Arexvy, getting its first approval for the jab in adults aged 60 and over in the US on 3rd May, although, Abrysvo was only a few weeks behind with an FDA approval for the same age group on 31st May,

Since then, Abrysvo has also been approved as a maternal vaccine to prevent RSV in newborns, an indication that GSK abandoned for Arexvy, but in that category it has to compete with Sanofi and AstraZeneca’s antibody Beyfortus, which is given directly to infants.

Meanwhile, GSK has also filed for approval in the 50 to 59-year-old age bracket in Europe and Japan, with a US filing due in the coming months, seeking an early move into a younger patient population. Pfizer is also running a phase 3 trial of Abrysvo in adults aged 18 to 59 at elevated risk of RSV disease due to chronic medical conditions, but data from that isn't due until later this year.

There had been expectations that GSK may see stronger uptake of its vaccine, not least because the data behind Arexvy in the over-60s seemed to be more convincing to FDA advisors, who voted in favour of approval of the shot by a greater margin than for Abrysvo. For now, that prediction is holding up.

There is also considerable room for both vaccines to grow, with GSK noting that approximately six million out of the 83 million US adults aged 60 and older at risk of RSV have been vaccinated with Arexvy – mainly in retail outlets – in what it has described as “outstanding launch.” Pfizer gave little information about Abrysvo in its fourth-quarter report.

The RSV vaccination market has been estimated to be worth somewhere between $5 billion and $10 billion worldwide, giving both companies a lot to play for as they try to stay ahead of other potential competitors, including Moderna and Bavarian Nordic.

Meanwhile, the rivalry between the two companies has spilled over into the courts, with GSK filing a lawsuit against Pfizer in the US last summer claiming that Abrysvo infringes four patents it holds on RSV vaccines.

GSK's chief executive, Emma Walmsley, said this morning that Arexvy had helped the group deliver an “excellent performance” in 2023, adding that it is planning at least 12 major product launches from 2025.