EU due to meet with pharma today to discuss tariffs

European Commission President Ursula von der Leyen

European Commission President Ursula von der Leyen is scheduled to meet with EU pharma leaders today about how to respond to US tariffs, as fears build that levies specifically targeting the drug industry are on the way.

Along with senior figures from pharma manufacturers, trade organisations including EFPIA, Europabio, and Medicines for Europe have indicated they are attending the gathering, according to a Reuters report, which suggests that one topic of discussion will be how to encourage more production of medicines within Europe.

The pharma industry around the world breathed a collective sigh of relief when the tariffs were announced last week, after it emerged that it was among a handful of sectors that would be exempted from the goods covered by the measures.

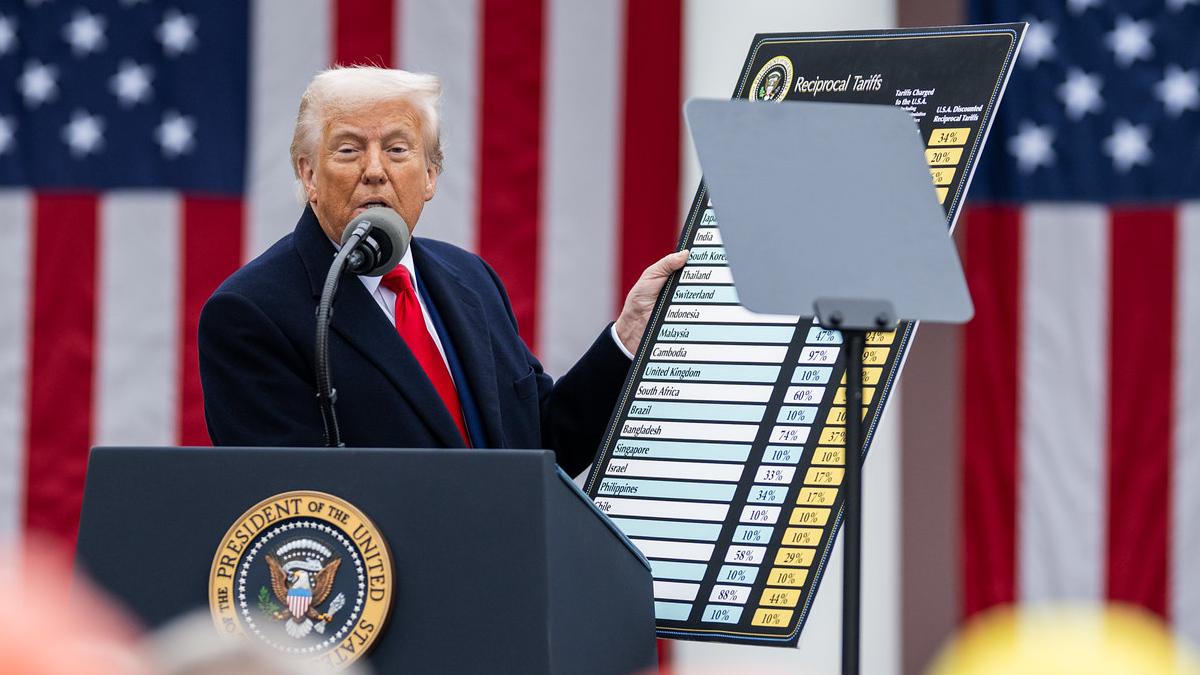

Any hope that the reprieve would be long-lived was quickly dashed, however, as President Donald Trump indicated that tariffs on pharma would be on the way, leading to fears that a previously discussed 25% rate on medicines will eventually be introduced with a gradual ramp-up.

"Pharma is going to start coming in, I think, at a level that we haven't really seen before," Trump said in remarks made aboard Air Force One after the announcement. "We are looking at pharma right now," he added.

In the meantime, it seems that some important pharma components like raw materials and ingredients, lab equipment, and primary and secondary packaging components like syringes will not come under the scope of the exemption, meaning that US-based companies are likely to see a near-term hit on the cost of manufacturing.

Meanwhile, the economic fallout from the tariffs continues to build, with stock exchanges around the world seeing sharp declines that have been dismissed by Trump as a necessary short-term hit in pursuit of his longer-term goals.

"Sometimes you have to take medicine to fix something," he said, in response to a legitimate question from a reporter yesterday asking about the "pain threshold" for US consumers facing price rises – calling it a "stupid" question – and insisted that the measures would make the US "wealthy like never before."

Meanwhile, the boss of financial giant JP Morgan, Jamie Dimon, has warned that the outcome of tariffs will be to drive the US economy towards recession and potentially even stagflation – the crippling combination of low or negative economic growth with high inflation and rising unemployment.

Many of the countries affected by the tariffs are still formulating their responses, but China has now announced tit-for-tat levies on the US, accusing the Trump administration of blackmail and "unilateral bullying practice." Trump has immediately responded with a threat to add another 50% to the rate levied on Chinese goods entering the US, taking the total to 104%.

China also filed a lawsuit with the World Trade Organization (WTO), saying it would "fight to the end" in the emerging trade war. The EU has reportedly said it will apply a 25% levy on some US goods after a proposal of a zero-for-zero rate on industrial goods received a cold response from the US administration.

Outsourcing upside?

The tariffs on pharma could, however, provide a short-term opportunity for companies providing outsourcing services like contract research and manufacturing, according to a Bloomberg report.

It has suggested that suppliers like Lonza, Thermo Fisher Scientific, Catalent, and Fujifilm Diosynth Biotechnologies are looking at ramping up capacity to serve companies that look to reshore these activities to the US in the interim before they can set up new facilities of their own.

Tariffs haven't prompted the development – other factors like the BIOSECURE Act that attempted to block US companies working with Chinese suppliers had already fired a warning shot across the bow of US industry – but Trump's actions have lent some urgency to their preparations, said Bloomberg. However, limited free capacity in the CDMO sector could be a bottleneck for this shift.