China-US feud forces PatientsLikeMe to find new investor - press

Increasingly fraught Sino-American relations are beginning to have a real impact on the health sector, after it emerged that the health networking startup PatientsLikeMe is being forced to find a buyer after the Trump administration ordered its Chinese majority owner to divest its stake.

According to CNBC, the divestiture is happening following a review by the Committee on Foreign Investment in the United States (CFIUS), which is aggressively cracking down on Chinese investment in the country.

In 2017 the company raised $100m towards its technology allowing patients to link up with people with the same disease and find clinical trials, selling a majority stake to Shenzhen-based iCarbonX, which is in turn by the giant Chinese firm Tencent.

Citing several anonymous sources CNBC said it started receiving notifications from the committee last year to try and force a divestiture.

The CFIUS was established under president George W Bush and allows the president to review and potentially block any merger that could result in a foreign person or company controlling a domestic business.

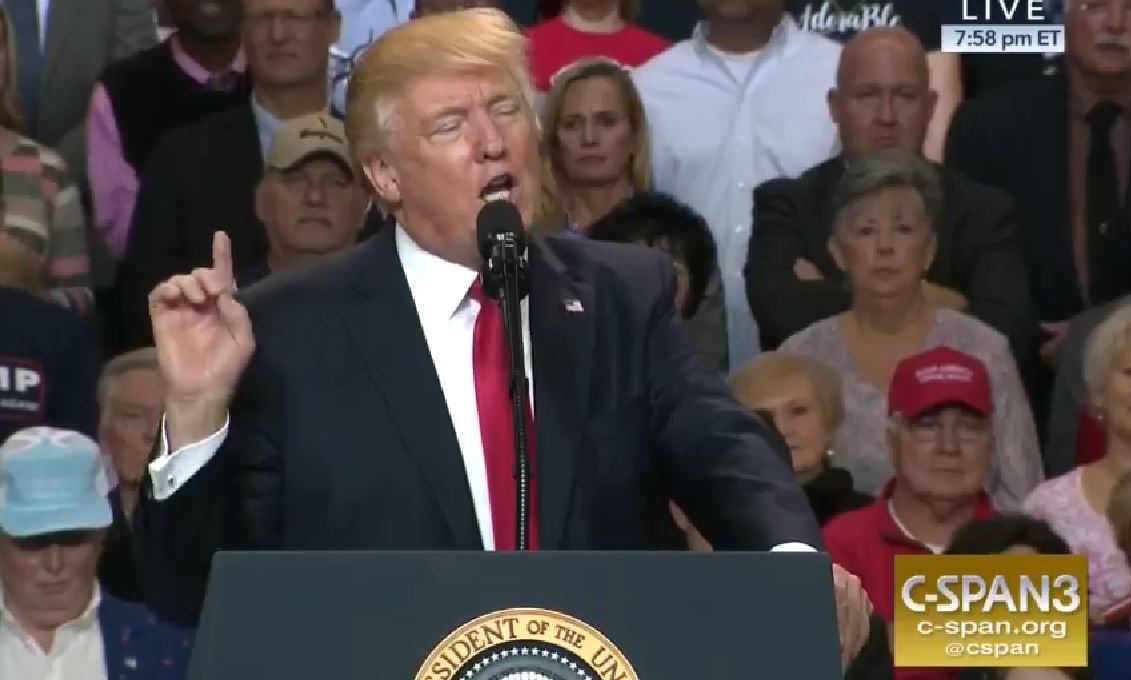

Trump has expanded its remit to review foreign investments and non-controlling stakes in addition to takeovers – but CNBC noted that forcing a small company into a divestment is “entirely new territory” for the CFIUS as until now the committee has focused on much bigger deals.

According to CNBC the committee is particularly concerned about PatientsLikeMe because of the sensitive patient data that it collects from their profiles to help with its operations.

The Chinese firm that owns the gay dating app Grindr is also under pressure from CFIUS to relinquish control amid concerns that American officials’ sexual orientation or personal details could be used to influence them.

Around 700,000 people use the site to report their experiences with medical conditions, and it works with big pharma companies like Biogen, as well as non-profit organisations.

PatientsLikeMe, which has not publicly commented on the matter, has been looking for a buyer for several months and has held talks with other health technology companies according to CNBC’s sources.

Nooman Haque, managing director of life sciences and healthcare at Silicon Valley Bank, told pharmaphorum there is no presumption that this source of money is "bad", but called on companies to thoroughly investigate investors in order to comply with strict banking regulations.

"This highlights how important it is for companies to do their own diligence on investors and look beyond the cheque.

"In light of increased capital flows from non traditional sources and types of funds it's paramount that companies really get to understand their investor base."