Amazon bundles its telehealth services under one brand

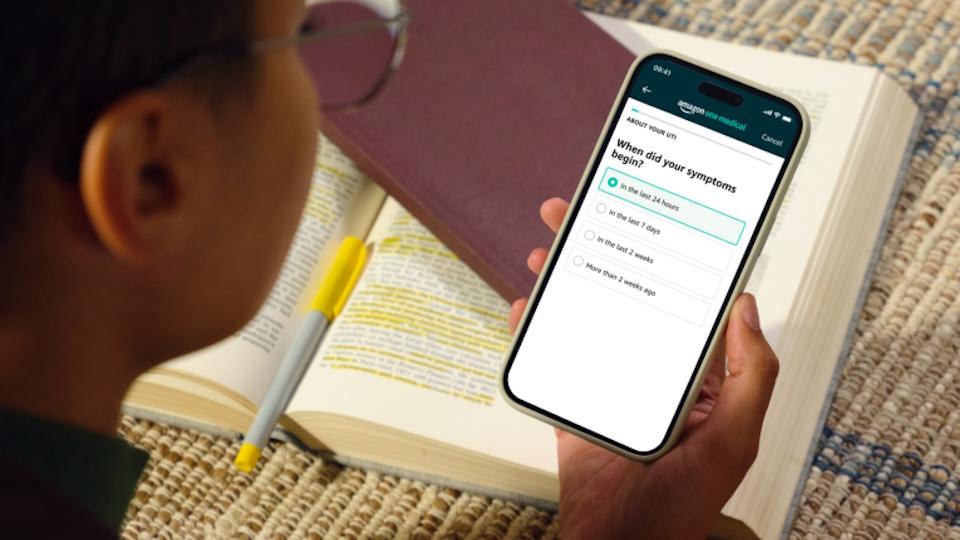

Amazon’s strategy in telehealth has coalesced around a pay-per-visit and subscription-based model under a new brand – Amazon One Medical.

The retail giant is merging its Amazon Clinic telehealth service with One Medical, the primary care provider it acquired for $3.9 billion last year, offering a pay-per-visit service for more than 30 common health concerns and the option to pay a monthly or annual fee for on-demand virtual care.

The service will provide simple, low, and transparent pricing – $29 for a messaging consultation and $49 for a video call – that Amazon said makes it “even more affordable” and easy to access.

It’s a price point that will fire a shot across the bows of Amazon’s rivals in the hugely crowded telehealth sector, where margins are already considered to be pretty tight, and a reduction on the $35 and $75 fees levied when Amazon Clinic launched 18 months ago.

The subscription option is offering on-demand virtual care and booking of same- and next-day appointments at more than 150 One Medical offices across the US. It is available at $199 per year, but Amazon is adopting its usual tactic of reducing the cost to $99 for customers using its Prime service.

“It’s simply too hard to get the medical care you need, when you need it, and affordably – long waits, high costs, and impersonal care make it unnecessarily difficult for many patients today,” said Neil Lindsay, senior vice president of Amazon Health Services. “We’re focused on improving both the occasional and ongoing medical care experience.”

The company is pushing its pay-per-visit service as an option for people who don’t live near a One Medical office or those who already have a primary care provider, but need a quick consultation on a one-off condition like acne, pink eye, the flu, a sinus infection, or erectile dysfunction.

The rebrand comes at a time when some entrants into the US telehealth sector have been forced to retreat. In May, for example, Walmart said it would close all 51 of its Walmart Health clinics across the country and shut down its telehealth service, built with its acquisition of MeMD in 2021, saying the business had proved “unsustainable.”

Amazon One Medical is just one way that the retail giant is staking a claim to the US healthcare market, alongside its online pharmacy business, a low-cost subscription service for generic medicines, and health monitoring programmes.

It has had some false starts in health, notably the employee-focused virtual primary care business, Amazon Care, which was shuttered in 2022. However, its strategy around integration and accessibility is starting to take shape, and the question now is how major rivals like Teladoc, Amwell, and MDLIVE respond to the challenge.