Pharma go-to-market transformation: Why cross-functional silos cost billions

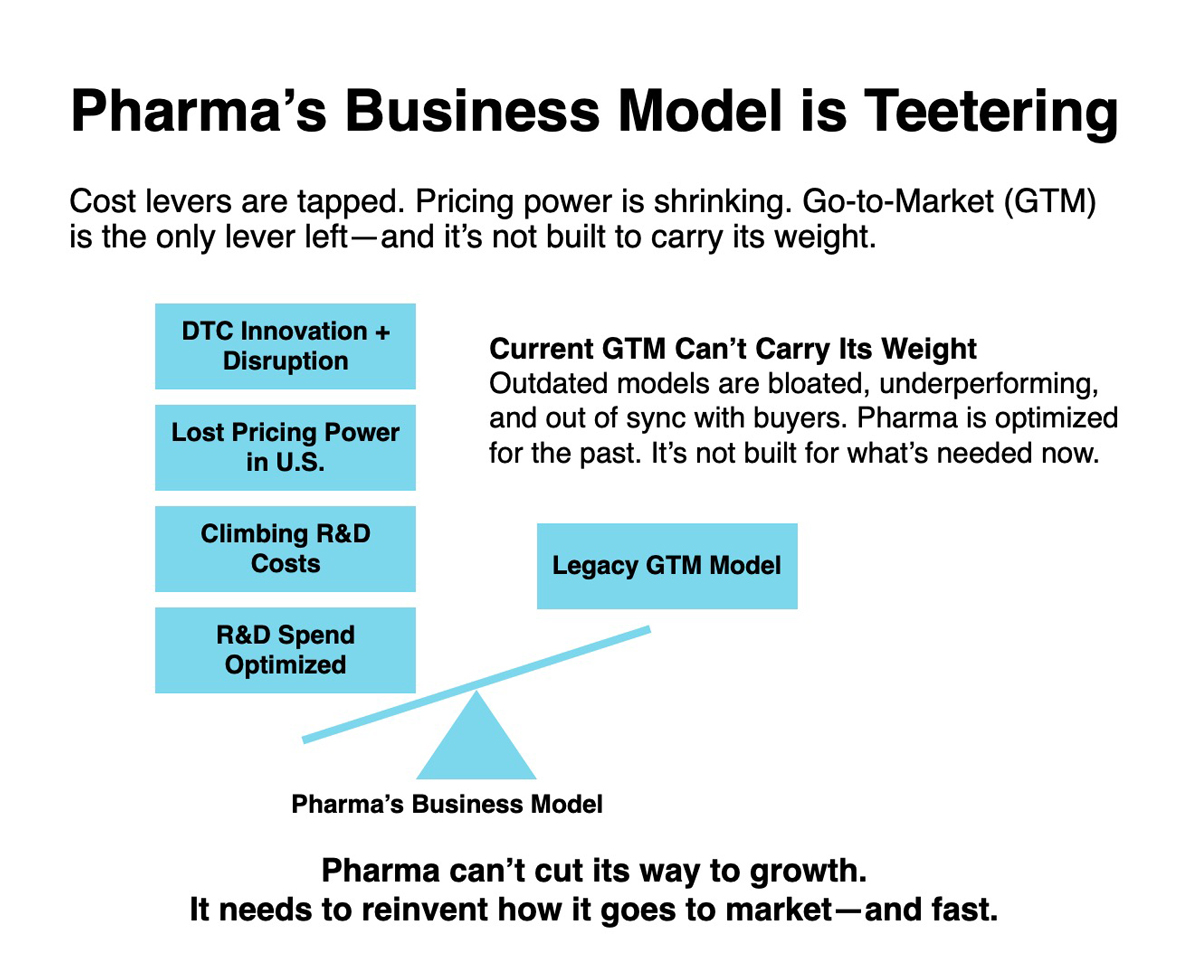

Pharmaceutical go-to-market transformation has become the industry's most urgent priority, yet cross-functional coordination remains pharma's biggest challenge. Commercial teams call it sales force effectiveness. Medical affairs calls it compliance complexity. Market access calls it payer relations challenges. IT calls it system integration headaches. They're all describing the same existential crisis: pharma's traditional GTM model no longer works in an era of Inflation Reduction Act (IRA) pricing pressure and direct-to-consumer (DTC) patient empowerment. But nobody's speaking the same language.

Welcome to the Tower of Babel, where every function has its own dialect for describing a problem that’s costing companies billions in lost revenue potential. The competitors who crack the translation code will pull ahead.

The IRA's impact on pharmaceutical go-to-market models

The Inflation Reduction Act didn’t just create “pricing pressure”. It introduced pharma to something entirely new: a US government that actually says no. When Medicare negotiated 38–79% price cuts in round one, it wasn’t a gentle market correction. It was like telling a teenager they can’t say “like”. Technically possible, but it breaks their entire sentence structure.

This pricing shock immediately exposed pharma’s second crisis: R&D costs that continue to climb, now between $0.8 and $2.8 billion per product, despite decades of optimisation. The usual cost-cutting levers have been exhausted. And the pivot to complex biologics virtually guarantees those costs will keep rising just as pricing power disappears.

The third disruption followed quickly: patient empowerment. In a world where one in three Americans lacks a primary care physician, platforms like BetterHelp, Hims/Hers, and now LilyDirect and PfizerForAll are teaching patients they don’t need to wait for a doctor or the traditional healthcare system at all. They arrive with formed opinions – if they show up at all.

Cross-functional silos in pharmaceutical commercial operations

This new reality has created a situation where commercial, medical, market access, and IT are all trying to fix pharma’s broken GTM model in their own ways. The result is a customer experience that feels like a Rube Goldberg machine designed by committee. And yes, it feels just as confusing to those of us inside pharma, too.

Commercial teams are still optimising field forces for a world that no longer exists. A world where physicians eagerly consumed whatever information pharma reps provided. Today’s HCPs want solutions, not more data. When commercial says “omnichannel”, physicians hear “more channels to ignore”. The result: declining sales force ROI as reps spend more time just trying to get in the door.

Medical affairs got promoted from “support function” to “strategic GTM driver”, but no one explained what that means or provided the resources to succeed. They’re like the quiet student who just got elected class president. Lots of new responsibility, unclear authority, and everyone watching to see what happens. They’re tasked with driving commercial outcomes while maintaining scientific independence – an inherently complex mandate made worse by murky governance and siloed priorities.

Market access teams are stuck in a landscape where traditional health economics models don’t reflect real-world impact, yet, payers demand proof of exactly that. They’re trying to demonstrate value with data that was never built to tell a complete outcomes story.

Meanwhile, IT is expected to fix everything with AI, without changing how anything actually works. It’s like demanding a self-driving car that still needs you to steer. And they’re responsible for compliance across functions that operate under wildly different regulatory constraints. A single CRM system might need to satisfy FDA, EMA, and internal audit teams, each with conflicting definitions of “compliant”.

These silos didn’t appear out of thin air. Many are artifacts of decades of compliance requirements and legitimate legal walls between functions. But, in today’s environment, those same walls have become operational liabilities.

The true cost of poor pharmaceutical GTM coordination

Research on cross-functional integration consistently shows that poor coordination reduces profitability, slows response times, and increases operational drag. In pharma, it shows up as duplicated technology investments that can consume up to 30% of IT budgets, delayed product launches when commercial and medical aren't aligned – affecting 40% of new drugs – and weak value propositions when payer messaging gets lost in translation.

When a major product launch requires commercial messaging, medical evidence, payer value propositions, and IT system updates, companies often discover these teams have been working toward different definitions of “launch success”. Commercial measures market share growth, medical tracks evidence adoption, market access counts payer coverage wins, and IT celebrates system uptime. Same launch, four different scorecards.

Pharmaceutical companies leading GTM transformation

So, how do we fix the Tower of Babel problem? Two approaches are emerging: tear down the walls that create different languages, or change what everyone's incentivised to talk about.

Take Novartis. Instead of adding more steering committees, they eliminated the organisational walls that created different languages in the first place. By combining previously siloed units under a single chief commercial officer overseeing marketing, medical affairs, and market access, they created actual cross-functional accountability across its go-to-market functions. This cross-functional alignment faces its first major test as Novartis navigates unprecedented Medicare pricing pressures—Entresto received a 53% price cut starting in 2026 as a result of the IRA. Whether their new structure can coordinate commercial urgency, medical evidence, and access strategies as one response, rather than three separate ones, will be an early test of pharma's ability to adapt its GTM model to a fundamentally changed reimbursement landscape.

Roche took a different approach to the coordination challenge – shifting budget allocation to solve it. While most Big Pharma spends more on promotion than science, Roche consistently spends 50% more on science than promotion. Their digital evidence generation platform delivers the real-world data healthcare professionals and payers actually use for treatment decisions, supported by unified customer engagement that works in real time, rather than through separate touchpoints. The result: while most Big Pharma companies saw their reputations decline, Roche consistently ranks amongst the top 3 most reputable big pharmas in the world – building that reputation on the kind of engagement patients and providers want and need. Different priorities, measurable impact.

Both approaches solve the same fundamental problem: when commercial urgency, medical rigour, access pragmatism, and IT constraints stop talking past each other, they can coordinate responses, instead of creating competing strategies. The results show up in faster time-to-market, higher sales force productivity, and stronger payer relationships because energy goes toward solving customer problems instead of internal translation. These aren't the companies with the flashiest transformation decks or the loudest omnichannel programmes. They're the ones that learned to speak across functions while their competitors are still building more translation layers.

Building unified pharmaceutical go-to-market strategy

The convergence of pricing pressure, cost inflation, and patient empowerment has created a shared sense of urgency – even if everyone describes it in different terms. For the first time in decades, all functions face existential threats simultaneously.

Commercial teams can't rely on detailing their way to growth. Medical affairs can't stay safely in the support role. Market access can't assume traditional health economics will satisfy payers. IT can't deliver incremental improvements when breakthrough coordination is required.

This shared crisis creates an opportunity that hasn't existed before: genuine alignment around survival, rather than theoretical integration around efficiency.

The companies that recognise this will stop building translation systems and start eliminating the need for translation. They'll measure coordination, not just function-specific metrics. They'll reward cross-functional outcomes, not siloed achievements.

They'll design customer experiences instead of optimising internal processes.

The Tower of Babel problem is real, but it's solvable – and the solution timeline just got much shorter.

The forces reshaping pharma are real and irreversible. The question isn't whether transformation is coming. It's whether your organisation will learn to speak across functions or be outpaced by the ones that already do.