The changing face of oncology market access

Cathy Wright of Succinct Healthcare Communications explores the changing face of oncology market access.

There's no doubt that the NHS in England is going through a period of unprecedented change, and new ways of working are now starting to gather momentum. But do we really understand the impact these changes will have on the pharmaceutical industry? Are we prepared? Are head office and field-based teams able to adapt their strategies to meet the requirements of these new organisations and engage with the new healthcare landscape?

One apparent difference for industry is the changing face of the oncology market access customer with new, seemingly more sophisticated roles emerging. From April 1 2013, NHS England, supported by the cancer and chemotherapy clinical reference groups (CRGs), has taken responsibility for commissioning all specialist cancer services. It also has responsibility for commissioning chemotherapy drugs for all cancers and associated diagnostic testing for targeted medicine.

The cancer and chemotherapy CRGs will play important roles in the decision-making process for chemotherapy. As a consequence, meeting the needs of these groups, providing them with the right quality information, at the right time will be critical in influencing any decisions made. Horizon scanning and advanced notification activities will remain important for these groups and it's been suggested that NHS England may expect drug companies to submit Cancer Drugs Fund (CDF) applications for new medicines at market launch, leaving clinicians to submit for off-licence and rarer indications.

National decisions, local implementation

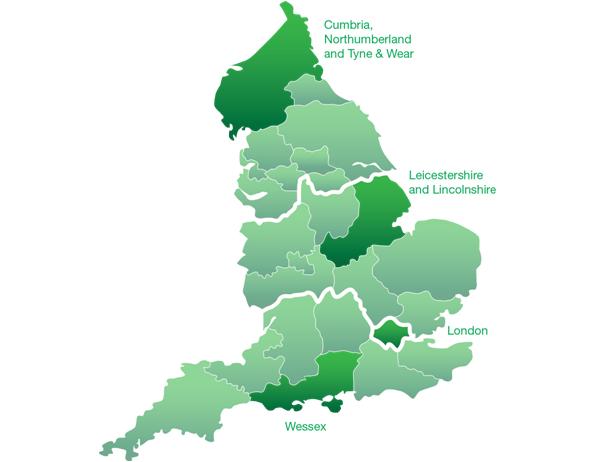

Whilst decisions will be made at national level, local area teams and providers are accountable for implementation. For example, the CDF is managed as part of the prescribed (specialised) service single operating model. There is a single national consistent policy for the management of the CDF, which is then operationally managed by four of the ten area teams responsible for prescribed services (Figure 1).

Figure 1: Four of the ten area teams responsible for operational management of the CDF

Importantly, these local operational management / implementation groups will also play a key role in collating and providing evidence of real-life value following the introduction of a new medicine or technology into a treatment pathway, and providing influence routes back to the national groups.

This consistent approach to central planning, that is delivered locally, aims to tackle previous variations and inconsistencies in the management of the commissioning cycle and take positive steps towards raising standards of care for all patients receiving treatment for cancer (and other specialised conditions) with equity across the country.

"...do we really understand the impact these changes will have on the pharmaceutical industry?"

Proof of concept

Providing evidence of the value proposition for a medicine will remain pivotal, and whilst the financial and economic considerations for the introduction of a new medicine or technology are important, they are well catered for via the National Institute for Health and Care Excellence (NICE) and other health technology appraisal bodies. However, with the increasing emphasis on service delivery, clinical protocols and patient pathways, local planners must also take account of essential logistical issues, such as treatment location (hospital or community), clinic organisation / staffing and inpatient bed days.

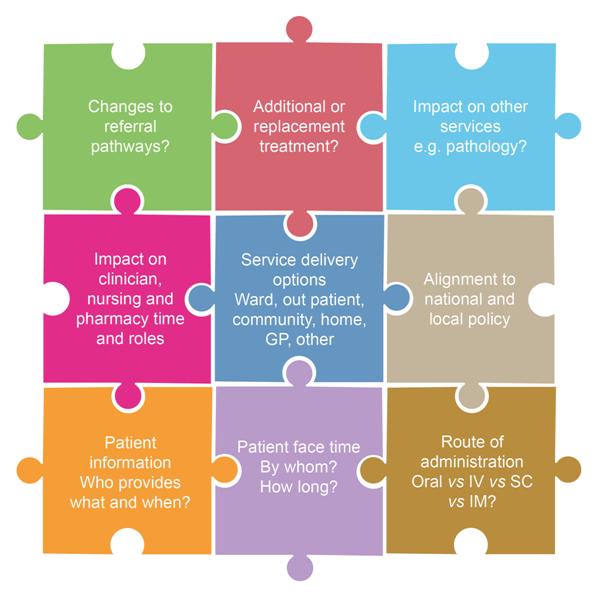

Some of these non-financial issues (Figure 2) can lead to considerable delays in the introduction of new treatments, and can be a common cause of frustration for healthcare providers, patients and pharmaceutical companies.

Figure 2: Service considerations for the introduction of a new medicine / technology

Important considerations to ensure optimal and timely implementation may include:

• Understanding the appropriate funding and procurement processes

• Referral routes for the management of the disease

• Where and how a new medicine fits into a current treatment pathway and how the pathway may alter

• Steps required to realise change in the pathway

• Validation of theoretical models and tools with real-life evidence and practice

Subsequent review, audit and data collection from local pilots can then help to measure the 'real-world' impact and value of the change made, which can in turn be shared with the national CRGs and the rest of the country to support continued best-practice, decision-making processes and promote efficacy and productivity gains. It will, however, be important for any pilot programmes to be transferable across multiple providers and localities.

The pharmaceutical industry, working in partnership with and within NHS systems, is well placed to assist in developing and providing the right sort of data to support the value proposition and facilitate optimal implementation of a particular medicine.

"Providing evidence of the value proposition for a medicine will remain pivotal..."

Innovation and quality are likely to be pivotal, and the pharmaceutical industry will need to think wider than simply introducing new drug entities. They will need to work with the system as a whole, offering solutions and programmes that include innovation around the whole patient pathway. Providing evidence to support claims made in the more traditional materials and tools developed by industry, such as budget impact models with real-life data and case studies, will be critical.

A number of companies are already taking this progressive approach, and mechanisms are in place to facilitate joint working.

As the new organisational structures become embedded, and roles within them continue to evolve, there are still many unanswered questions, such as how industry will access and interact with fewer stakeholders involved in the national decision-making processes, without inducing conflict of interest. How will companies and healthcare providers continue to gain mutual, valuable strategic advice for new medicines and technologies coming to market? Does this make the role of the third-party agency all the more important? These questions all need to be addressed. However, one thing is certain, industry needs to think about how it will change its market access strategies and ways of working to fit with this new world.

About the author:

Cathy is Director of Market Access and Value at Succinct Healthcare Communications. She joined the company from Roche where, latterly, she was a member of the Healthcare Management Team. She was responsible for developing the strategy and delivery of implementation tools for the managed entry and market access activity for the Roche hospital specialist products, including those following National Institute for Health and Care Excellence (NICE) and Scottish Medicines Consortium (SMC) guidance. Cathy has extensive experience in the development of materials and initiatives for field-based market access teams and, since joining Succinct, has developed and led a wide variety of market access projects.

Tel: +44 (0) 1494 549108

E-mail: cathy.wright@succinctcomms.com

How can pharma adapt its oncology market access strategies to adapt to the changing environment?