Market access in early stage development: essential to the licensing process?

Samantha Morrison

GfK Bridgehead

As our partnerships &, licensing month continues, Samantha Morrison questions whether market access in early stage development is essential to the licensing process.

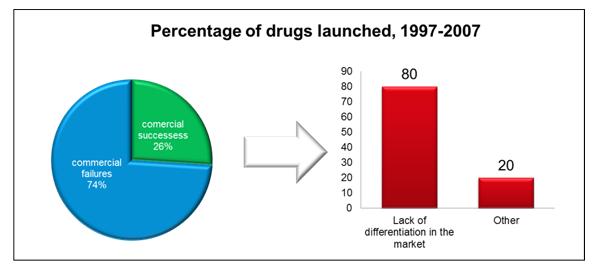

In the 1990s, pharmaceutical companies could bank on a successful drug launch if they could prove that their drug was safe and effective. Now the requirement is for proof that new drugs are safer and more effective than those already on the market, and even regulatory approval is no guarantee of success (Figure 1).

As we are all aware, the economic conditions have been putting pressure on budget everywhere, this has meant that financial constraints on payers have been increasing. In turn, this has led to greater scrutiny of products entering the market to demonstrate improved outcomes to justify the price.

,

"...this has led to greater scrutiny of products entering the market to demonstrate improved outcomes to justify the price."

,

Figure 1: Almost ¾ of launches over last decade were defined by McKinsey as commercial failures, with a lack of differentiation being the key driver

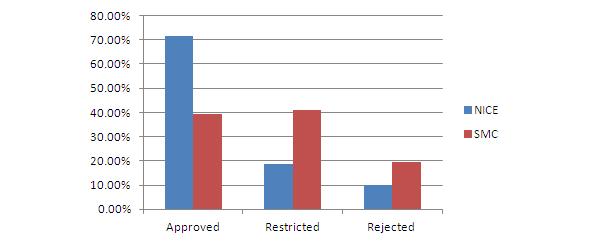

For example in the UK, reviews and assessments by NICE and SMC have resulted in restricted access for a number of regulatory approved products and non-recommendation for many (see Figure 2) based on the evidence manufactures have been able to present on the cost versus benefit.

Figure 2: NICE and SMC final outcome

So how important is a market strategy for the licensing process?

During their out-licensing process, partners are increasingly looking not just for a product with the potential for regulatory approval, but for a reimbursable product.

"To be successful in the healthcare marketplace in the next few years, it’s all going to be about delivering value."

Andrew Witty, CEO, GSK.

The goal remains, ensuring patients gain access to the best possible therapies, but to do this there are a number of stakeholders and demonstrating value along the way is essential. So for a company relying on a partner to bring their product to market the drivers of the partner company must be taken into account. As we have seen over recent years, this has been increasing not only to find an approvable product from a regulatory agency perspective, or even an area where there is unmet clinical need, but to have a reimbursable product for the market.

,

"...when in-licensing, companies consider the likelihood of reimbursement and the resources that will be required..."

,

Demonstrating that the reimbursement environment has been considered and that the evidence requirements of key stakeholders have been planned for can greatly improve the offering to a potential partner, ultimately increasing the likelihood of out-licensing success.

So when should market access be considered?

Despite pharmaceutical companies engaging with market access activities there are still issues that can be attributed to a number of failings in the process:

• The majority of market access starts too late.

• Market access capabilities are not spread throughout the areas of the company where the expertise is required and not integrated into company processes.

• The focus of R&,D is still marketing authorisation, not reimbursement.

• The value propositions fail to address the ability to pay particularly in light of increasing budget pressures.

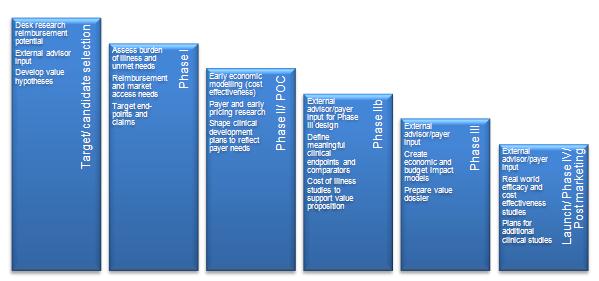

Demonstrating that the market access landscape has been considered during the development process can be a commercial edge in the out-licensing negotiation process. Increasingly, when in-licensing, companies consider the likelihood of reimbursement and the resources that will be required along with, importantly, the evidence generation necessary. There are steps developers can take even at the early stages to start understanding and defining the market ready for the development of a market access strategy for their product (see Figure 2).

,

Figure 3: Health economics and market access in the development process

The simple steps detailed above for the early stages of development may provide the developmental asset and commercial edge to mark the product out as a more attractive proposition to in-license.

,

"By understanding the market access landscape and issues for your asset you become a more valuable and creditable partner..."

,

Before entering the licensing discussions developers should be more aware of pricing and reimbursement issues. To improve success in these negotiations, developers need to be better at measuring and communicating value to licensees and investors. By understanding the market access landscape and issues for your asset you become a more valuable and creditable partner in the licensing process hence, hopefully, leading to more successful deal terms.

References

1. Value-driven drug development—unlocking the value of your pipeline. McKinsey and Company. 2011.

2. NICE guidance: a comparative study of the introduction of the single technology appraisal process and comparison with guidance from Scottish Medicines Consortium BMJ Open 2012,2: doi:10.1136/bmjopen-2011-000671

Some previous articles by GfK Bridgehead:

• Medical devices: the future is emerging markets

• The evolution of personalised healthcare within oncology

,

About the author:

Samantha Morrison is a Senior Consultant at GfK Bridgehead.

Samantha graduated with a BSc (Hons) in Biochemistry with Biological and Medicinal Chemistry from Keele University. After this, she joined Wells Healthcare Communications Ltd and spent just over 4 years at as Editor / Writer on various projects. Samantha then moved to Phase IV Communications as an Editor / Project Manager and then as an Account / Project Manager specialising in medical education programmes for the UK market. During this time, Samantha was involved in a range of therapeutic areas and has arranged activities such as advisory boards, focus groups and conferences.

Samantha joined GfK Bridgehead in 2004 and was initially based at GfK Bridgehead’s sister company, Healthcare Education Services. During this time, Samantha worked on a variety of different projects including training manuals, satellite symposia, large stand-alone meetings, training meetings and multimedia programs.

In 2006, Samantha moved to the consultancy in GfK Bridgehead and since this time has been involved in a range of projects including due diligence studies, market analyses of new products and technologies including medical devices, and pricing and reimbursement projects gaining considerable insight into the systems in within Europe and US as will other major markets.

Tel: 01664 503 700

Email: Samantha.morrison@gfk.com

How important is it for pharma to have a market strategy for the licensing process?