Market access - what now?

Iain Claxton

Roboleo &, Co

Market Access has become the buzz-word within the healthcare industry. There is no shortage of scholarly articles, publications and events discussing the subject in great depth and generating much debate. This article will discuss the following:-

• How to exploit successful market access strategies, and

• How to leverage value and ensure patients receive better treatments

Market entry continues to present major challenges for pharmaceutical companies. Indeed recent trends have clearly demonstrated that in some countries (the UK being a prime example), a successful HTA does not guarantee uptake of your new drug or technology.

Payers are now more demanding as they seek benefits on both sides of the value equation - namely improved outcomes and an overall reduction in treatment cost. These new challenges have been driven by a number of factors:

• Increased demand for expensive new technologies and drugs

• Ageing populations with increasing chronic conditions

• Increased influence of patients and patient groups

• New drugs and technologies to treat previously untreated conditions

• The increasing importance of HTAs

• Downward pressure on healthcare budgets

"...a successful HTA does not guarantee uptake of your new drug or technology."

However, what is absolutely clear is that whilst barriers-to-entry will continue to grow, there are significant opportunities for companies to use market access to create a sustainable competitive advantage. It should be seen as an approach to help differentiate your brand / proposition and not just as a means to get onto the market.

There are many opinions on the definition of Market Access. Our view is that market access comprises those interrelated activities necessary to create a favourable environment for the successful launch (or further development) of an asset / intervention.

This involves both strategic and operational functions, to ensure the case for a particular therapy is not only truly compelling (based on the evidence) but also presented in a way that engages with and specifically addresses the needs of each stakeholder – whether a group or an individual.

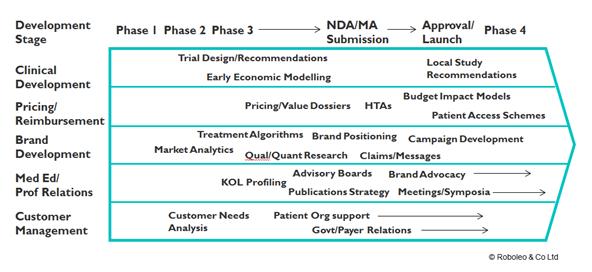

In this context Market Access needs to be considered early in the development pathway e.g:-

Figure 1: Market access needs to be considered in early development pathway

Getting it right at the start is critical. There are many examples where companies have struggled because the development programme only focused on securing registration and a successful HTA. If market access programmes are activated early, commercial success is much more likely.

This approach will help make those tough calls regarding prioritisation of resources. For example, early economic modelling for a candidate drug is used to help make Go / No Go decisions and determine which indications / specific patient populations should be targeted. This should now include an assessment of the likely Value Based Price – with a greater priority given to those segments that can realise the highest VBP as it creates a benchmark for the duration of the brand’s life.

"...across Europe, the various agencies and stakeholder groups are increasingly sharing information with a view to producing a common framework..."

This new paradigm has of course come at a price for industry, with many companies trying to come to terms with the fact the traditional way of doing business is no longer viable. This means organisations having to rethink their business models. However, this will create a serious problem for those who continually play ‘catch-up’ rather than taking a more strategic view (based on what the landscape is going to look like in 3–5 years) and shape their organisation and strategies to capitalise on this.

Currently each country has different criteria, different agendas and different priorities. This means that there is no ‘one-size-fits-all’ approach. However, across Europe, the various agencies and stakeholder groups are increasingly sharing information with a view to producing a common framework e.g. HTA Core Model (EUnetHTA Joint Action 2010-2012).

We are now in a period of economic austerity and this is having a significant impact on healthcare. This means continued downward pressure on drug budgets, which, in certain markets, has significantly affected uptake of new drugs - even those which have successful HTAs - simply because there is no money ‘in the pot’ to pay for them.

So, what does this mean for companies?

Let’s consider a few of the areas which are potentially critical to successful post HTA uptake of your new drug or technology:-

Global core value dossier

This should contain all of the key data and information on which you based your HTA submission.

However, being able to tease out the core value messages is where much work needs to be done in order to develop and tailor them not just for each country, but also each stakeholder / customer group.

This is a crucial document, but when developing it, you need to consider the specific issues and challenges faced by all stakeholders in order to develop the key messages that are meaningful, differentiating and motivating. It also needs to be presented in such a way that they can be readily adapted to ensure that any target customer can quickly and easily comprehend how value is being created and how it can help in achievement of their specific goals and objectives. This becomes more difficult as treatment protocols and competitor sets can differ not only by country, but across regions too.

"We believe, however, that in future KOLs and advocates will be as important, if not more so."

Publications strategy

A key element of what flows from the publications strategy will depend on the original clinical programme being aligned at an early stage to demonstrate economic as well as clinical value. Get this right and you will be able create a steady flow of data which is relevant for your market and importantly your payers and patients. Companies need to be thinking of more patient centric approaches to R&,D in order to achieve success within the life cycle of the drug.

Patient vs. product

There is considerable attention currently on the value of Real World Data and Patient Reported Outcomes (PROs) and the need to demonstrate value and positive outcomes. This will continue to gain traction with stakeholders, who want to see value, not only in the economic models based on clinical trials, but also realised in practice.

Increasingly, efficacy will be taken as a given by payers and clinicians, who will more likely be asking: ‘How does it add value over our existing treatments, improve outcomes for our patients and reduce cost’.

Stakeholders, KOLs and advocates

There is much debate about the continued role of KOLs and advocates. After all, if your drug has been approved by the various HTA bodies, surely their influence will be greatly reduced? We believe, however, that in future KOLs and advocates will be as important, if not more so. Their role will alter and new stakeholders and influencers are and will continue to appear and influence decisions on drugs used. Companies need to continue to focus on:-

• Identifying who are the key stakeholders (decision makers) in each market

• Understanding and meeting their real needs - both in the short and longer term

• Ensuring they have access to the information they require to justify use of your drug

• Working with stakeholders and KOLs in new ways to develop trusted partnerships

• Continuing to identify and train the appropriate personnel to engage with the relevant stakeholders across different functions

"Companies who develop innovative adherence strategies and programmes will be able to differentiate their drugs and add value to their offering"

Patient adherence

Patient adherence and compliance is another area which is gathering pace and interest with both pharmaceutical companies and healthcare providers. It is well documented that patients frequently have very poor adherence for many reasons. With the advent of new technology and the digital revolution, the scope for advances in this area is enormous. The rewards are clear for patients, healthcare providers and companies alike. Companies who develop innovative adherence strategies and programmes will be able to differentiate their drugs and add value to their offering, thus increasing the chance of successful uptake. For example, increasing adherence from 60% to 80% will have a marked effect on outcomes for patients and potentially reduce secondary care admissions and hence costs. This adds value to your offering, making it potentially much more attractive to payers.

Clearly, these are only a few points for consideration when thinking about how to maximise uptake in the new world of constrained budgets and value based propositions. What is very clear is that companies must think differently, adapt, change and start to identify, engage and align much earlier with new stakeholders, whilst continuing to work with existing stakeholders and KOLs.

The old model may be broken, but the new model extends well beyond HTA and offers companies major opportunities to create new drugs which offer real value in order to meet and exceed the needs of patients and healthcare providers.

About the author:

Iain is a partner at Roboleo &, Co. - www.roboleo.com

How can you exploit successful market access strategies?