Decision making and negotiation part one: technology licensing

Jean?Louis Roux Dit Buisson

Foro Ventures

In part one of two, Jean-Louis Roux Dit Buisson discusses the deal structuring in licensing for pharmaceutical companies.

Entrepreneurs, innovators and inventors are not necessarily educated in modern finance. One of their concerns, when dealing with partners or investors, is that they would leave money on the table.

They usually believe that their project will hit the market, big, for sure. Otherwise they would probably not put such long hours, weekends and days-off in the lab developing their innovation.

So when the investors step in and start talking about risks, probabilities, ROIs and conclude on share of the equity, they are often lost.

This is the same when a partner proposes a Term Sheet including milestone payments, initial payments, contributions in kind and royalties. The issues seem complicated and, unless explained one by one, could create a sense of frustration and even a sense of defiance.

This article is intended to provide elements to decipher term sheet elements and to construct negotiation and decision making support road-maps highlighting the trade-offs between risks, cash-flows, timing and size.

A particular application highlights term sheets when the negotiating party is not anymore in the money.

Licensing: getting to the deal

The first question licensors raise is to agree on the value of the project on the market. Licensors can refer to the fundamentals developed in “Strategy and evaluations part one: governance &, staffing” in which we examined in depth the role of boards for the understanding the key drivers of project value, essentially scenario planning, sales estimates and estimates of discount rates.

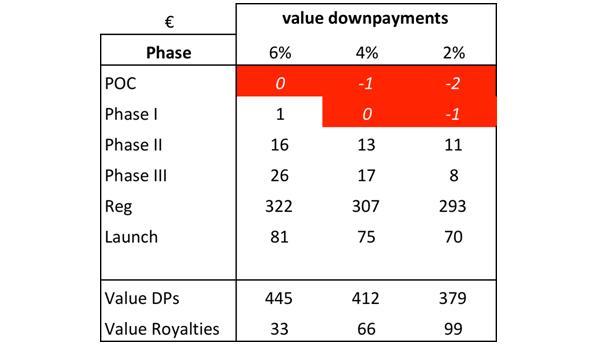

Figure 1 below summarizes the accretion of value as time will develop and a project or a technology progresses through the phases of development.

Figure 1: an example showing the accretion of value as time develops

Figure 1: an example showing the accretion of value as time develops

The licensee naturally looks at the table with a different view-point, as they are the ones exchanging money against the right to sell a product and generate the cash-flows sustaining the estimates of value.

,

"The licensee naturally looks at the table with a different view-point, as they are the ones exchanging money against the right to sell a product..."

,

The second question that the negotiators will bring to the table, once parties have agreed on a suitable value for future cash-flows, is how much of that value licensees would be willing to give away in order to have an exclusive access to the product / technology.

Should the value be split 50/50 between the licensee and the licensor, or 70/30, or 60/40? Should it be shared with the same ratio as the project progresses or should the payments reflect a changing attitude towards risk as the project progresses?

The impact of these discussions is quite high on the valorization of both companies. However, the licensee hesitates to be the sole stakeholder facing the development risks.

The objective for both parties will be to agree on how much of the risk is to be shared by the licensor. In other terms, what will the timing and the amount of the payments made by the licensee to the licensor be, and what should the royalty rate that will end-up in the total shared value to be the one agreed upon?

Some years ago at a conference on the topic of Business Development, executives of large European-based pharmaceutical companies were considering that a 70/30 spread between licensee and licensor would be fair to both parties.

,

"...pharmaceutical companies were considering that a 70/30 spread between licensee and licensor would be fair to both parties."

,

Road maps for licensing negotiations: strategic use

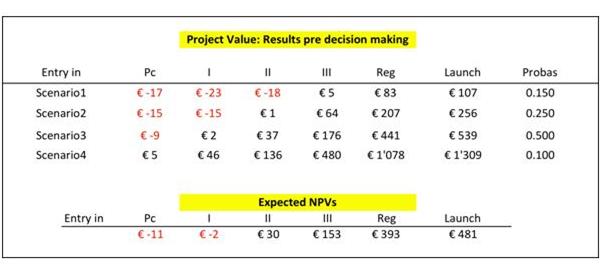

When properly constructed, models, including development uncertainties, allow for versatility in strategic simulations (figure 2) that can be included in licensing negotiations: what is the additional bonus if after phase I it can be concluded that scenario 1 and 3, which had a 65% chance of occurrence, will be pursued and scenario 2 and 4 abandoned? A modified table incorporating the new information is easily constructed and modifications to milestone payments agreed upon on that basis.

,

Figure 2: an example showing negotiation table licensing

Conclusions

Governance and valuations extend far beyond the computation of values. Properly constructed models allow for increased chances of success in negotiation between parties with an imbalance of education – more technical on one side, essentially financial on the other side – which could lead to difficulties in trusting each other.

Additionally these models offer the strategic background and information for boards to exert their governance in full knowledge of the impact of their decisions.

Part 2 of this article can be viewed here

,

,

About the author:

Jean-Louis Roux Dit Buisson is a Professor of Entrepreneurship at the Grenoble Management School in France. He is founder of Foro Ventures, a company dedicated to provide assistance and interim management for top-line growth projects and turn-arounds.

Jean-Louis is specialized in high technology sectors (such as Bio Pharma, Medtech). He has an MSc from MIT and an MBA from INSEAD and can be reached at jl@forotech.ch.

How can pharma negotiate a fair deal when it comes to licensing?