Biotrinity 2012

Rebecca Aris

pharmaphorum

Last month OBN hosted Biotrinity 2012 at Newbury racecourse in the UK. The conference saw a large VC turn-out and presented a great opportunity for partnering.

This article details the topics discussed throughout the panel sessions on the second day of this three-day event.

Figure 1: Panel discussion at Biotrinity 20121

Figure 1: Panel discussion at Biotrinity 20121

A changing landscape

According to Sanofi’s Chris Viehbacher, ‘business and financing models are changing, and investors and pharmaceutical companies must change as well.’2

Startup companies clearly require funding to succeed and as purses tighten, a lesson learnt by larger pharma companies is that instead of spending money developing new drugs, ‘It's cheaper to just buy developed molecules from private startups’3 and more pharma companies are turning to such investments.

In addition, we couldn’t fire up our startups without Corporate venture capital investors,4 whilst, Venture capital investment in startups is considered to be ‘the financial engine that drives new drug development.’3 Despite being a more costly form of funding it can offer good contacts, industry specific expertise and great potential for future development.

,

"It was a different world 5–10 years ago."

,

It was a different world 5–10 years ago. Corporate venture capital investors typically held a broad portfolio and little influence over the companies they invested in. The world today couldn’t be more different. Investors today bring expertise, consistent capital and strong voices to the boardroom.

However, it’s harder for early stage start-ups today, ‘with 17% fewer raising venture capital during the first three quarters of 2011 than during the same period in 2010’.3 They therefore need to work harder to attract investment.

What makes an attractive investment?

Investors at Biotrinity discussed drivers of their key deals and what they are looking for in their next major investment. As highlighted by this conference the rules to investing are that there are no rules but some important points to consider from some investors are outlined below:-

• Investors have little preference on company size or geographic focus.

• Investors prefer to invest by product than by company.

• Investments with a view on financial return and gaining licence on products is important for most investors.

• There may be a strategic element – a pharma company may invest in products they would like to have in their pipeline in upcoming years and / or technologies that they and other companies would like to have in their portfolio.

• Proof of concept is important – investors have to believe that the product will get to clinic.

• Some investments are strategically focused – e.g. invest in companies that develop technologies that the pharma company may need to utilise later. However, some investors have a white space investment strategy.

,

"Early engagement with partners has the potential to add huge value to the product from an early stage."

,

Licensing or M&,A?

But how do investments close – with licensing agreements or with merger and acquisitions?

Licensing deal generally allow a better idea of how companies could work together and can very naturally lead into an acquisition.

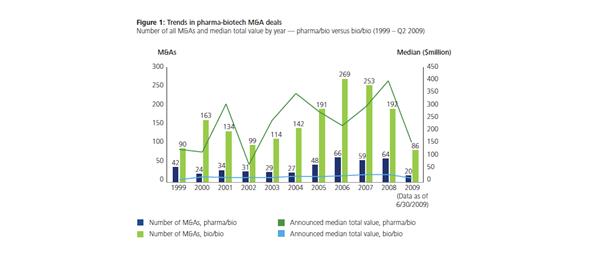

The growth seen in acquisition (Figure 2) – ‘the median value of deals in which a pharmaceutical company acquired a biotech firm rose from $80 million in 2000 to $400 million in 2008'– reflects ‘greater maturity and perceived worth of target companies and their pipelines’.5

Figure 2: Trends in pharma-biotech M&,A deals5

Figure 2: Trends in pharma-biotech M&,A deals5

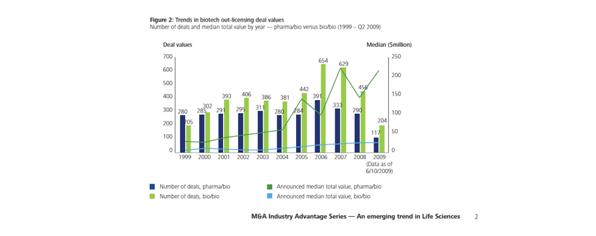

The increase seen in recent years in the median value of out-licensing deals (Figure 3) ‘reflects the need from pharmaceutical companies to reflect near-term revenue, as well as the premium being placed on targets with later-stage products in development.’5

Figure 3: Trends in biotech out-licensing deal values5

Figure 3: Trends in biotech out-licensing deal values5

It’s never too early!

It’s never too early to reach out to potential investors as early investments hold many advantages for investors as outlined in this article on Evaluate Pharma.6

Early partnering with pharma partners not only provides necessary investment but also early input to ensure the product is better aligned with the end customer. Early engagement with partners has the potential to add huge value to the product from an early stage.

,

"The lesson here is to prepare for FDA approval well."

,

Get your approval strategy in place

Many investors will consider investment only after the potential product is beyond FDA regulatory risk, this is demonstrated by the fact that 70% of acquisitions in the Medtech space are post FDA approval. In addition, Recent M&,A activity analysis by Deloitte revealed an ‘increasing preference for later-stage compounds’.5

Some investors blamed a decline in investments on ‘decreased guidance and transparency from the FDA, which makes it difficult for both companies and their investors to understand future costs’.3 As approval time increases investors become more nervous around products where the approval strategy is uncertain and therefore potential associated costs are not transparent.

The lesson here is to prepare for FDA approval well. Have a strategy is place from an early phase as without this the product can put potential investors off.

Conclusion

Investments today are changing. The conversation, motives and endpoints are different to what they were a few years back.

There is no quick win to guarantee investment in a product but some key take away points from Biotrinity 2012 in attracting investors are:-

• Attract and have discussion with investors early on.

• Know your approval strategy.

• The objective for the VC business is making a return on funds so make sure you have a clear strategy and path to sales.

• A licensing deal can naturally lead to an acquisition at a later date.

References

1. Biotrinity 2012 website http://www.biotrinity.com/silverstripe/

2. Sanofi’s Viehbacher thinks Big Pharma will seek earlier-stage deals. Here’s why, Medcity news 2012 http://medcitynews.com/2012/02/sanofis-viehbacher-thinks-big-pharma-will-seek-earlier-stage-deals-heres-why/

3. No new drugs? Blame Wall Street, Finance Fortune 2011 http://finance.fortune.cnn.com/2011/11/28/pharma-startups-problem/

4. Corporate Pharma VCs: Preferred Partners, Big Funds, Forbes 2012 http://www.forbes.com/sites/brucebooth/2012/01/23/corporate-pharma-vcs-preferred-partners-big-funds/

5. http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/MA/us_ma_LS%20Industry%20Advantage_Acquisitions%20versus%20product%20development_091609.pdf

6. Sanofi's corporate VC move underscores strategic motives, Evaluate pharma 2009 http://www.evaluatepharma.com/Universal/View.aspx?type=Story&,id=199879&,sectionID=&,isEPVantage=yes

About the author:

Rebecca Aris is Managing Editor of pharmaphorum, the primary facilitator of thought leadership and innovation for the pharmaceutical industry featuring news, articles, events / company listings and online discussion.

Rebecca was the first full time employee to join pharmaphorum, starting in her current role in mid-2010, and is responsible for coordinating all editorial content on the site. Prior to working at pharmaphorum she was a medical writer at a healthcare PR agency, where she researched, wrote and proofread copy for a variety of medical education and communication materials over a vast range of therapy areas. In addition, she spent three years working as a commissioning editor on three journal titles at a biomedical publishing. Rebecca holds a BSc (Hons) in pharmaceutical science.

For queries she can be reached through the site contact form or via Twitter @Rebecca_Aris.

How can start-up companies make themselves more attractive to investors?