Regeneron forges CAR-T R&D partnership with bluebird bio

Regeneron is pushing forward with its investment in cancer immunotherapy, striking a deal with bluebird bio to develop cell therapies.

Through its partnership with Sanofi, Regeneron is poised to bring the sixth checkpoint inhibitor therapy to the market with its cemiplimab, which the FDA is set to make a regulatory decision on before the end of October.

Now Regeneron is building on this with its deal with bluebird, which sees it invest $100 million in the cell therapy biotech.

The research deal will combine Regeneron’s antibody and T-cell receptor discovery know-how with bluebird’s expertise in gene transfer and chimeric antigen receptor T-cell (CAR-T) therapy.

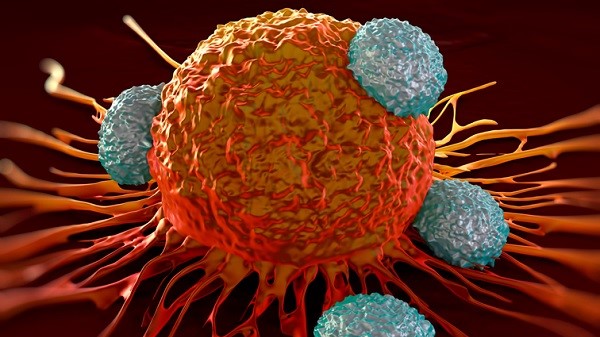

Bluebird’s tech uses a customised lentiviral vector to modify T cells so they can recognise tumour-specific proteins expressed by cancer cells and kill them upon engagement.

The companies have selected six initial targets and will equally share costs of R&D up to the point of an FDA filing.

At this point Regeneron will have the right to opt-in to a co-development and co-commercialisation arrangement for certain targets, with 50/50 cost and profit sharing.

If Regeneron does not opt-in, it will still receive milestone payments and royalties from blue bird bio on any resulting products.

Regeneron has invested $100 million in bluebird at a price of $238 per share, a 59% premium over the closing price on Friday.

This $37m premium will be credited against Regeneron’s 50% funding obligation for basic research, after which the collaborators will fund ongoing research equally.

Regeneron’s chief scientific officer, George Yancopoulos, said: “We believe that the tremendous synergies between Regeneron’s proven technologies and bluebird’s toolbox of advanced cell and gene therapy technologies create a promising opportunity to help people with cancer by developing innovative new treatments. This collaboration adds yet another dimension to our rapidly advancing portfolio of immuno-oncology candidates and combination approaches.”