Gilead finally breaks its silence on remdesivir’s price

After weeks of speculation, Gilead Sciences has revealed its pricing plans for coronavirus drug remdesivir – and the rationale behind its decision.

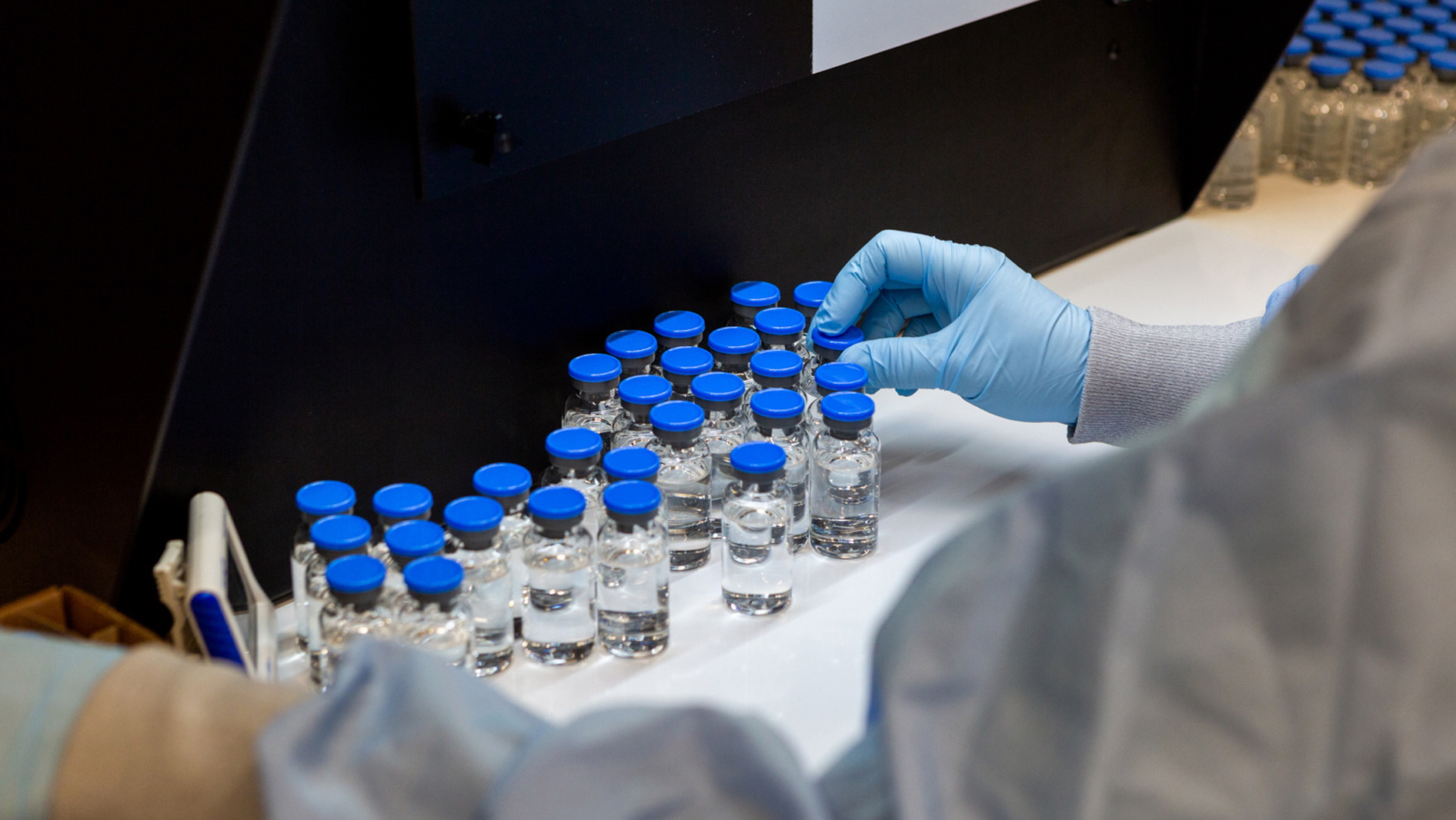

In an open letter, the company’s chief executive Daniel O’Day reveals a tiered pricing system for the drug. The US government and other developed countries will get it for $2,340 for a five-day course of six vials of the intravenous drug – equivalent to $390 per vial.

US insurers will however have to pay 33% more, hiking the cost to $520 per vial or $3,120 per course, which O’Day says is a consequence of “the way the US system is set up and the discounts that government healthcare programmes expect.”

Remdesivir will be priced “substantially lower” in the developing world thanks to agreements already in place with generic drugmakers to supply the drug, writes O’Day, without giving any precise details of those costs.

Data from the ACTT-1 trial showed that remdesivir can reduce the time spent to discharge from hospital by four days in patients seriously ill with COVID-19, and Gilead said that represents a saving in the US of around $12,000 in hospital costs alone.

The federal price in the US comes below two price ranges deemed by the Institute for Clinical and Economic Review (ICER) to be cost-effective in a report published last week, looking at remdesivir on its own and also when new data from the RECOVERY trial of dexamethasone is taken into account.

ICER says remdesivir would be cost-effective at a price of between $4,580 and $5,080 based on new data on the drug, slightly higher than the range it published in May based on its earlier modelling, and should not exceed $1,600 on a cost-recovery basis.

Since then however the low-cost steroid dexamethasone has been shown to reduce mortality in seriously-ill COVID-19 patients by around a third. With that in mind the cost-effectiveness benchmark range for remdesivir falls to a price range of $2,520 to $2,800.

O’Day says remdesivir’s price comes well below its value and does away with “the need for country by country negotiations on price” because the drug will be available at a level “that is affordable for developed countries with the lowest purchasing power.”

It also comes well below what some analysts feel the company could charge for the drug, which may disappoint some of Gilead’s investors.

Earlier this month, SVB Leerink analyst Geoffrey Porges said remdesivir sales could reach $7.7 billion in 2022, assuming a price of $5,000 in the US and $4,000 in Europe.

Gilead’s CEO reiterated the investment the company is making in the drug in the letter, saying that it will hit $1 billion this year.