AbbVie waits on data from Humira successor

AbbVie will clearly fight to keep its top-selling Humira (adalimumab) anti-inflammatory drug on the market for as long as possible – but it also has one eye on a possible successor that is beginning to show promise in mid-stage clinical trials.

A series of drugs are jostling to become the next big-selling rheumatoid arthritis (RA) drug as Humira, with sales predicted to top $15 billion this year by some analysts, potentially faces US biosimilar competition for the first time later this year.

This became more likely after advisers to the US Food and Drug Administration voted unanimously in favour of approving Amgen's cheaper biosimilar rival.

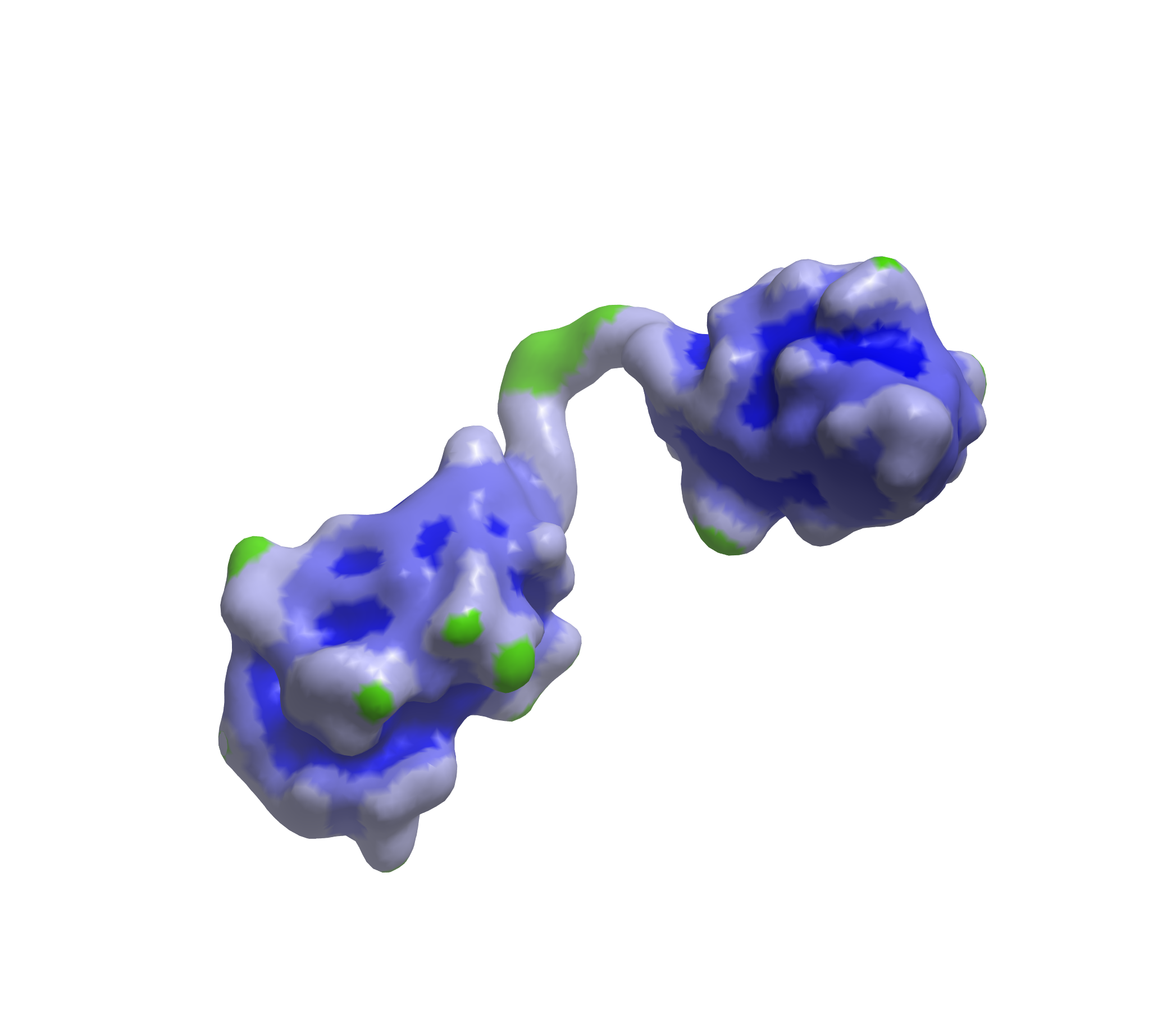

Belgium’s Ablynx is developing an anti IL-6R antibody, vobarilizumab (pictured), in partnership with AbbVie, and the drug has already produced encouraging efficacy data compared with Roche’s RoActemra (tocilizumab) in RA.

Ablynx’s drug has already caught the eye with what looks like a best-in-class safety profile in a phase 2b trial, and AbbVie has an option to take on phase 3 development should another phase 2b trial go well later this year.

Topline efficacy results show that vobarilizumab could produce similar efficacy to Roche’s older IL-6 targeting drug, but with a fortnightly dose, instead of a weekly dose.

Analyst Hugo Solvet from investment bank, Bryan, Garnier & Co, said vobarilizumab is “key for AbbVie’s post-Humira period."

In the latest trial of 251 patients, 2.1% discontinued treatment due to adverse events, compared with 6.3% in a RoActemra group. Serious adverse events occurred in 0.5% of vobarilizumab patients compared with 3.1% for Roche’s drug.

The trial tested vobarilizumab as a monotherapy at three different doses over a 12 week course, in patients naïve to methotrexate, or who had not responded to it. It was not powered to demonstrate statistical significance over RoActemra, the fourth group in the trial.

But the crunch will come later this year when results from a second Ablynx phase 2b trial will be announced. This trial will compare vobarilizumab as an add-on to methotrexate versus placebo.

Should AbbVie decide to opt in, Ablynx will be eligible for a milestone payment of $75 million. If all targets are achieved, the deal is worth $665 million to Ablynx, plus royalties on sales.

The drug will likely face competition – Sanofi and Regeneron have already filed their sarilumab IL-6 inhibitor in the US earlier this year and the FDA is due to make a decision before the end of October.

GlaxoSmithKline and Janssen have revealed strong phase 3 data for their sirukumab at last month’s European League Against Rheumatism (EULAR) conference and are planning to file later this year.

But Solvet said in a note to investors: “While vobarilizumab would not be the first IL-6 to reach the market, we believe that its best-in-class safety profile and AbbVie’s strong commercial capabilities should be decisive in making it a blockbuster.”

Predicting peak sales of 1.5 billion euros, Solvet said AbbVie has no IL-6 drug developed in-house, adding that research has shown that it may have already started to work on the autoinjector for vobarilizumab.

“We see vobarilizumab as key in the durability of AbbVie rheumatoid arthritis franchise,” said Solvet.