Non-cancer and HST focus are needed to speed up NICE guidance

Leela Barham uses data shared by the Department of Health and Social Care (DHSC) to take a look back at just how long it can take NICE to reach the milestone of publication of final guidance.

Non-cancer Single Technology Appraisals (STAs), as well as guidance under the Highly Specialised Technologies (HST) programme, will need to be speeded up for NICE to achieve the goal of final guidance within 90 days of marketing authorisation.

Monitoring NICE speediness

NICE monitors in-house just how quickly it can produce final guidance. The institute has been providing more visibility of the agency’s TA work speed and drivers of delays in board papers over the last year, including the integrated performance report for the year-end of 2023/24. Details at the TA level are not routinely publicly available.

It is possible to look at stats on speed at the TA level. As part of the Voluntary Scheme for Branded Medicines Access and Pricing (VPAS), speed of NICE TAs was a metric that the government and the industry looked at and published, at a high level, in reports. When asked, the DHSC supplied the underpinning data from 2014/15 to 2022/23, which underpins the most recent metrics report under VPAS.

KPI and non-KPI

Monitoring under VPAS was focused on a subset of TAs, those where the referral was received on time and the company did not request a delay. Changes were made to reporting over time. TAs reported as part of VPAS metrics included licence extensions in 2022/23, but not before. A fuller picture emerges by looking at the Tas that are not within the KPI’s scope and those that were. The DHSC shared the full dataset.

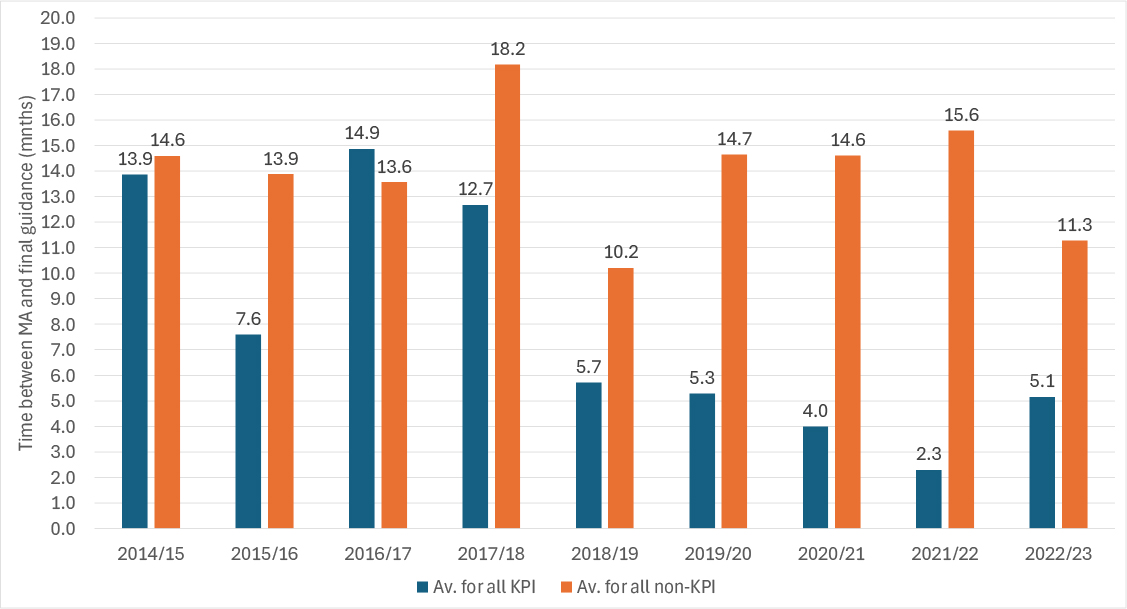

Non-KPI STAs took on average longer than KPI STAs every year since 2014/15, except for 2016/17 (Figure 1).

Figure 1: Speed of publication of final STA guidance, 2014/15 to 2022/23

Source: Analysis of data from the DHSC

There is considerable variation in the speed at which final guidance was published; the longest took 60 months, even for a TA included in KPI data. The fastest was publication in less than a month after marketing authorisation. That contrasts to a maximum of 153 months for a TA in the non-KPI data, although less than a month was achieved, too.

Cancer and non-cancer TAs

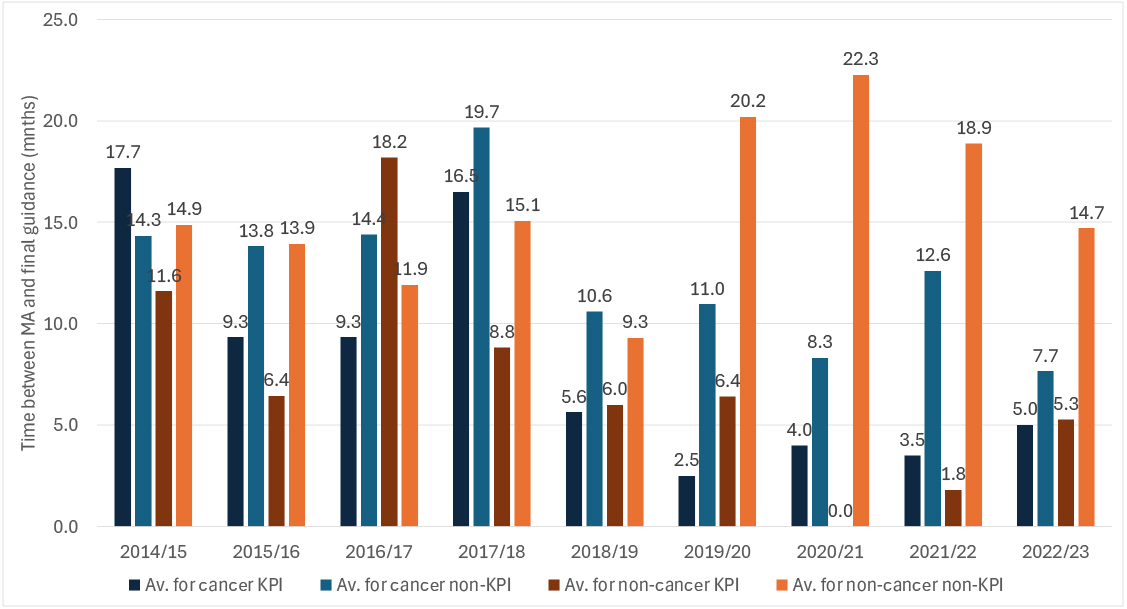

VPAS reporting differentiates between cancer and non-cancer because the scheme included a target to speed up non-cancer appraisals to be in line with cancer medicines appraisal timelines. This goal isn’t in the successor scheme, VPAG, and reporting is yet to be finalised on metrics for that scheme.

Since 2018/19, STAs of cancer treatments have been on average faster than their non-cancer counterparts (Figure 2).

Figure 2: Speed of publication of final STA guidance, 2014/15 to 2022/23 by cancer and non-cancer

Source: Analysis of data from the DHSC

The turnaround in the speediness of cancer STAs has corresponded to an increase in the average time taken to publish final guidance for non-cancer STAs.

NICE targeting faster publication in ‘divergent’ guidance

The institute has already highlighted that the challenge in speeding up publication lies in ‘divergent’ guidance versus ‘optimal’ guidance. These categories are similar to the distinction between KPI versus non-KPI, given that an optimal piece of guidance has to be where the institute has been notified of the topic at least 16 months before GB marketing authorisation is anticipated and the company hasn’t asked for a delay, although there are more criteria for optimal guidance, too.

Speeding up guidance will need a focus on HSTs and non-cancer STAs

The institute has noted that highly specialised technology guidance takes far longer than STAs, so that’s an area the institute will focus on in the future. HSTs aren’t in the DHSC data.

Tackling the speediness of non-cancer STAs looks to be another place for the institute to focus if past experience is relevant to the future mix of treatments. That work is not just for the institute, it’s for the companies as well. The most popular reason given in DHSC data for being exempt from being included in KPI reporting was late referral/notification (a factor in 87 STAs). The next most often cited reason was a request for delay, presumably by the company (46 STAs). These resonate with NICE’s identified drivers of delay too.