Novartis’ blockbuster hope Beovu clears EMA advisory panel

Novartis could launch its new age-related macular degeneration drug in Europe early next year after getting a green light from the EMA’s main advisory committee.

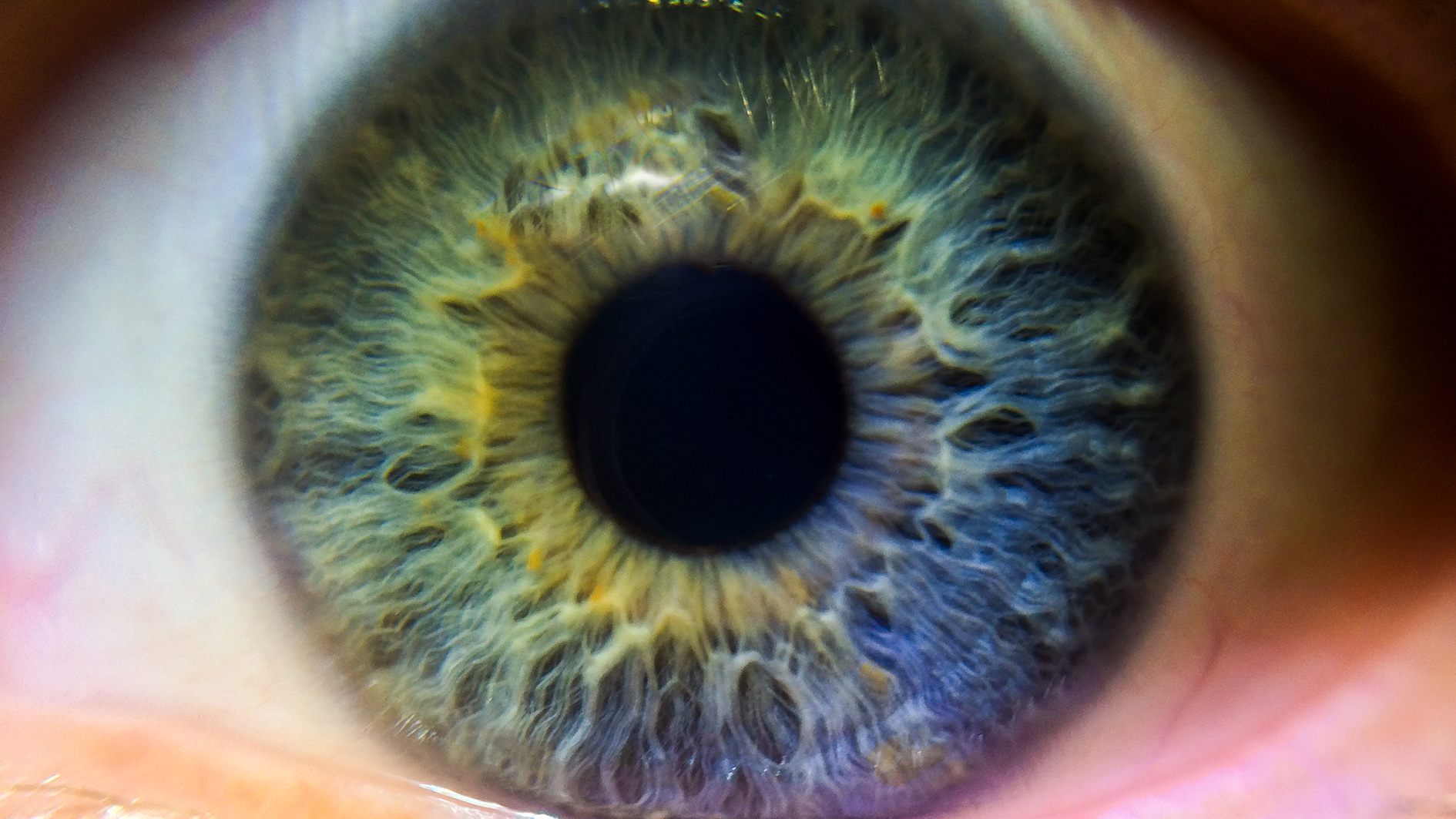

The Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion late last week for Beovu (brolucizumab) as a treatment for neovascular or ‘wet’ AMD, a sight-robbing disease that affects the central part of the retina at the back of the eye.

The new drug is a follow-up to Novartis’ VEGF inhibitor Lucentis (ranibizumab), which is currently locked in a marketing battle with Bayer and Regeneron’s rival Eylea (aflibercept) as well as off-label prescribing of Roche’s older Avastin (bevacizumab), and has started to see its growth slow down.

Beovu has already been approved in the US and launched at the same cost per dose as Eylea, which for some patients makes it a cheaper option as it has a less frequent dosing regimen that might be preferred by patients. Novartis says annual and lifetime cost should be lower with its drug.

Novartis’ new drug, given every 12 weeks by injection into the eye, matched the efficacy of Eylea given once a month in the HAWK and HARRIER clinical trials filed in support of its regulatory approval.

The Swiss pharma added that frequent injection intervals are a common reason why patients drop off treatment for wet AMD, one of the most common causes of blindness, affecting around 20 million people worldwide.

The jury is out on how well Beovu will compete with Eylea, which has also been approved in a 12-week dosing format. Analysts at Piper Jaffray say having the four-week dosage regimen approved could be an advantage for Bayer and Regeneron’s drug for patients who need more intensive therapy for wet AMD.

Meanwhile, while the two drugs were statistically non-inferior in the trials on visual acuity, trend data from the studies has also been open to interpretation, with both drugs scoring points from the other.

Beovu seemed to perform less well than Eylea on secondary measures of inflammation and immunogenicity in the eye. On the other hand, Novartis’ drug seemed to do better on measures such as accumulation of fluid in the retina, and was significantly better at reducing central subfield thickness – another measure of eye health.

Unsurprisingly, debate about the relative merits of the two drugs has meant that analysts’ views of peak sales projections are also very varied. GlobalData has previously suggested Beovu could become a $4 billion product, while some analysts think it could struggle to rise too much higher than $1 billion.

Novartis booked $2 billion from Lucentis last year while marketing partner Roche – which sells it in the US – reported sales of $1.7 billion. Those are respectable numbers but pale in comparison to Eylea – Regeneron made more than $4 billion from the product in the US in 2018 with Bayer adding $2.1 billion from international markets.

Lucentis meanwhile is due to lose patent protection in the US next year and in Europe in 2022, so Novartis doesn’t have too long to go before biosimilars could start to take their toll on its wet AMD franchise.