Price decay after loss of brand exclusivity (patent expiry) and generic launch

Charles Joynson

Wavedata

There comes a point in the life of every brand when exclusivity will be lost and generics will begin to compete for market share. However this is not the end of the brand’s lifecycle and many branded Pharma companies have commercial departments whose main function is to maintain value in the brand years after loss of exclusivity.

Both generic and innovator companies have tried to understand the ways in which prices change once a patent has expired and a generic product launched.

Generic companies have to plan their production scheduling and so need to estimate how quickly the price might decline, and will make a stab at predicting the length of their product’s profitability window.

Branded companies on the other hand need to understand how well any price equalisation against the generic product might work.

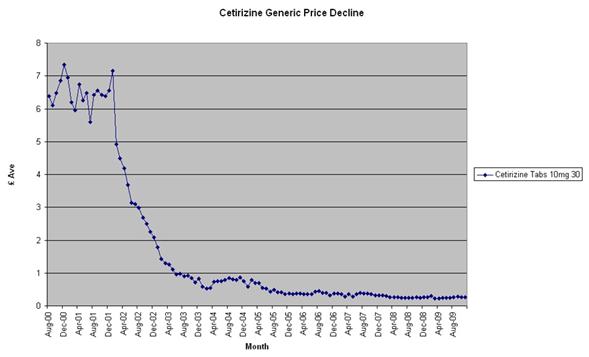

Scalloped decay

It had long been recognised that prices paid by chemists and dispensing doctors for a generic product would decline in the weeks and months after generic launch, but how quickly this would happen could only be guessed at.

Typically the product price follows a ‘scalloped’ curve as the price initially declines rapidly as generics firms compete for market share, but then flattens out as the price approaches their cost of goods.

In some cases the decline is extremely rapid, whilst in others the decline can take many years.

Some generic companies still use ‘rules of thumb’, which states that ‘if there are more than three generic licence holders the price will decline rapidly and the profits will be low.

However if the brand is worth many millions of pounds, they focus on this and seem to forget that the value of the market is likely to decline massively.

Thus the value of the brand in the year prior to generic launch has an effect on the speed of price decay. In other words, the larger the value of the brand, the more generic companies there are likely to be competing for this new market.

"...the value of the brand in the year prior to generic launch has an effect on the speed of price decay."

This means that blockbuster products see more generic manufacturers and licence holders than products with low values.

Figure 1: Cetirizine price decline

Figure 1: Cetirizine price decline

Price bounces

The number of API (active pharmaceutical ingredient) manufacturers is also important, as if the generic price approaches a generic company’s cost of goods, some are able to get a price decrease from their supplier whilst others are not.

The difference is that if the API price is not flexible as there is only one supplier, the market price may then decline to a level at which some licence holders decide not to schedule further batches and withdraw from the market.

As the number of licence holders declines, the price rises or bounces, resulting in some changing of minds and market re-entry.

These bounces happen in about 20% of products, and the remaining 80% continue to follow the ‘scalloped’ curve.

Figure 2: Omeprazole average price vs drug tariff

Figure 2: Omeprazole average price vs drug tariff

Therapeutic category

The therapeutic category of a product has not so far been shown to be related to the speed at which price declines. This seems to be controlled far more by chemist and wholesaler buying behaviour than the disease the product is used for.

Paediatric and geriatric products behave in exactly the same way as the normal adult usage products with price decline being driven by buyers rather than clinicians.

"The only products which do behave differently are those which are more difficult to manufacture..."

The only products which do behave differently are those which are more difficult to manufacture than the normal solid dose formulations (tablets and capsules). For example injectables, patches and inhalers restrict the number of manufacturers, and thus the competition between them is less intense.

However normally larger value products suffer faster price reduction than smaller value products.

Conclusion

The key factors determining generic (and thus equalised brand) prices are the reimbursement price, the number of generic competitors or licence holders, manufacturing difficulty and the value of the brand prior to patent expiry.

Statistical models have been used successfully in the past to forecast price decay, but still many product managers choose to base their expectations on therapeutically appropriate analogues and expect buyers to behave differently when the product is used for different diseases.

About the author:

Charles Joynson is Managing Director of Wavedata and specialises in analysing the discounted retail prices in the UK.

He can be reached on info@wavedata.co.uk

What instances of price decay following patent expiration have been the most notable?