Pivoting to the patient to achieve high performance

Since October 2012, the industry outlook has continued to improve with enterprise value1 rising – driven by improved future growth forecasts. Entry in emerging markets and expedient product launches are still driving the markets, however, investor sentiment has shifted and science based innovation strategies are now eclipsing diversification. Our analysis reveals that a select group of high performers is breaking away from the pack by focusing on innovation-driven growth strategies substantiated by patient outcome focused commercial models. Anne O'Riordan discusses in this article.

We are entering a very exciting time in the pharmaceutical industry with clear evidence of recovery post the peak of the patent cliff in 2012. As the industry "pivots to the patient" with an increased focus on delivering improved patient outcomes, the research indicates that a new scientific rigour is emerging that goes beyond just innovation in drug discovery and extends through the commercial model. Market and patient success requires not just developing a great new drug, but being able to articulate and prove that drug's patient and economic value to payers, providers and government. Getting the drug approved is just one step to success, getting it approved for reimbursement is another, and potentially more difficult.

Our research indicates that a few high performing pharmaceutical companies have leapfrogged competitors in terms of high performance in profitability, growth, future value, consistency and longevity. They have done so with an emphasis on innovation-driven growth strategies validated by patient outcome focused commercial models. These strategies are bringing the right products, with the right level of disease focus and differentiation to market through value-focused commercial models that are welcomed by reimbursers and appreciated by patients and the scientific community.

We have examined the long-term performance of pure play pharmaceutical companies, (defined as drawing more than 75 percent of their revenue from pharmaceutical products) for the last eight years.

Those high performing companies excel in putting science back into life sciences by strategically transforming cutting edge discoveries into market viable products; applying equally rigorous science and analytics to deliver successful product launches; and demonstrating improved patient outcomes.

Four predominant take-aways rise to the top of the analysis:

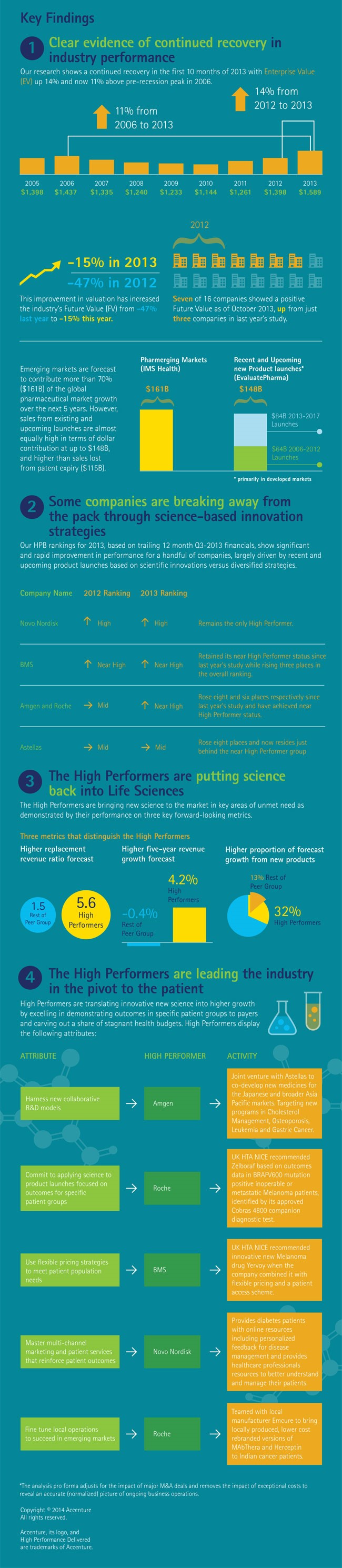

• Clear evidence of continued recovery in industry performance: Research shows that a recovery continued through the first ten months of 2013; enterprise value1 rose 14 per cent, reaching 11 per cent above the pre-recession peak of 2006. But performance between individual companies varies widely.

• Some companies are breaking away from the pack through science-based innovation strategies: Our research shows significant and rapid improvement for 30 per cent of the companies surveyed who have faster average growth rates than their peer group, largely driven by recent and upcoming product launches based on niche scientific innovations, targeted at specific therapeutic areas of needs, versus more diversified portfolios.

• High performers are putting science back into life sciences: Three forward-looking metrics show how high performers are outperforming the averages for the rest of the peer group: higher replacement revenue ratio forecast, higher five-year forecast revenue growth average, and a greater proportion of forecasted growth from new products.

• High performers are leading the industry's pivot to the patient: High performers combine products with a clear articulated view on how they improve patient outcomes for select populations. They have been able to bring new products to market with a clear articulated view on how the drugs improve patient outcomes and are consequently able to carve out a unique place in today's price and value-conscious health market.

Building excellent launch capabilities to demonstrate whole system patient outcome benefits to payers is becoming more important than ever, because new launches are entering into a radically more competitive and crowded market dominated by payers.

"Some companies are breaking away from the pack through science-based innovation strategies..."

Our findings highlight the difficulty presented by this tougher payer environment. Six of 12 selected New Molecular Entity (NME) launches from 2011 missed analysts' pre-launch sales target for their first 2 years by $2.7 billion collectively. Also, 12 of the 38 significant NME launches studied from January 2011 to November 2013 have now had their 2016 sales forecasts revised downward from original pre-launch expectations, leading to $6.2 billion in lower 2016 revenue estimates. In addition, many drugs remain on the market which are forecast to generate more than $1 billion in revenue, but will contribute a smaller proportion of the global market and its growth.

High performers more successfully bring new science to market by demonstrating whole system patient outcomes.

It is the attributes and capabilities of high performers that set them apart. They:-

• Focus on collaborative R&D, developing the best science through external collaborations with academia, biotech or other pharmaceutical companies.

• Apply science and analytics to product launches focused on outcomes in specific patient groups, initiating and maintaining dialogue with payers and other patient-oriented organisations from early in the development process.

• Use flexible pricing to meet patient population needs, generally utilising strategies that maximise accessibility and outcomes, while continuing to support physicians and patients.

• Master multi-channel marketing and patient services that reinforce outcomes, and providing ongoing support and consultation beyond the point of purchase to encourage/ensure patient adherence and outcomes.

• Fine-tune local operations to succeed in emerging and developed markets, offering appropriately priced products tailored to local patient needs.

o This more focused approach usually goes hand-in-hand with financial assistance, patient services and healthcare professional training, which all optimise accessibility and value.

New science-driven launches represent a significant opportunity for growth that complements ongoing growth in emerging markets. As payer pressures increase, high performers will rise to the top by delivering real, science-backed innovations that optimise outcomes in identified target patients, supported by evolving commercial capabilities.

Reference

1. Enterprise Value (EV) is the sum of Market Capitalization and Net Debt, totalled across a peer set of 16 of the largest pure play Global Pharmaceutical Companies, and measured at constant USD exchange rates from 2005-2013.

Learn more about our research findings here.

About the author:

Anne O'Riordan is the Global Industry Managing Director of Accenture's Life Sciences industry group. Anne has 20 years of experience working with clients in the Health and Life Sciences Industries around the globe. She is based China and prior she spent nearly two decades working across Europe and in the United States for Accenture.

Have your say: Which pharma companies are focussing on truly innovation-driven growth strategies?