Pharma sales part one – looking for a new role

Marie Crespo

SalesAssessment.com

In part one of two, Marie Crespo, CEO of SalesAssessment.com, explains why understanding your sales talent’s performance potential is fundamental to your business model.

The last few years have placed pharma sales firmly under the spotlight. Indeed, some commentators are suggesting that the whole business model needs to undergo a revolution.

A recent article in Forbes1 argued that pharmaceutical companies should look to other industries for inspiration and, for instance, learn from IBM’s story in the 1990s. As the hardware market commoditised, IBM transformed its product-centric culture to one focused on customers and services. Author Dave Chase writes: ‘Remarkably, IBM demonstrated how it’s possible for a large company to shift from a product-centric culture to a customer and service-centred company. The handwriting is on the wall for pharma companies: they will succeed or fail based not on how many drugs they sell, but on how well their offerings improve health outcomes.’

He asked: ‘Do pharmaceutical companies see themselves in the drug business or the disease management business? Or, where possible, in the disease prevention business?’

A major part of any transformation for pharmaceutical companies will involve creating new relationships with partners and drawing on the depth of engagement they have with the market, albeit that their sales force’s access to providers has already been dramatically limited.

,

"...the salesperson of the future will become a business equal of the buyer..."

,

So what can pharma organisations do to redefine their sales approach? Even before they begin the tough process of transforming ‘what they’re all about’, companies are going to have to continue adapting to the new realities of the existing market. In many ways, this means being able to demonstrate the value of new products, especially by ‘payers’. These buyers are looking for real value in terms that demonstrate ROI (return on investment). They’re demanding hard comparative economic and clinical value (ECV) data in order to justify premium pricing, and price increases: companies are going to have to work hard simply to stand still.

In every industry, the balance of power between buyers and sellers has shifted. Advances in professional procurement practice, more knowledgeable buyers with access to vast libraries of online information, compliance issues, and a greater focus on value have combined to fundamentally and irreversibly change the way sales organisations are able to interact with buyers.

Transactional sales are inexorably moving online. The professional selling that remains – especially if pharma organisations follow the IBM approach – will be sophisticated and demanding. In many cases, the salesperson of the future will become a business equal of the buyer, a creative problem-solver and value creator, a role which demands high levels of professionalism. In short, pharma companies will have to learn how to sell differently.

Inevitably, this will lead to reductions in the number of salespeople employed: the throw-enough-mud-at-the-wall-and-see-if-it-sticks approach no longer applies. It will also involve fundamental changes in the type of salespeople pharma companies retain and hire.

Addressing the market effectively is not simply a case of employing ‘better talent’, it necessitates employing the ‘right talent’. This means highly competent people with a substantially new competency profile. Therefore, the current priority for any pharma organisation is to identify and hire sales professionals capable of addressing the market in new, more relevant ways.

In this context, it is vital to understand that the ability to perform well in one type of sales role doesn’t imply an individual will be successful in another, although some of the relevant skills and behaviours will be transferable. Significantly, they are highly unlikely to be ‘high-performers’ in a new role.

,

"...high-performers deliver substantially more revenue..."

,

Why is this important? Because high-performers deliver substantially more revenue: in a well-known study, McKinsey &, Co research2 found that sales high-performers generate 67% more annual revenue than average performers.

So, given the fast pace of change within the sector, how can pharma sales forces respond effectively to this market evolution in a timely manner? The task is made immeasurably easier if companies have the appropriate diagnostic tools to help them. An assessment approach that can distinguish between roles such as Key Account Manager, Strategic Sales, Solution Sales, Sales Manager and Sales Leader is essential.

Step one in the process is to define the new sales roles that best address the organisation’s target market segments: for instance, many businesses are currently seeing the role of Key Account Manager as strategically important. Beyond that, sales organisations also need to define the role-mix and level of resourcing that will achieve revenue goals and deliver long-term sustainable growth in the most cost-effective way.

If step one is all about defining where you are headed, step two is about understanding your current position. Comprehensive assessment of existing talent (benchmarked against the profile of a global sales high-performer for the relevant new role) delivers the data in relation to individuals’ key behavioural competencies, skills and critical reasoning ability. At the same time, appropriate ‘dashboard’ tools provide appropriate insight at the organisational level.

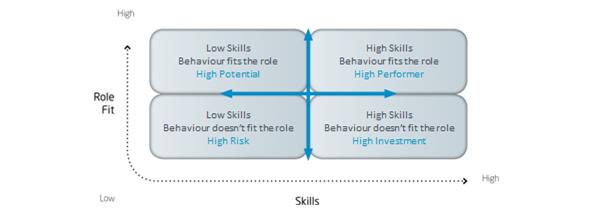

Figure 1 represents what we call the Sales Talent Performance Matrix. It’s basically a ‘Boston Box’ focusing on the performance potential of the salespeople in an organisation, based on their skills and behaviour competencies. Why these two factors? Because they’re the two intrinsic ‘performance factors’ that organisations are able to influence through development. Where individuals are positioned on the graph provides instant insight into their performance potential.

Figure 1: The Sales Talent Performance Matrix (Copyright: SalesAssessment.com)

For instance, those falling within or close to the high-performer category will be the organisation’s stars. Inevitably, many more individuals are going to lack some skills and behaviours necessary to fulfil their new sales role effectively. Such concerns may be addressed by development – training in the case of skills gaps and coaching in the case of behavioural issues – but the scale of the investment and time taken to address them will vary according to the individual’s position on the chart. And, of course, a substantial number may lack both the behavioural profile and the relevant skills to enable them to perform effectively in the proposed role, so consideration should be given to their redeployment.

Clearly, an organisation should focus on retaining its stars in light of the McKinsey research discussed above. Where there are gaps, however, it is important to deploy the appropriate development intervention.

,

"...an organisation should focus on retaining its stars..."

,

Most behavioural issues are not solved by training and can only satisfactorily be addressed by intensive coaching – that’s one of the reasons sales training may not be effective in boosting performance in many cases. What’s more, coaching tends to be a longer-term process than training skills and is correspondingly more costly, at least in terms of management time.

Conversely, individuals with poor skills but a good behavioural fit to their new role should receive the relevant skills training as a matter of priority in order to equip them to perform at their full potential. If they don’t receive the necessary training in a timely fashion, their underperformance can quickly translate into disillusionment and they will leave.

Finally, an effective sales talent assessment is not just for evaluating your current talent, of course, it’s also a vital tool for recruiting new high-performing individuals to the organisation.

References

1. IBM's ‘Reinvention Should Inspire Flat Pharma Businesses’, Forbes, 28 July 2012.

2. McKinsey’s ‘War for Talent 2000’ survey of 410 corporate officers at 35 large US companies.

Part two of this article can be viewed here.

,

,

About the author:

Marie Crespo has been involved in running major business units of Fortune 250 companies and subsidiaries of Fortune 500 companies for more than 30 years. Marie started in the IT business and stayed there for over 20 years, during which time she enjoyed significant success in various business and technical roles including Pre-Sales, Sales Management and Management Consultancy.

Moving on to the Medical and Pharmaceutical sector, Marie has been responsible for a highly sophisticated IT department at EMEA level and been Managing Director of a global division of a major pharmaceutical services corporation.

Marie has an EMBA from Imede, speaks fluent Spanish and French and is qualified by the British Psychological Society.

If you would like to discuss any of the points raised in this article, feel free to email Marie at mdmcrespo@salesassessment.com or contact her by telephone on +44 (0)7713 192005.

You can download SalesAssessment.com’s free role definitions here http://www.salesassessment.com/sales-assessment-products/sales-role-definitions, which includes various account manager and field sales roles.

How can pharma redefine its sales approach?

,