Pharma pricing and market access: a global outlook

Rebecca Aris

pharmaphorum

Pricing and market access is constantly evolving – to adapt with the changing healthcare environment throughout Europe, the US and the emerging markets. With these changes, market access has become one of the pharmaceutical industry’s focal points throughout the last five years. 1

The recent ‘Pharma pricing &, market access outlook’ event organised by Health Network Communications covered the latest global trends in pharma market access, which are discussed below.

The search for value in pharma pricing

If you look back 20 years, you’ll see that drug makers then didn’t fully realise the need to demonstrate the value of their new treatments to payers. Today, whilst drug makers understand the necessity to demonstrate value, according to a recent report, many are concerned about their ability to do so. 2 The report also suggests that the ‘value challenge’ “is a leading concern for the majority of drug companies worldwide”.

In most markets, competition / market forces are usually the optimum way of determining a product’s value and deciding how much of a good should be produced. However, healthcare does not follow these rules and isn’t a ‘normal market’, you can’t simply compare pharmaceuticals to goods such as computers or cars. Healthcare access is deemed to be a basic human right and determining costs within healthcare is a result of an intricate relationship between the payer, the patient and the physician. This complex decision model is based on many factors and varies from country to country whilst continuing to present a challenge to payers across the globe.

,

"If you look back 20 years, you’ll see that drug makers then didn’t fully realise the need to demonstrate value of their new treatments to payers."

,

Value as therapeutic benefit isn’t easy to assess and is measured differently in the schemes adopted in different countries. But what lessons can be learnt by the various schemes – and who seems to be getting it right?

UK NHS reforms – value-based pricing

As with healthcare systems across the world, the NHS is changing significantly to a model of value-based pricing (VBP). The key driver behind value-based pricing is Andrew Landsley, whose view is as follows:-

“We need a system that encourages the development of innovative drugs addressing areas of significant unmet need. And we need a much closer link between the price the NHS pays and the value that a new medicine delivers, sending a powerful signal about the areas that the pharmaceutical industry should target for development.”

"Most importantly, using our Cancer Drugs Fund in the interim and value-based pricing for the longer-term, we will move to an NHS where patients will be confident that where their clinicians believe a particular drug is the most appropriate and effective one for them, then the NHS will be better able to provide it for them."

Andrew Lansley 3

,

"VBP applies to new medicines on the market from 1 Jan 2014 and is intended to differentiate between therapeutic improvement and innovation."

,

VBP applies to new medicines on the market from 1 Jan 2014 and is intended to differentiate between therapeutic improvement and innovation. The government’s objective is to use society’s valuation of treatments.

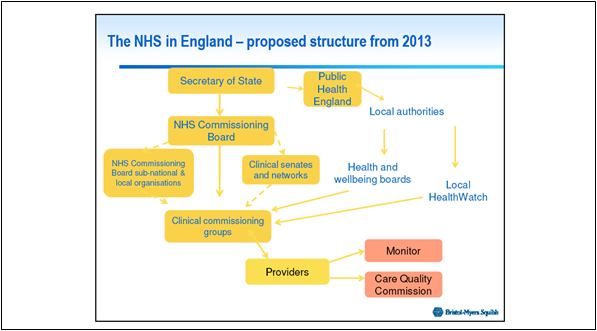

Figure 1: The proposed structure of the NHS in England from 2013*

The Government’s key priority with these changes is economic stability whilst supporting growth.

New medicines in Scotland

Scotland has a population of 5 million and consists of 14 health boards allocated a budget to provide for total health needs of the population.

The Scottish Medicines Consortium (SMC) assess treatments and is made up of a multi-disciplinary committee of doctors, pharmacists, public partners, industry, board chief execs and economists. Decisions by the SMC are made in a two-stage process. During stage one draft advice is issued once clinical and economic evidence has been assessed. The Second stage takes a broader perspective and takes into account any company comments posted after the first stage.

With respect to treatments, the SMC may:-

- Accept

- Accept with restrictions

- Not recommend

,

As of Feb 2011, 34% treatments were accepted for use, 37% were accepted for restricted use and 28% were not recommended.

The SMC is believed to provide a robust, transparent evidence-based approach to assessing cost effectiveness of new medicines.

Pricing and reimbursement in France and Germany

France

In France, the Haute Autorité de Santé (HAS) was set up by the French government in August 2004 to help improve the quality of patient care whilst striving to guarantee equity within the healthcare system.

The HAS assess the value of treatments based on a five-point scale (ASMR).

I. Major therapeutic progress.

II. Significant improvements in terms of therapeutic efficacy and / or reducing side effects.

III. Moderate improvement in terms of therapeutic efficacy and / or reducing side effects.

IV. Minor improvement in terms of therapeutic efficacy and / or reducing side effects.

V. No improvement, reimbursed at cheaper price than comparator.

These help to determine the therapeutic value of treatments and, in turn, the appropriate costs.

An important consideration is that the value of a treatment may be considered to be different for different indications. When put into practice treatments may be ordered (for example to a hospital) without prior knowledge as to which therapeutic indication they will end up being used for. This complicates the process of charging different prices for different indications. In real terms rebates will result in the price reflecting different indications.

The industry considers the French system to be a good ‘value based’ pricing system.

,

"…the value of a treatment may be different for different indications."

Germany

In Germany, the Arzneimittelmarkt-Neuordnungsgesetz (more commonly known as AMNOG) act came into effect on January 1st 2011. It was intended to curb the spiralling expenditure for medicinal products by the statutory health insurance funds. In the case of new medicinal products this was particularly apparent, high prices did not necessarily correlate with a high added benefit for patients. AMNOG assesses treatments in a manner which doesn’t quite match the French definitions, however similarities do exist.

In Germany the GBA decide on the additional benefit of a product and determine the price. The GBA may reach a decision that the product has additional benefit in which case negotiation ensues as to the reimbursed price. If an agreement can’t be reached then the decision is turned to the arbitration board.

If the product is deemed to offer no additional benefit, the price could be capped at the maximum of comparative level therapy or be assigned a reference price.

Once the GBA arrive at a decision on the additional benefit of a product they publish this. This leaves the manufacturer with two options – either accept the price or withdraw the product from the market. The manufacturer has a four-week window in which to withdraw the product if it wishes to do so.

The AMNOG concept has some limitations, markets such as the multiple sclerosis market is one in which fair and balanced prices will be hard to achieve. Despite limitations the legislation has been deemed to be a success throughout its first year. 4

Pricing and reimbursement in the US and Canada

The US

In the US, the Patient Protection and Affordable Care Act (PPACA) became law on 23rd March 2010. The three goals of which were to:-

- Expand health insurance coverage

o Improve access to prescription medicines and other health services

- Change the incentives of health care financing

o The fee-for-service payment model lacks incentives to coordinate care and target early intervention and implement preventative methods

o Managed care plans establish financial incentives for a provider to serve as a gatekeeper to healthcare services

- Generate revenue to pay for expanding coverage

o Congressional budget office estimates federal cost of coverage expansions to be ? $938 billion over the ten year period 2012-2019.

Since the launch of the PPACA one key learning that has emerged is the importance of involving stakeholders early in the drug development process to better understand their needs.

Canada

Canada has a population of 34.7 million and is divided into 10 provinces and three territories.

In Canada the patented medicine prices review board (PMPRB) determine pricing, which was established in 1987. It is an independent body with a dual mandate – regulatory and reporting.

Canadian prices are comparatively higher than a number of OECD countries. In addition, the growth in drug sales in Canada outpaces competitor companies such as the US and Europe (2005–2010).

Policy changes in other countries such as France, Germany and the UK impact on Canadian drug prices, with the cost-containment measures in Germany being likely to lead to lower introductory prices in Canada.

There are several benefits to the Canadian price regulatory system. It boasts a high level of compliance (on average 93–95% overall compliance). In addition, the scientific review process establishes four levels of therapeutic improvement, which better recognises and rewards innovation. Furthermore, the PMPRB establishes the price ceiling rather than the selling price, offering patentees the flexibility to set the price anywhere up to the price ceiling.

One drawback to the system is that, owing to the fact that Canada is made up of provinces, some have stronger negotiation powers, which leads to inconsistencies in access to treatments across the country.

Conclusion

Drug makers clearly now realise the full extent of the need to demonstrate value to payers of new treatments and will continue to work towards this in the future. Despite concerns on the drug maker’s part to fully demonstrate the value of new treatments to payers, lessons have been learned through existing pricing policies worldwide. Key learnings from these need to be taken into consideration going forward, such as early involvement of payers in the drug development process. By introducing payers early in development and understanding payer focus, companies can begin to embrace payer expectations. In addition, as payers increase their transparency in decision making, drug makers can evolve how they operate to ensure that value demonstration becomes a more natural process in the drug development process.

Changes are clearly noted throughout pricing polices across the globe, for example the SMC is far more likely than the Canadian strategy to recommend new drugs to be publically funded. But there is no scheme that clearly demonstrates that it is far more superior than others in achieving optimum value whilst rewarding innovation. What we do see is that as each country adapts their pricing policies, changes echo across the globe and drug price alterations are seen far and wide. Drug prices will continue to adjust as pricing schemes evolve.

Challenges will be met, such as new biologic therapies emerging and presenting high costs resulting in tough value decisions. But what must not be forgotten is that the key to future successful market access is integrating payers with the industry to ensure that innovative and valuable treatments make it to the market for the benefit of all.

References:

- http://www.pm360online.com/f1_Understanding_Payers_for_Commercial_Success_0911

- http://www.managementthinking.eiu.com/economist-intelligence-unit-finds-biopharmas-facing-challenge-demonstrate-value.html

- http://www.dh.gov.uk/en/MediaCentre/Factsheets/DH_121652

- http://www.thepharmaletter.com/file/110289/german-pharma-hails-successful-2011-views-amnog.html

,

*Figure used with permission of Patrick Hopkinson - Director Market Access &, External Affairs, Bristol-Myers Squibb Pharmaceuticals Ltd UK.

,

About the author:

Rebecca Aris is Managing Editor of pharmaphorum, the dynamic online information and discussion portal for the pharmaceutical industry. For queries she can be reached through the site contact form or via Twitter @Rebecca_Aris.

How can payers be introduced earlier into the drug development process?