Maneuvering in a dynamic global payer environment

Ed Schoonveld of ZS Associates offers an overview of recent changes and trends in the global payer environment.

The Challenge

The prescription drug landscape is changing in an unprecedented way. Economic recession related austerity measures and budget challenges motivate payers to act on long-standing concerns that incremental benefits for new drugs are often insufficiently substantiated at time of pricing and market access decision making. In the five largest European markets (EU-5), major changes are finalized or under implementation in France, Germany, Italy and the UK. Spanish and Italian regional healthcare budget administrators are dramatically cutting expenses as in some cases bankruptcy is an imminent threat.

"How can we plan for needed evidence of the benefits of new drugs, when payers themselves are not sure how they will review a new drug in five years' time?"

In the United States, the Affordable Care Act (ACA) is changing the healthcare coverage landscape, and the debt level is demanding attention in a highly politically divided and seemingly incapacitated political system. Emerging markets face challenges of a reduced growth rate of their economies, while striving to fund universal health care coverage. Compulsory licensing threats have grown substantially, particularly for oncology drugs, after some controversial decisions by the government and courts in India.

How can a pharmaceutical company make prudent clinical trial investment decisions, when almost all global markets are in apparent disarray? How can we plan for needed evidence of the benefits of new drugs, when payers themselves are not sure how they will review a new drug in five years' time, when it will come to the negotiating table? Will companies be forced to stay out of India and other emerging markets for oncology drugs, which represent a large share of innovative molecules in the drug development pipelines? As uncertainty on payer decision making grows, one can be tempted to ignore payers entirely and revert back to only considering FDA, EMA and other national regulatory approval criteria. This however would be a serious mistake as the consequences of not addressing payer needs is almost certainly resulting in underperformance in today's and even more so in tomorrow's pharmaceutical market.

The Good News

Payers have historically often made changes to their evidence requirements and related price expectations. Most changes have been gradual in character, without changing the fundamental principles and drivers of value. Other changes have been an adoption of existing approaches by payers in other countries. The German AMNOG system has some commonalities with the French ASMR rating system. The South Korean health economic review was largely copied from Australia. The general principles and methodologies employed by payers in decision making continue to evolve relatively slowly. With individual countries changing continuously, it is important to base the analysis and input to the early drug development process on the more general payer principles of management rather than today's country rules only. Changes in global market access and pricing environment are discussed on the context of four global payer segments.

"...as the consequences of not addressing payer needs is almost certainly resulting in underperformance in today's and even more so in tomorrow's pharmaceutical market."

Global Payer Segments

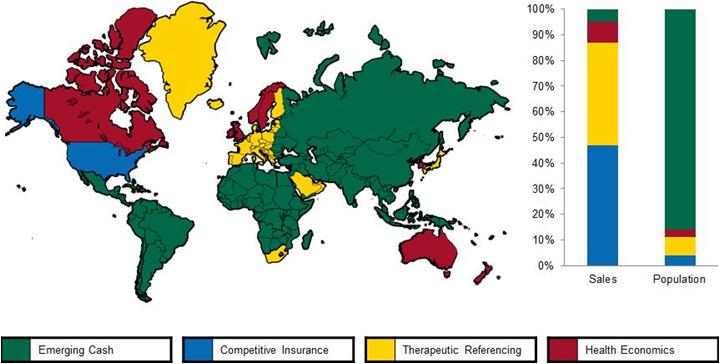

For the purpose of analyzing payer needs and evaluating their management practices, we can consider the main global payer segments: Competitive Insurance Based (mainly US), Therapeutic Referencing (Japan, most of Europe), Health Economics Driven (UK, Canada, Australia, Sweden, and S. Korea) and Emerging Cash Markets. Figure 1 illustrates how countries are currently distributed across the segments, as well as how the segments compare in pharmaceutical sales and population size. Where countries fit multiple segments, the most dominant control mechanism is represented. The idea is also not to suggest that countries perfectly fit in a box, but rather how the various payer management philosophies are representing payer behaviors across the world. Also, countries may very well adopt new control measures and as a result move to another segment. A more detailed description of the segments is found in The Price of Global Health (ref 1).

Figure 1: Global Payer Segments

Competitive Insurance Based (US) segment trends

The implementation of the Affordable Care Act (ACA) is underway, despite resistance in many states. Health Exchanges are intended to offer insurance offerings to previously uninsured citizens.

There is a clear, yet slowly evolving trend towards adopting more outcomes measures in provider payments. The creation of Accountable Care Organizations, Medical Homes and similar arrangements help encourage providers to take more accountability for long-term patient outcomes.

Comparative Effectiveness and Real World Evidence are much debated, however they do not yet represent a wholesale change in US market characteristic.

Therapeutic Referencing Systems

Among the many changes in Europe, the German Arzneimittelmarktneuordnungsgesetz (AMNOG) has been the most controversial change. Today, we slowly get clarity on what AMNOG actually means through an analysis of the outcomes of various negotiations. A detailed discussion is beyond the scope of this overview article. Not surprisingly, drugs that have been assigned a "no additional benefit" rating see the steepest rebates, as their net prices are pegged to their lowest cost comparators, making it obvious that a classification of some benefits, even if just for a sub-indication, is critical for commercial viability, unless if one can be confident of a high cost comparator. Being in the same class as a few predecessors, offers no guarantee for a favorable outcome, such as BI experienced with linagliptin. As they say, it looks like a duck (gliptin) and it quacks like a duck, but G-BA insisted that it should be priced like a chicken (metformin). It certainly feels arbitrary and in conflict with fair competition principles.

"Pharma and biopharma companies have shown a renewed interest in emerging markets, as growth rates in US and Europe have steadily declined."

The French government has launched some draft changes to its drug evaluation system, which may replace the SMR and ASMR ratings for one integrated "ITR" rating. The draft ITR classifications show great similarity with the German benefits classifications under AMNOG. This is perhaps not surprising as Europe continues to synchronize review principles. Another much speculated change in France is the introduction of economics in price negotiations. Particularly higher priced drugs are likely to be more closely scrutinized on economic aspects, although it is not anticipated that this will have the same nature as the cost effectiveness reviews under NICE and SMC in the UK.

Also the Italian AIFA is preparing a change in its assessment of new drug innovation, which drives price determination. Initial drafts of the algorithm look highly complicated....

Health Economics Driven

Value Based Pricing (VBP) has dominated the discussion with respect to the UK healthcare system. England and Wales have been subject to the PPRS profit control scheme since 1999. At the start of 2014 the system is to be replaced by a VBP system. Discussions over VBP have only progressed slowly, making a timely implementation uncertain. The essential change of VBP in comparison with the existing system is two-fold:

1. Introduction of variable cost-effectiveness cut-offs, to be based on a broader societal perspective and to include aspects such as disease severity, unmet need and innovation

2. Introduce price controls at the VBP level i.e. rather than deciding that reimbursement will not take place above its cost-effectiveness threshold, the government fixes the price at what it perceives to be its value

Under influence of the reasonable sounding name, many had assumed that VBP was a good thing. As details are becoming clearer, the picture is changing. Actually, one can argue that the R&D based drug industry has always engaged in value based pricing, as its alternative of cost-plus pricing does not fit the industry's cost structure.

"Affordability and social responsibility need to be carefully weighed against the risk of price erosion in developed markets."

Emerging cash Markets

Pharma and biopharma companies have shown a renewed interest in emerging markets, as growth rates in US and Europe have steadily declined. China and Brazil have climbed the market size rankings, thus offering substantial pharmaceutical market opportunities for disease areas such as diabetes, oncology and infectious diseases.

Multinational manufactured branded drugs still earn a large share of their revenues through cash paying patients. Economic growth offers both opportunities for expanded healthcare coverage and for cash pay drugs. However, expansion of healthcare coverage comes with threats, as governments become motivated to institute price controls. Particularly India has been on the forefront of exploring drug price controls, including compulsory licensing and purchasing power adjusted international referencing. Compulsory licensing threats should be a point of strong consideration for emerging market strategies. Affordability and social responsibility need to be carefully weighed against the risk of price erosion in developed markets. The issue is not new, but the unfolding events may lead to different decisions.

What will the future hold?

International payer systems have frequently changed in the past and will continue to frequently change in the future. The underlying payer management principles and methodologies will continue to evolve slowly. The latter is extremely important as that helps us inform critical drug development and commercialization decisions. Truly understanding payers, not just their latest set of rules, is the fundament to running a successful pharmaceutical company in today's environment.

References

1. The Price of Global Health, Ed Schoonveld, April 2011 Gower Publishing, ISBN 978-1-4094-2052-1

About the author:

Managing Principal, Market Access & Pricing Practice, ZS Associates

Author of "The Price of Global Health", Gower Publishing, 2011

Ed.schoonveld@zsassociates.com Tel: 212-808-3328

How can we make sure we truly understand payers?