Digital health round-up: Make or break for Fitbit?

A round-up of this week’s digital health news. Marco Ricci reports.

Make or break

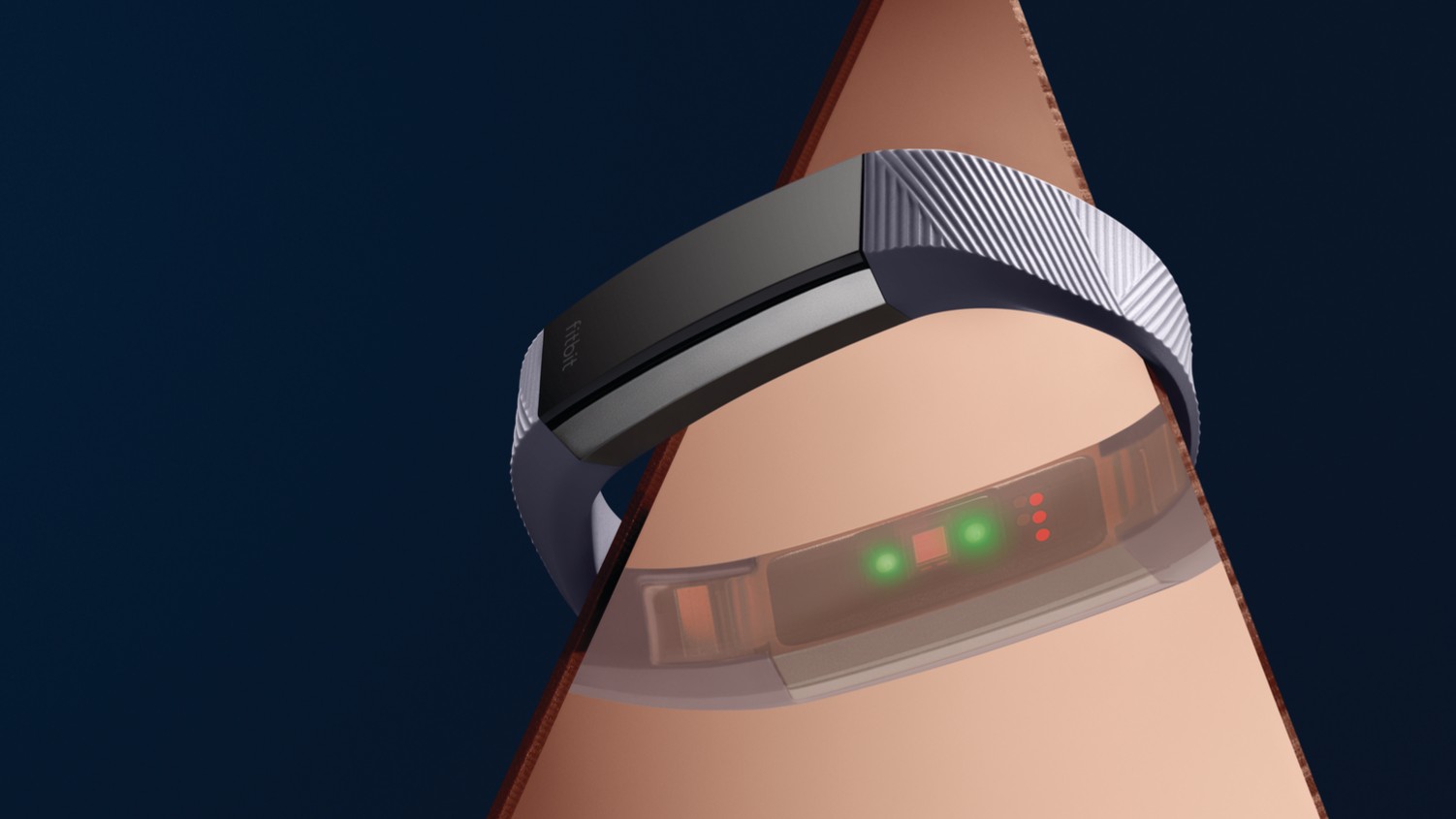

From the outset, Fitbit's aim has been to lead the world into a wearables age, one where its fitness trackers become a natural and routine element of everyday life. The simple design and manageable fitness goals the firm's bracelets offer provide an accessible support method for anyone to get fit.

Now, it seems that goal may be too ambitious. For a while, questions have been raised about the long-term potential of Fitbit, with a plateauing of consumer interest, lower-than-expected sales revenues and a diminishing need for standalone fitness trackers painting a bleak future for what was once a hot property when it hit the stock market just two years ago.

Those heady $51 stock price days are now firmly in the past, with current stock price at a lowly $5.61.

However, Fitbit saw this coming and has laid the foundations for entry into the healthcare sector, too, lending its trackers to clinical research trials and installing top executives.

As reported by The Times this week, it seems part of its plan is to strike a deal with the NHS to bring its trackers to the general public.

How the trackers would fit into the system is unclear, but CEO James Park told the newspaper that it was looking to roll out "something similar" to Fitbit's partnership with US health insurer UnitedHealthcare – one that uses Fitbits to save customers up to $1,500 in premiums based on them hitting certain health targets.

This will be challenging, even for a company with a brand as well known as Fitbit. The NHS is renowned for its difficult technology adoption process and it demands valuable supporting data that can take years to collect.

Research will be needed into whether Fitbit's gear actually instigates a provable clinical benefit – something many wearables companies struggle with beyond briefly upping a daily step count or helping people sleep better. This is why many wearables remain in the consumer technology category as opposed to the medical device one.

Of course, the deal with the NHS may not need proof of its use as a medical device at all, instead centring on 'general wellness' or monitoring capabilities. Perhaps the trackers will be used solely for low-risk patient populations or given out freely to track recovery. Even so, how the deal could be 'similar' to one with an insurance firm when it is being made with a free-to-use public service remains to be seen.

If a deal is forthcoming, it will be the first example of a major consumer brand of Fitbit's ilk to be used in the NHS. But with that moniker comes huge pressure to succeed - pressure which could boost Fitbit's reputation once more, or see the demise of another once-promising startup.

Read more: Is the wearables boom dying out?

Investor lawsuit claims Theranos created a secret company

Just a few days after it seemed Theranos was back on the right track when it settled its disputes with both the Arizona Attorney General and the Centers for Medicare and Medicaid Services, the company finds itself accused of further underhand practices in a new lawsuit.

Rivalling the bizarre news that Theranos CEO Elizabeth Holmes was in debt to her own business to the tune of $25 million, it is now claimed that the blood testing start-up set up a secret company to purchase off-the-shelf machines to perform the blood tests that its own flawed devices could not.

The statement comes from Partner Fund Management (PFM) – a 2014 backer that invested $96.1 million – which claims Theranos had a subsidiary called 'Protegic Procurement', which purchased commercially-available testing machines to carry out most of its analyses.

PFM also claims Theranos used fake demonstration tests which it used to convince potential investors and business partners of the capabilities of its nanotainer technology.

The lawsuit is the second from PFM against Theranos in recent months. In October, the company sued Theranos over being misled over its technology and, earlier this month, it filed a suit trying to block Theranos' tender offer to investors offering more equity to prevent them suing.

Theranos responded that, “The items on which PFM focuses have nothing to do with why PFM invested, and they amount to a repackaging of allegations the media have already reported for nearly two years.

"This is a one-sided filing by one party to litigation, and we will respond at the appropriate time in the appropriate forum."

More competition for AI image analysis as AiDoc raises funds

With the numbers of trained radiologists remaining static, artificial intelligence (AI) could help clear bottlenecks in analysis of medical imagery. Many tech companies are developing AIs capable of this task, with IBM Watson one of the most well known.

This week Israel-based start-up AiDoc joined in, receiving $7 million in a funding round led by Tel Aviv venture capital firm TLV Partners to help develop its technology and expand its marketing to a US audience.

AiDoc's technology uses deep learning algorithms to identify abnormalities in scans to speed up analysis and reduce caseloads for radiologists.

“Over the past few years, the amounts of CT and MRI exams have increased dramatically, while the amount of radiologists has remained basically the same. This has led to medical image interpretation becoming a severe bottleneck in healthcare today,” says Elad Walach, CEO and co-founder of AiDoc.

Image analysis AI is proving a hot topic in Israel. Fellow Israeli startup Zebra Medical Vision is developing a platform it hopes will go beyond highlighting abnormalities and act as a fully-fledged diagnostic tool.

Also in the news:

- Wearables provider Fitbit in talks with the NHS

- Digital mental health platform Healios endorsed by NICE

- More funding for Babylon Health's 'AI doctor'

- Science 37 gets funding for 'site-less' clinical trials

- NHS digital pilot aims to cut elderly hospital admissions

About the author:

Marco Ricci is Staff Writer at pharmaphorum. Contact him at: marco.ricci@pharmaphorum.com or on Twitter @pharmaphorum_MR