Challenges and opportunities in the drug-delivery technology market

Robyn Fowler discusses the challenges and opportunities in the drug-delivery technology market.

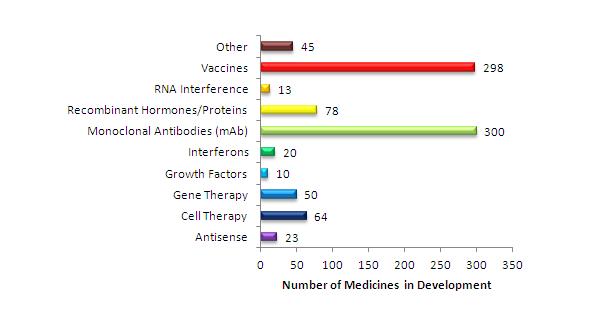

There is an increasing demand for effective and, ideally, non-invasive drug-delivery methods. This is especially the case for the biopharmaceutical sector, which has experienced an overwhelming growth due to advances in biotechnology. In 2009, over $12 billion were invested in biologics / biotechnology research and development (R&D), representing a 26% share in the total R&D expenditure1. A recent report by the Pharmaceutical Research and Manufacturers of America (PhRMA) states that in 2011 there were 901 biologicals in development, targeting more than 100 diseases2. A significant proportion of biotherapies are based on proteins, with monoclonal antibodies becoming increasingly popular (Figure 1).

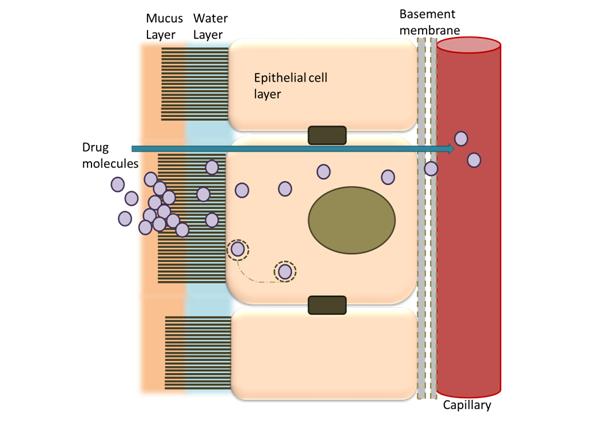

Mucosal absorption of protein-based pharmaceuticals is highly inefficient as these large molecular weight compounds do not efficiently cross the epithelial surfaces (Figure 2). Furthermore, biopharmaceuticals are highly prone to enzymatic and acid degradation (e.g. stomach environment), making oral administration a non-viable delivery method.

Figure 2. Drug absorption barriers in the intestine.

Typically, biopharmaceuticals cannot be effectively delivered by conventional methods, with administration options limited to injections. It is estimated that worldwide, nearly 40% of injections are given with syringes and needles reused without sterilisation and in some countries this proportion is as high as 70%3. Furthermore, unsafe practices, including hazardous disposal of dirty injection equipment, expose healthcare workers and the community to the risk of needle stick injuries and infection.

Moreover, even for patients who self-medicate, some individuals discontinue their medication due to anxieties associated with self-injection administration and needle phobia which may even impact on their ability to seek medical assistance or even due to physical constraints of the disease. Drivers for innovative, non-invasive delivery include improvement of patient acceptability and therefore compliance (e.g. controlled release formulations), improvement in public safety, decrease of administration costs (where injections rely on administration by healthcare professionals) and a reduction of adverse effects associated with injections.

"...in 2011 there were 901 biologicals in development, targeting more than 100 diseases."

In addition to continuing attempts to develop non-invasive drug-delivery technologies, tremendous research efforts are being made to develop drug-delivery systems that achieve targeted or selective delivery of therapeutic agents. The latter 'targeted delivery' strategy potentially offers huge benefits in terms of minimising or even eliminating drug side effects (e.g. toxic effects to healthy tissue with anti-cancer therapy) and reducing the dosage needed for a therapeutic effect. Targeted drug-delivery technologies are numerous, with 'nanomedicine' (e.g. the use of nanoscale drug carriers) offering particular benefits within this area.

The drug-delivery technology landscape is rapidly evolving to accommodate these incoming new classes of pharmaceuticals and is now a highly competitive space even though drug delivery has only recently made its way from academia into the commercial area. The market attracts both "start-ups" and major players in the medical device, pharmaceutical and biotechnology industries. The development and subsequent launch of a product often involves combinations of technologies from multiple players, with complex licensing and strategic partnering relationships. Furthermore, this is a market with extensive intellectual property protection.

The identification and integration of novel future technologies combined with developments in drug discovery and biotechnology show promise in meeting the ever increasing demands of stakeholders, including optimising drug-delivery methods for an ageing population. Undoubtedly in the future, delivery devices and drugs will become more conjoined. In some cases, device or formulation development is beginning as early as the pharmaceutical discovery phase. To remain competitive, companies must be able to consistently demonstrate the value that their combination of drugs and delivery technology brings to market.

To enable successful product launch and market penetration, companies require advanced development and technology portfolio planning (with special focus on market requirements and value propositions more than a decade ahead) that uniquely define the delivery technologies requiring investment. The universal goal for any pharmaceutical player is to be able to parallel the advances in drug discovery with appropriate drug-delivery technologies, providing the wherewithal to deliver effective therapies in a simple, pain free and targeted manner.

"Mucosal absorption of protein-based pharmaceuticals is highly inefficient..."

Concluding remarks

There is continual work to develop new, as well as to optimise, existing drug-delivery platforms with the imminent arrival of new and more complex drug therapies, more stringent regulatory barriers and spiralling healthcare costs. Wasted treatment and increased hospitalisations are indirect consequences of poor patient compliance, driving healthcare systems into financial difficulty. Improvement of compliance by appropriate drug-delivery systems undoubtedly improves the cost effectiveness of healthcare. Of key significance is that a congruous delivery system in place of an injection also has considerable potential to reduce the amount of drug used thereby relieving costs to healthcare providers thereby optimising cost effectiveness.

Gaining an appreciation and understanding of the long-term alliance of drug development and drug delivery, the intellectual property landscape, and evolving technologies will position and inform a company to make the best possible investment decisions. Unravelling the complex interplay between competing companies, core competencies, intellectual property, stakeholder needs, and technology trends, requires knowledge and experience in the area to facilitate corporate planning and decision-making. To this end, strategic innovation is required to ensure complex and competing technology investments are aligned with unmet market needs and to support corporate goals while securing the future potential for the company to participate in secured market growth opportunities.

References

1. PhRMA, PhRMA Annual Member Survey. 2011, The Pharmaceutical Research and Manufacturers of America: Washington, U.S

2. PhRMA, Biotechnology Medicines in Development, in Medicines in Development. 2011, The Pharmaceutical Research and Manufacturers of America: Washington, U.S

3. World Health Organization (2006). Injection safety. Fact sheet N°231

About the author:

Robyn joined GfK Bridgehead as an Analyst after completing her PhD in Pharmacy at the University of Nottingham in 2012. Much of Robyn's current work at GfK Bridgehead is centred around desk research for a variety of projects under multiple therapy areas along with conducting and analysing interview programmes with both payers and Key Opinion Leaders.

Her PhD research largely focused on studying the mucosal barriers to drug absorption and looking at strategies to overcome them. Robyn also took part in the Biotechnology YES enterprise competition in 2009, giving her valuable insight into the commercialisation of bioscience products.

Prior to starting her PhD, Robyn worked as a research scientist in eADMET (early absorption, distribution, metabolism, elimination and toxicity drug studies) for Argenta Discovery (drug discovery firm).

Robyn graduated in 2007 with a first class honours degree in Molecular Biology and Biochemistry from Durham University. As part of her degree, she undertook a sandwich industrial placement year working for the drug metabolism and pharmacokinetics group at AstraZeneca (Charnwood, Leicestershire).

How can we parallel the advances in drug discovery with appropriate drug- delivery technologies?