Nine for 2021: Addressing the pandemic legacy

In this second 'Nine for 2021' article, IQVIA’s Sarah Rickwood looks at four issues which will directly impact pharma in 2021: the permanent changes in customer engagement models, the implications of a geographic re-balancing towards the East, CNS as the new value growth area for the 2020s, and the new biologics environment as biosimilars accelerate.

Focus on customer engagement impact

The customer engagement story of 2020 could be summarised in three themes: trend break, agility and remote interaction. The trend break was the most immediately measurable commercial model impact. For April 2020 almost all face-to-face contact with healthcare professionals (HCPs) ceased. Preventing virus transmission, as well as “getting out of the way” of healthcare professionals pivoting to address the virus was key, and HCPs largely welcomed the way pharma reacted as responsible and necessary.

However, qualitative interviews conducted by IQVIA with HCPs in the top 5 European countries on their experience of engagement with pharma during 2020 show that doctors still valued interaction, including face to face interaction, with pharma and missed it when it was absent.

Pharma moved rapidly to remote interactions, even to the point of all virtual launches of new products. The overall volume of interactions fell, and those remaining became more remote and less interactive. The agility of many organisations effecting this rapid change was impressive, and a more resilient hybrid model seemed to be emerging as face-to-face interactions returned post the first wave.

This has, of course, been more recently challenged in Europe by second wave infections and new lockdowns, but this masks more fundamental and as yet unresolved challenges for 2021’s commercial model, which could be defined by environment divergence and the need to achieve impact.

Environment divergence

The promotional environments of major pharmaceutical markets were already divergent in 2019 – some, like Italy and Spain were very high on traditional face to face interactions, others, like the UK, were the complete opposite, and still others, like Japan and the US, had high volumes of both digital and face to face contacts. The ways in which country promotional environments recovered from the first lockdowns has accentuated that divergence. This has implications for the commercial model companies employ by geography.

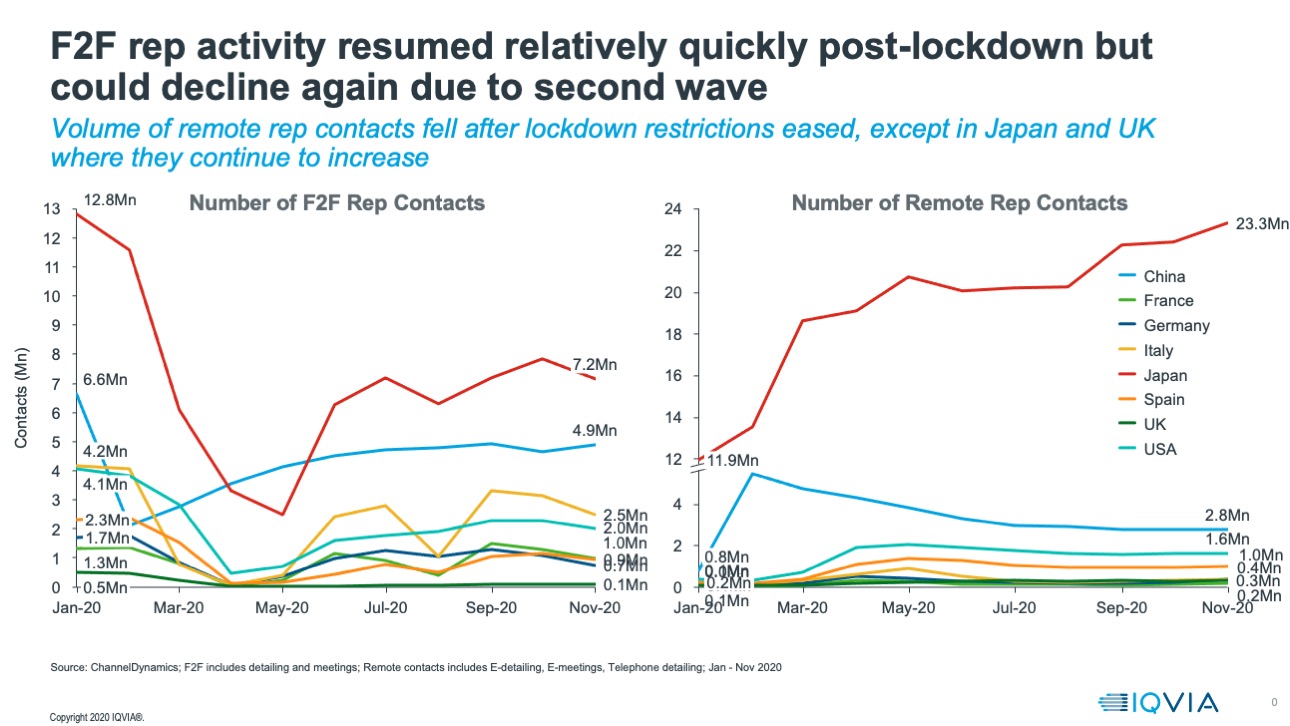

Environment divergence has been accelerated by recovery post the first infection wave – IQVIA ChannelDynamics data shows that in Europe, countries have recovered to a different promotional mix.

The UK has diverged most – it was always the country with the lowest volume of face-to-face contacts, and those contacts remain at negligible levels, replaced (but not completely) with remote rep contacts, creating a near 100% remote engagement model.

Other European countries have seen face to face contacts recover, then fall back because of second waves, but the model that emerged towards the end of 2020 was lower in volume and much more hybrid – a greater proportion of interactive contact was remote. The US, Japanese and Chinese promotional environments saw contact volumes recover to close to or greater than 2019 levels, with a channel mix that was more heavily remote.

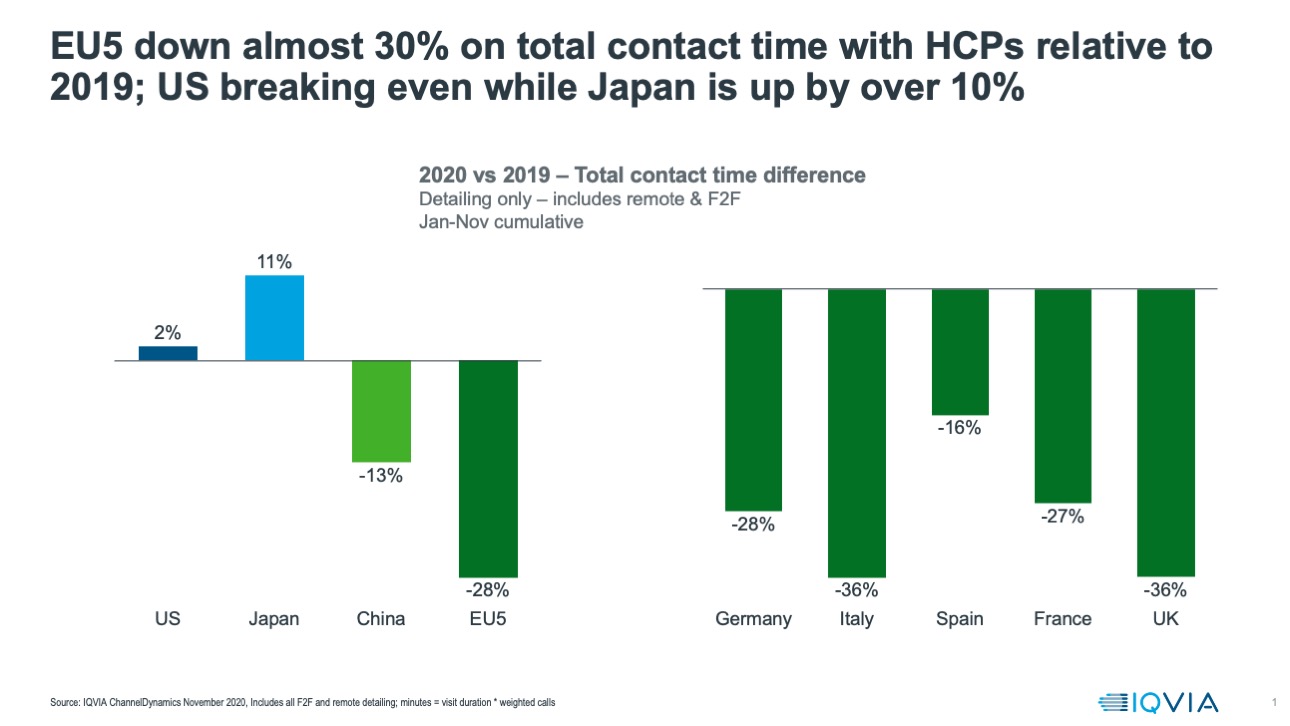

The divergence of promotional environments is especially stark in the difference in the total interactive time the pharma industry had with healthcare professionals in 2020, compared to 2019. Up to November, the US and Japan actually saw increases in interactive time in 2020. Not so China, and especially not so the lead five European countries – on average European pharmaceutical companies saw a loss of 30% of the interactive time they previously had with healthcare professionals in 2020. Much of this lost time would have ordinarily been spent introducing and establishing new innovations and building growing products.

The need to achieve impact

As interactive time with HCPs is likely to be scarce, companies need to be even more ruthless in prioritising content and in deciding what content to generate in the first instance – for example, in Real World Evidence, as outlined in IQVIA’s white paper, 'Excellent Launches are winning the Evidence battle'.

CNS (re) emerges

The 2010s were the decade of oncology: the decade started with oncology tipping hypertension off the top spot as the world’s most valuable therapy area, and during the next ten years, via continuous introduction of significant innovation, oncology grew its share of global prescription medicine value from 8% to 13% of sales. Oncology will continue to dominate the world market in the 2020s, albeit with slower growth, but that is not news. Instead, we will focus on therapy areas which will take on new significance in the 2020s. Of these, the most significant in terms of the conditions’ prevalence, and unrealised therapeutic potential, is CNS.

CNS is a “Back to the Future” story – scroll back to the 1990s and 2000s and CNS was one of the largest segments of the Rx market by value, driven by anti-depressants, atypical neuroleptics, anxiolytics and hypnotics. Then, by the 2010s, a wave of genericisations took down the blockbusters across all leading classes, and innovation stalled. Hopes for an effective disease modifying Alzheimer’s treatment, the holy grail of CNS research, were repeatedly dashed by late stage failures. By the end of the 2010s, CNS as a whole was highly genericised, with low innovation and few important launches. From 2021 onwards, this will change. Over the next five years we expect the global CNS market to accelerate ten-fold in list price value from near-flat historical growth of 0.4% CAGR for the past 5 years to 3-5% CAGR for the period of 2020-2025 to reach $100 billion globally by the middle of the decade.

The drivers behind this transformation are two classic elements – perennial unmet need and innovation, but with some very specific 2020s twists. The pandemic and consequent lockdowns have led, in some countries, to an explosion of mental health disorders. The pandemic has accelerated the trend to remote and digital healthcare at a time when the development and use of digital diagnostics and biomarkers has become possible and very relevant to many CNS conditions. Psychiatry has proven one of the areas of clinical practice most amenable virtual delivery.

Underlying this all, long term innovative investment is finally yielding fruit in a range of CNS therapy areas, for example new therapies for treatment-resistant depression (e.g. Janssens’s Spravato), the novel CGRP inhibitors for migraine, or dual orexin receptor antagonists (DORAs) developed for insomnia. Two of the three largest selling products launches in 2020 by 2020 sales were CNS products: the oral migraine treatments Ubrelvy and Nurtec. Progress on the holy grail of an effective disease modifying Alzheimer’s treatment is also possible in 2021, but not a foregone conclusion.

CNS will end 2021 with a renewed relevance and powered by new innovation, both molecular and digital, placing the therapy class in a strong position to re-ascend the rankings as one of the most valuable therapy areas for the remainder of the 2020s.

Biosimilars accelerate

Biosimilars are now a long-established feature of European markets, and an increasingly well-established element in the US. 2021 marks the start of the era when these healthcare systems really need biosimilars to come good on their promise to realise cost savings. As economic crisis leads to healthcare spend constraints, the proportion of product value that will lose exclusivity in the next five years that is biologic has never been higher, at 44% of the $200m of the 2019 pharmaceutical market which will lose exclusivity in the next five years.

Counting from infliximab, the first of the monoclonal antibodies to face biosimilar competition, uptake of the biosimilar into the originator molecule has improved significantly, with the last volley of biosimilar launches reaching 40% of all treatment days within 12 months of in Europe, compared to nearly three years for infliximab to reach that level. Bevacizumab (Avastin) is on track to achieve 40% average European biosimilar treatment day penetration in six months, the first to do so. However, biosimilar uptake is not evenly distributed, and savings are still not always realised where they are most needed. Given the very powerful incentives that especially European countries will have to realise savings on medicines budgets where they can, we expect further measures to be implemented to promote the use of biosimilars in 2021.

Pharma pivots East

Increasingly, pharmaceutical companies add China to their launch priority countries group, typically the US, EU, and Japan, and from 2021, this trend is likely to accelerate. Europe, still in the throes of lockdowns and second waves will be living with healthcare system disruption for much of 2021, as well as economic austerity. Fragmentation of the European top 5 as the UK pursues its own regulatory regime post Brexit may also impact Europe’s attractiveness. The US, also still to effectively manage the infections crisis, will enter a new phase with the Biden presidency, and that could mean changes to healthcare system and pharmaceutical pricing reform.

China entered the first wave of the pandemic crisis earliest and emerged earliest, and (as at January 2021) has so far managed to avoid the debilitating second waves which have precipitated further lockdowns and healthcare system disruption in Europe and the US. Whilst the details of China’s economic recovery have been disputed, one forecaster, the Centre for Economics and Business Research, has predicted that China will now overtake the US as the world’s leading economy in 2028, five years earlier than was previously forecast.

China has been the world’s second most valuable pharmaceutical market since 2013, but it has not been an important market in terms of contribution to the sales of the newer innovative pharmaceutical products – in fact, whilst China ranked second on total Rx market sales, it ranked below 30 in terms of sales of newly launched innovative products. This is now changing and will be accelerated in 2021 by how China exits the pandemic crisis.

Pre-pandemic, China had already worked hard to reform its regulatory systems, reducing the backlog of medicines applications under or awaiting review by 80% by the end of 2019. New Active Substances, as monitored by IQVIA audits, entered the Chinese market in 2020 at historically high rates – by August 2020, 27 new active substances were in the Chinese market, as opposed to a five-year historic average of 15 by that point in the year for China.

Approval is not everything, and there remain significant market access and pricing challenges for innovative launches in China, but China’s domestic appetite for innovation is growing fast – the innovative branded products segment of the market grew by 12% in value between 2015 and mid-2020, while the remainder of the market grew by 3%. In addition to China, Japan, already one of the key country contributors to early innovative launch sales, has also accelerated the introduction and uptake of innovation in recent years. Japan has also emerged from the pandemic relatively unscathed, in terms of healthcare system, although economic recovery might be slow.

Because of these trends, from 2021, the importance of China and Japan to innovative product value is likely to progressively increase, driven both by increases in attractiveness of these two markets, and challenges in the European (and possibly US) environment. This will tip the geographic balance of the global pharmaceutical industry east, which will not just influence where pharmaceutical companies get their value from, but also usher a new collection of Chinese innovators into the global market.

If 2020 was the crisis year, 2021 is the year of transformation. Some of our nine 2021 trends were set pre-crisis, for example the re-emergence of CNS, but may see some acceleration or change because of the crisis. Others, for example the transformation of the commercial model and the renewed focus on impact, have been dramatically shaped by the events of 2020, leading the industry into a much-accelerated change and possibly taking commercial environments in directions they would not have moved without the pandemic. Others, and especially the pandemic-accelerated tilt towards the East in terms of innovative market, have ramifications that will be decades long in realisation. 2020 was a year in which, by rising to the challenge of the pandemic, the pharmaceutical industry demonstrated it can accomplish that which would previously have been labelled impossible. Whatever the challenges, the pharmaceutical industry enters 2021 with a new sense of purpose.

About the author

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.