Who should pay for HTA?

Part of the drive for strengthening EU cooperation on health technology assessment (HTA) is to tackle duplication of work – ‘double paying’ would be another way to put this.

To do this the European Commission has commissioned research which not only sheds a light on governments’ spending on HTA, but also whether fees are charged. However, unanswered questions remain, including: given how much it costs, who should pay?

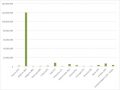

Spend on HTA agencies across Europe

The European Commission asked for a great deal of research to support their policy making in relation to this area across Europe. As part of that work, mapping was conducted which has set out – where available – the budget allocated for HTA in member states.

It’s by no means comprehensive, not least because it’s quite hard to pull the data together and sometimes the bit of work that is really HTA - as opposed to other activities - is hard to split out. Nevertheless, it is a material cost (see figure 1) and even where it seems small it should still be considered. After all, even a few thousand Euros can buy valuable healthcare.

Figure 1: Budget allocated to HTA by EU country in 2017

Source: Data from Chamova (2017) Mapping of HTA national organisations, programmes and processes in EU and Norway Annexes

Note: In some countries the budget is the sum of spend on more than one agency.

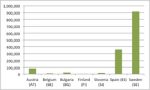

For some countries details are also available of the spend on external experts, since not all the expertise needed for HTA is available in house (figure 2).

Figure 2: Budget for contracting external experts for HTA by EU country in 2017

Source: Data from Chamova (2017) Mapping of HTA national organisations, programmes and processes in EU and Norway Annexes

In some countries the budget for external experts for HTA is the sum of spend by more than one HTA agency.

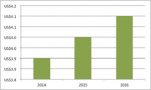

It’s clear from this that, even without a fuller picture, some big HTA agencies in Europe are missing - including the spend on the National Institute for Health and Care Excellence (NICE), that HTA is big business. There are also wider costs to consider to companies to furnish HTA agencies with the data and submissions that they ask for, plus all the input of others in the process. Given the rise of HTA it also goes some way to explain the rising costs of market access in the region (figure 3).

Figure 3: Annual market access spending, EU and Canada, 2014 to 2016

Source: Data from Cutting Edge Information (2016) Total Market Access Budgets are Increasing for Most Drug Companies

Pharma industry fees

The mapping work has also set out whether HTA is supported by fees or not and this presents a mixed picture. There are a handful of countries where there is a charge to the pharmaceutical industry for assessment of a company’s drug. Furthermore, a few agencies are planning to charge in future (figure 4).

Figure 4: Pharma industry fees in 2017

Source: Data from Chamova (2017) Mapping of HTA national organisations, programmes and processes in EU and Norway Annexes

Unanswered questions for pharma

Just as economists say for the technologies subject to HTA, there is an opportunity cost to doing the assessment itself, then if we assume that it provides value for money there remains the question of who should pay for the process.

In proposals on pause at NICE, the principle under consideration had seemed to be a full cost recovery from companies. Alternatively, we may find that NICE or other bodies apply different principles, perhaps where companies pay a part of the cost involved.

In any case, charging fees can bring a degree of transparency to the process and prompt reflection on how to carry it out in the most efficient way and get the very most from it - which should be a benefit for payers, prescribers, patients and pharma.