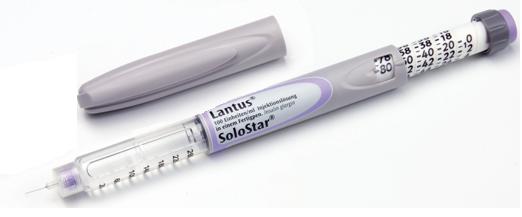

Mylan’s Lantus biosimilar held up by manufacturing issue

Mylan’s hopes of grabbing a slice of the big US market for insulin glargine – the active ingredient in Sanofi’s Lantus blockbuster – have been dealt a blow.

The FDA has issued a second complete response letter (CRL) rejecting the marketing application for the biosimilar after uncovering quality problems at Biocon – Mylan’s partner for the drug – in a pre-approval inspection of one of its manufacturing facilities in Malaysia.

Biocon played down the implications of the compliance issue, saying in a statement that it doesn’t expect “any impact of this CRL on the commercial launch timing of our insulin glargine in the US” and that the FDA had no “outstanding scientific issues” with the marketing application.

It is however a near carbon-copy of the situation last year when the FDA issued its first CRL for the product, once again because corrective actions were needed at a Malaysian plant.

Mylan, which is due to merge with Pfizer’s Upjohn unit next year, is trying to bring the second Lantus copycat to market in the US after Eli Lilly and Boehringer Ingelheim's Basaglar, which was approved by the FDA in 2014 and launched under an agreement with Sanofi at the end of 2016. It hasn’t released a statement on the latest CRL.

Sales of Lantus were around €6 billion (around $6.5 billion) at their peak but started to decline in 2014 after the first biosimilars were approved in Europe, and as downward pressure on insulin prices in the US started to take hold.

It’s still a big earner for Sanofi however, bringing in €3.6 billion last year – a drop of 19% on 2017 – and fell another 17% to €1.53 billion in the first six months of the year.

Lantus has been insulated thus far from the impact of biosimilar competition in the US with just one rival available, which is classed as a follow-on biologic rather than a direct biosimilar.

The distinction is important because it means Basaglar isn’t directly substitutable for Lantus. And of course having only one alternative has kept the price differential in check, and the fall-off in brand sales is expected to accelerate once true biosimilars become available.

Merck & Co/MSD had also been developing a Lantus biosimilar for the US market with South Korean biotech Samsung Bioepis, but decided to pull out of that partnership last year despite getting a tentative approval for the clone from the FDA.

At the time, it said the decision was taken after a look at the market opportunity for biosimilar Lantus, particularly in light of the anticipated pricing for the product, as well as the cost of production.

Sanofi meanwhile is still defending its last Lantus patent in the US which is due to expire next year, so Mylan’s biosimilar version of the drug still has some sizeable challenges to overcome before it can reach the market.