Humanigen facing bankruptcy as reverse merger fails

Three years ago, Humanigen was riding high with a COVID-19 therapy in late-stage testing and shares worth upwards of $20 apiece. Now, it is facing the threat of bankruptcy and its stock is firmly in penny share territory.

In a filing with the Securities & Exchange Commission (SEC), the company said it had been in negotiations for a reverse merger with an unnamed, privately-held biopharma company, but these have now ended "without execution of a definitive agreement."

It has also been unable to find another source of financing that would allow it to fulfil the requirements to retain its Nasdaq listing, including a minimum share price of $1, and it will swap to the OTC Pink Market from today – making it even harder to raise money.

Three board members have also resigned, taking it below the minimum needed to stay on the main exchange, and it has now informed the Nasdaq it is unlikely to come back into compliance.

"The company anticipates that it will not be able to continue as an ongoing concern and is exploring all restructuring options, which may include commencing a bankruptcy or other insolvency proceeding sometime in the third quarter of 2023," according to the filing.

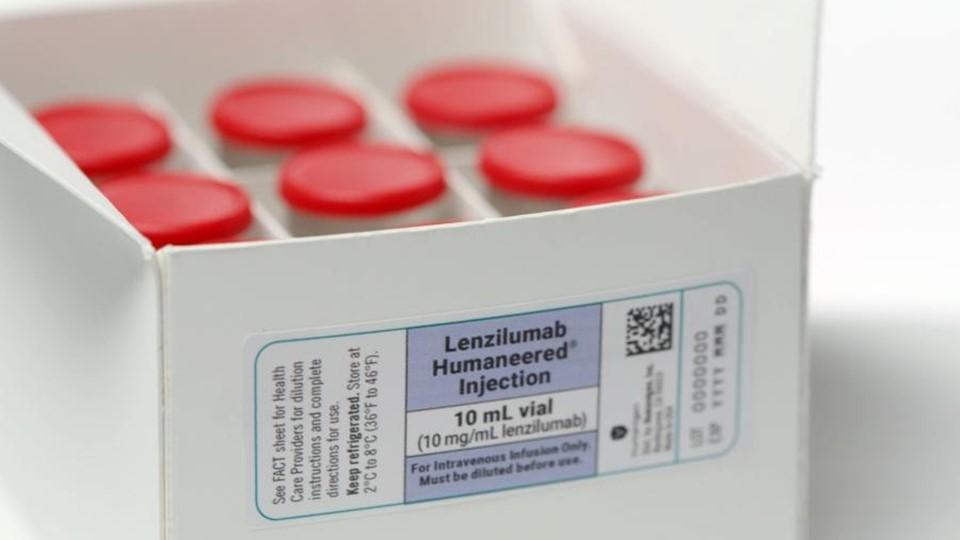

Humanigen has been struggling since its lead drug lenzilumab – which targets colony-stimulating factor 2 (CSF2) and granulocyte-macrophage colony-stimulating factor (GM-CSF) – failed to work as hoped in patients hospitalised with COVID-19 in a phase 3 trial that generated results last year.

Back in mid-2020, the New Jersey-based biotech was hopeful of emergency use authorisation by the end of that year as a therapy to fight the so-called ‘cytokine storm’ that leaves some people with coronavirus infections fighting for their lives with acute respiratory distress syndrome (ARDS).

That hope fell apart when the application was rejected by the FDA towards the end of 2021, and the company's efforts to repurpose the drug for other indications – including as an add-on to CAR-T therapies for non-Hodgkin's lymphoma (NHL), rare blood cancer chronic myelomonocytic leukaemia, and graft versus host disease (GvHD) – failed to come to fruition.

In its last financial statement, released at the end of March, the company was down to just over $3 million in cash reserves from around $10 million at the end of 2022, and it is now exploring the potential sale of its remaining assets in a bankruptcy proceeding that could “result in a complete or substantial loss of value” for its shareholders.

Shares in the company lost more than 80% of their value to dip below 4 cents yesterday.