Hikma buys potential Epipen rival from troubled Insys

UK-based pharma Hikma has snapped up assets from embattled Insys Therapeutics, including potential generics of Mylan’s Epipen allergic reaction shot and a drug to reverse the effects of opioid painkillers.

The agreement is fall-out from a high-profile court case related Insys’ illegal marketing of opioid painkillers that ended in the company filing for bankruptcy.

In June Insys filed for relief under Chapter 11 of the US Bankruptcy Code and as part of this process the firm began a supervised process to sell its assets, which has now concluded.

Hikma has signed an agreement to buy manufacturing equipment for nasal and sublingual sprays, as well as two pipeline products, epinephrine and naloxone, and nasal sprays.

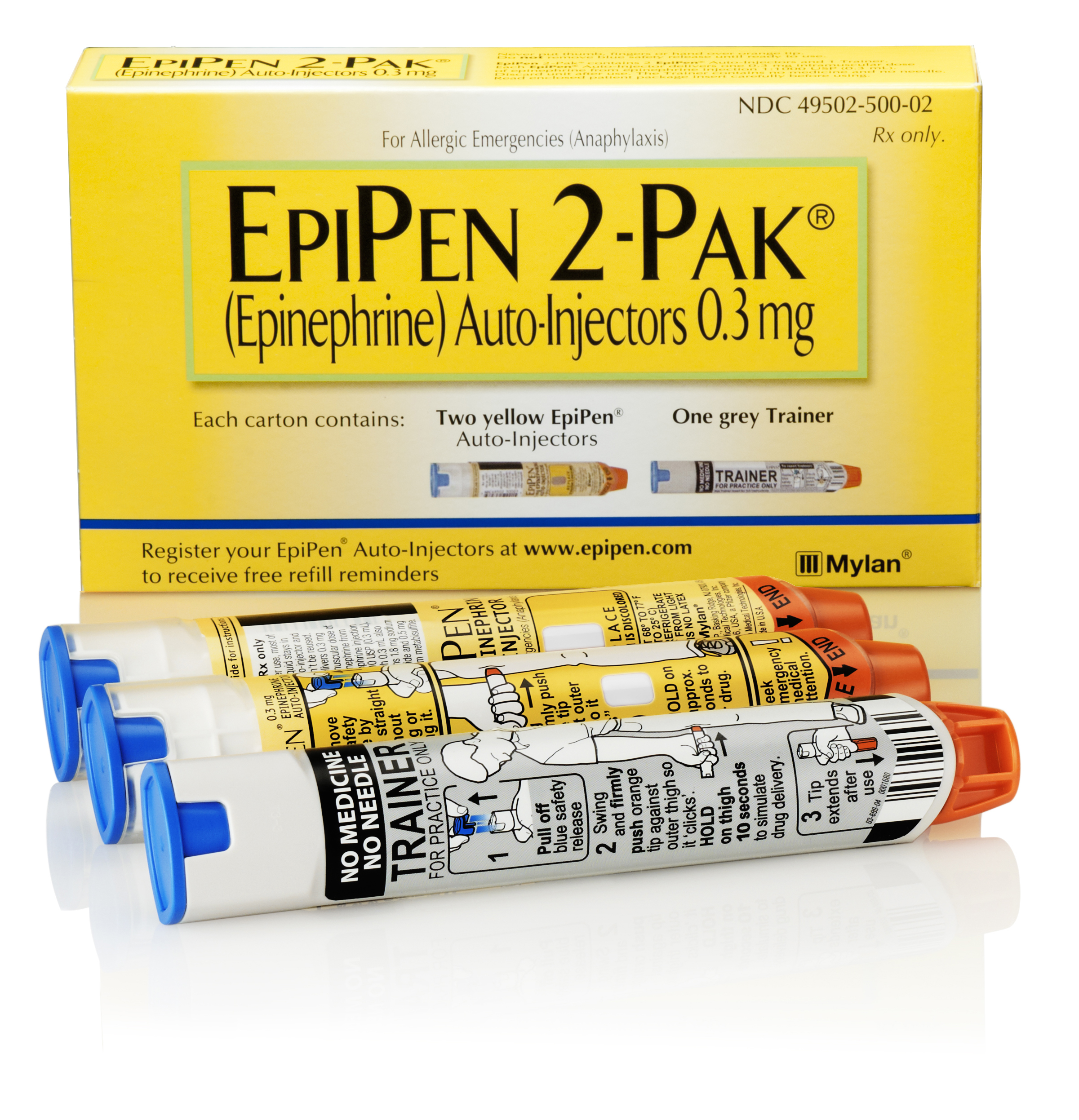

While there are no nasal forms of epinephrine available in the US, Mylan markets the drug in its Epipen autoinjectors, which generated sales of around $4.3 billion in the US in the year ended June 2019 according to figures from IQVIA.

Epipen was at the centre of a pricing scandal three years ago, after it emerged that Mylan was charging branded prices for a well-established generic drug.

Generic competitors to Epipen have since been approved, including a branded generic from Mylan, but there are no currently approved nasal forms of epinephrine available in the US, Hikma noted.

Naloxone is an injected medication used to block or reverse the effect of opioids, but there is only one form of the drug on the market to reverse opioid symptoms, Emergent Biosciences’ Narcan.

The FDA approved a generic nasal version of the drug earlier this year, but manufacturer Teva is not able to launch it because of ongoing patent litigation.

Hikma has raised its revenue forecasts for the full year following a strong first half that saw revenues increase 7% to just over $1 billion, with operating profits up 15% to $246 million.

In June, Insys paid $225 million to settle criminal and civil investigations into unlawful marketing practices for opioids including kickbacks to doctors to boost sales.

The Arizona-based firm used “sham” speaker programmes, supposedly to increase brand awareness, to pay “bribes and kickbacks” to increase sales of the painkiller Subsys, the US Department of Justice said.

A whistle-blower court case revealed lurid tales of a former stripper sales director giving a lap dance to a doctor as an incentive to prescribe Subsys, and a rap video encouraging sales reps to maximise revenues.